20 companies with amazing operating leverage

Let me know which ones you would like to see covered in more detail.

TLDR Summary

Operating leverage is the ability to grow earnings disproportionately relative to revenues. Finding a company with strong operating leverage can be very lucrative, especially if there’s a topline catalyst on the horizon. I’ve screened the US stock market for companies with strong operating leverage and shortlisted 20 promising candidates for further investigation. Check them out in the attached pdf document.

How I look at operating leverage

When I look at ideas that worked well for me, such as Tesla from 2017 to 2021, Root since last year or lately Rocket Companies and Better Home & Finance, there is one thing they have in common: their strong operating leverage.

Operating leverage is the ability to convert revenue growth into disproportionate earnings growth, that is having high incremental margins for every additional Dollar of revenue. High in absolute terms, but more importantly high in comparison to average margins. Because that is where the potential for earnings surprises comes from.

This topic is particularly relevant in today’s market that is full of companies that effectively buy their revenues at very high cost. It helps their stock to rerate higher to reflect this top line growth. Investors love to fantasize about how much bigger the company could be at a future steady state. But the long-term earnings outlook is often poor because these companies haven’t figured out how to convert revenues into profits. Various AI companies fit that category and some meme stocks as well. Lemonade is a notorious case that I have covered often (in fact way too often than justified).

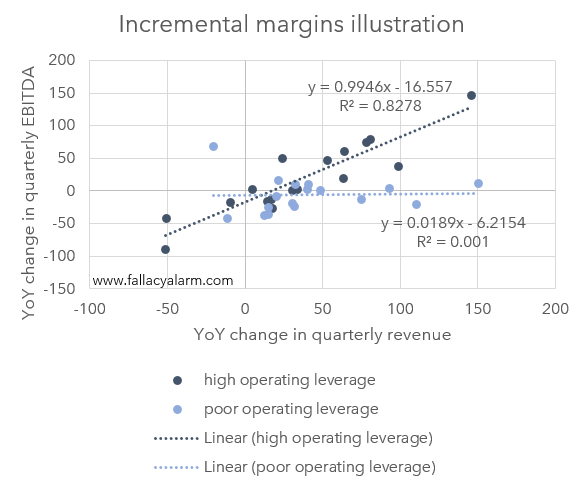

As you may have noticed over the last few years, I usually illustrate operating leverage by plotting incremental YoY or QoQ revenue growth vs. earnings or costs growth. The regression line of both can then be interpreted as an estimate of the incremental margin. The R-squared will provide insight into whether that incremental margin estimate is reliable.

Below is an illustration of how this could look like in practice. The dark dots plot the incremental revenue and EBITDA combinations for a company with strong operating leverage. The incremental margin is near 100% as evidenced in the slope of the regression line. And an R-squared of 83% suggests that revenue growth is a strong predictor for EBITDA growth.

In contrast, the light dots plot the incremental revenue and EBITDA combinations for a company with poor operating leverage. Revenue growth doesn’t impact EBITDA as suggested by the slope and the R-squared of the regression being close to zero.

Not every investment idea must look pleasing on such a chart and not every form of operating leverage can be captured in this analysis. But it is at times helpful to gauge how much power for earnings growth there might be in the future, especially when combined with a potential top line catalyst.

This begs the following question: If strong operating leverage is a systematic predictor for attractive stock ideas, can’t we just screen the market for companies that exhibit signs of strong leverage? That is exactly what I have done below.

Approach

For the purpose of this analysis, I selected a universe of US stocks with a minimum market cap of $500m which gave me in total 2,100 tickers to choose from. I downloaded their quarterly revenues and EBITDAs for the last 20 quarters and calculated the YoY change in quarterly revenues and EBITDA. I opted for YoY comparisons vs. QoQ comparisons to avoid distortions from seasonality.

The financials I used are based on GAAP figures which may not properly eliminate non-recurring and non-operating items. But it also avoids the elimination of relevant costs that managements often like to ignore, such as stock-based compensation for example. I like GAAP data better for this task.

Once I calculated the incremental margin estimates, I searched the results for attractive candidates by

reviewing the statistical significance of the margin estimates,

comparing incremental margins to average historical margins,

performing a very high level review of the business model as a sanity check how relevant the incremental margin analysis is for this type of business, and

gauging if there could be a growth trigger in the near-term to make earnings surprises more likely (basically filtering out super defensive industries where nothing ever happens).

In total, I selected 20 stocks that fit these criteria. I could probably have shortlisted more candidates. But I don’t want to overload the content for now. If you enjoy this type of screening, let me know and I can do another round soon.

But for now, I am curious whether you would like a deeper dive on any of the companies that I short-listed. Pdf follows below.

Sincerely,

Rene