AirBnB: Defying the Disruptor's Deflation Dilemma

While public sentiment deteriorates, the investment thesis is actually getting stronger with a robust moat and impressive financial turnaround.

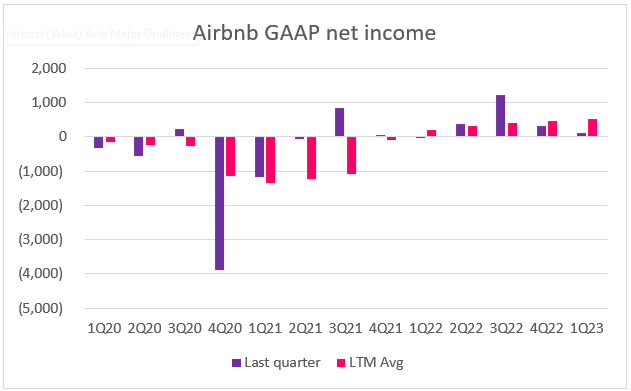

On May 9, 2023, ABNB 0.00%↑ announced their 1Q23 earnings and took a hefty beating. The growth story appears to be intact. They grew quarterly revenues to $1.8bn (+20% YoY) and achieved $117m in GAAP net income, the first profitable Q1 ever. The stock sold off during the days following the earnings release, which seems to primarily driven by cautious guidance. They expect $2.35-2.45bn in revenues in 2Q23, which corresponds to a growth slowdown to 12-16% YoY.

But there is more to the story. Airbnb has become a hated stock, suspected to be losing its moat and supposedly operating in the wrong verticals for the coming recession. I believe this is a beautiful contrarian set-up and I will explain why in this report.

This report is entirely free. It is sponsored by Stellar Fusion, a platform that provides interactive financial models with the ambition to make investing accessible to everyone. It’s a great tool where you can build scenarios for companies of your interest based on crowdsourced prepopulated templates. These models are tailor-made for each company and its key valuation drivers. There is a lot of community effort in there. I have used Stellar Fusion to build a scenario for Airbnb here. Feel free to play with my assumptions and build your own case. I have detailed the rationale for my assumptions below.

Also, my #2 and #3 interviews with Randy Kirk are online. In #2 we covered how the Tesla investment thesis is intertwined with the macro environment. In #3, I provided an overview how Tesla’s transformation to a services business will likely unfold later this decade.

Table of Contents

1. Investment Thesis Summary

2. Company Background & History

Parabolic entrance to public markets

The end of the pandemic windfall

Cyclicals and real estate out of investor favor

3. Inflationary Disruption

The disruptor’s deflation dilemma

Investing in scarcity is a winning strategy

Prime real estate is the embodiment of scarcity

Even better without location risk

4. Moats are still strong

The nature of platforms

Owning customer relationships

Cyclicality of growth

5. Skating where the Puck is going to be

Industry performance is a function of collective wealth levels

Recreation Spending

Housing spending

6. Catalyst S&P Inclusion

7. Valuation

Multiples

DCF

1. Investment Thesis Summary

The stock is down 50% from its early post IPO peak. It has fallen out of investor favor because the windfall from the pandemic era remote work bubble is gone and cyclical stocks are deemed untouchable given recession fears.

The underlying business fundamentals are strong. Since 2018, revenues have grown at 27% CAGR. During this period, the company has outperformed expectations. They surpassed their inflection point and successfully transitioned to profitability with >20% operating margins. In 2023, they will likely make $3.50 in EPS. Two years ago, analysts thought they would barely breakeven this year.

Airbnb is a rare example of an Inflationary Disruptor. Disruptive innovation is typically cost driven just as much as it is utility driven. Newcomers win against incumbents because the offering is significantly cheaper than the traditional alternative. Some companies can evade the disruptor’s deflation dilemma by riding underlying inflationary trends. Airbnb is taking a highly scalable share in travelling/hospitality/housing while at the same time riding monetary debasement driven real estate appreciation. And they are not even exposed to location risk. Wherever real estate demand pops up, Airbnb supply will follow. The hiking cycle has paused the monetary asset price inflation which has caused bleak real estate sentiment that may provide a decent contrarian entry point.

Airbnb is operating in the right verticals to demonstrate sustainable growth. Consumers will continue to allocate a rising share of their spending to products and services that provide prestige and self-actualization. Housing and traveling are manifestations of such.

This is a unique company, which is a category definer with lots of levers to grow its user base and enhance its monetization. 200m people are on the platform already today, 90% of whom access the offering organically. It’s a huge asset waiting to be monetized via additional services. And in the long run, they can tap into huge new market segments, such as extremely fragmented long-term rental markets (28+ days).

The company’s valuation is ambitious, but not egregious anymore. At 7x EV/LTM Revenues and 33x Forward P/E, they are trading in line with hospitality peers, comprised of hotels and online travel agencies (OTAs). Compared to those peers, Airbnb’s business model is more scalable, there is more operating leverage to tap into, it is asset lighter and more defensible.

In terms of catalysts, there is a good chance that bookings will surprise to the upside as recreation spending is still below prepandemic levels. And the stock might catch a bid from institutions later this year. As they just reported a profitable Q1 (seasonally their weakest quarter), their S&P inclusion this year has become almost a certainty. This might result in buying pressure. At 69% of float, the stock is significantly underowned by institutions. S&P companies are on average 86% owned by institutions.

2. Company Background & History

Parabolic entrance to public markets

I will skip the basics, I am sure you know them. Airbnb went public in December 2020 in the middle of a fully fledged (growth stock) bubble. The stock immediately went parabolic. It was originally priced at $68, but opened trading at $146. It hit its ATH in February 2021 at $216. Ironically, this was the absolute EPS bottom. (Technically 4Q20 was worse, but I normalized the chart below for the IPO-related SBC expense.)

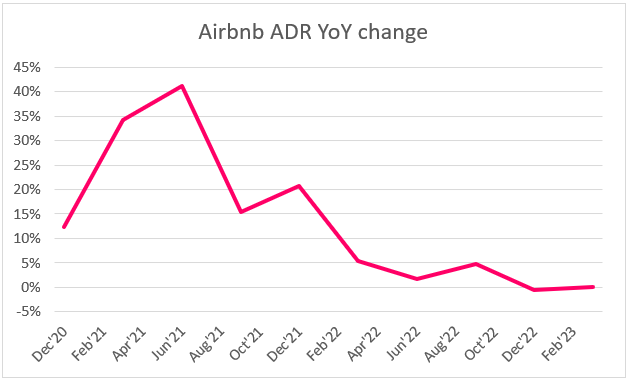

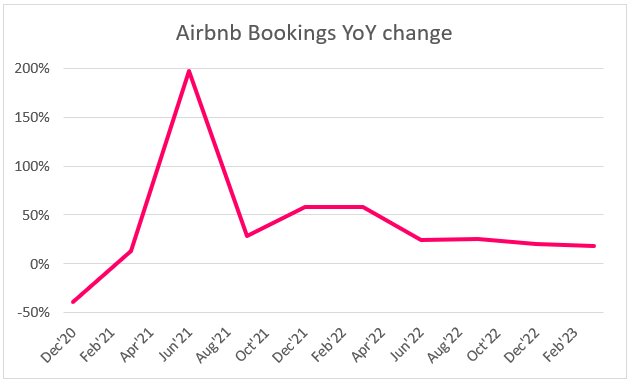

That was not just the time of the peak of the meme stock mania. It was also the time when the pandemic economy was in full swing. People had gotten used to the ‘new normal’. While health fears subsided, they took advantage of flexible work accommodations and adjusted their living arrangements for changed needs and preferences. In early/mid 2021, Airbnb’s average daily rate (ADR) surged by 40% YoY. It was an early taste of the subsequent inflation spike in the broader economy.

Demand for Airbnbs was huge. By 2Q21, Gross Booking Value (GBV) was 3x higher than a year earlier. 4Q21 was 30% higher than 4Q19, the last pre-pandemic quarter.

While price increases and booking rates slowed down in 2022, the company still continued to perform very well. In 1Q23, GBV was 19% higher than a year earlier and 2x higher than two years earlier.

But the stock has not reflected that. It formed a double-top in November 2021 alongside the broader market top. It’s now down by 50%, which appears to be driven by both micro and macro considerations.

The end of the pandemic windfall

Investors don’t expect Airbnb to continue their recent pace. They view their pandemic era performance as a temporary windfall. And most recent data points somewhat support that view.

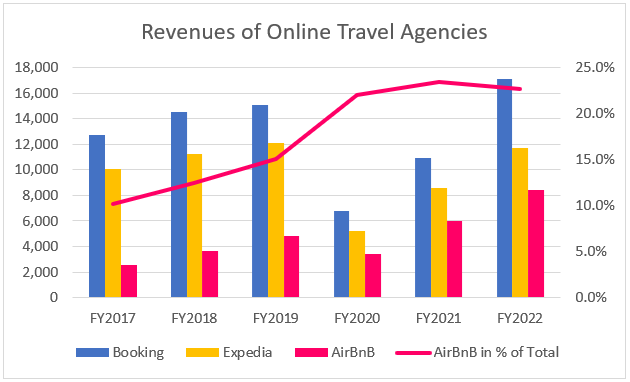

In 2020 and 2021, Airbnb’s revenue grew much faster compared to other OTAs like BKNG 0.00%↑ and EXP 0.00%↑ . Those companies were hit much harder by the lockdowns and did not benefit that much from the remote work boom. In 2022, they recovered and Airbnb has underperformed in terms of revenue growth.

Consensus now estimates that Airbnb will grow revenues at 14% CAGR to $12.4bn by 2025. This is still faster than Booking (12%) and Expedia (9%), but it would be a significant slowdown.

Cyclicals and real estate out of investor favor

From a macro perspective, investors fear that a recession is coming which will then hit discretionary spending. The chart below plots the stock against XLY 0.00%↑ (cyclical stocks ETF) and XLP 0.00%↑ (consumer staples). Airbnb has underperformed alongside other cyclical stocks for the past year.

And as I will outline below in more detail, Airbnb is not just a bet on tourism and traveling. It’s also a bet on real estate, which has also fallen out of favor over the past year.

Sentiment on the company and the verticals they operate in is bleak. Is that warranted? Has Airbnb lost its mojo? To assess that, we need to understand the nature of this company first.

3. Inflationary Disruption

The disruptor’s deflation dilemma

Typically, technological disruption is based on deflationary drivers. A new technology scales due to favorable cost curves. Amazon revolutionized shopping by making it cheaper. Google revolutionized information collection/distribution by making it cheaper. This means that innovators are usually in a race against deflation. In terms of value-add, companies like GOOG 0.00%↑ or META 0.00%↑ need to permanently outrun the deflation in their revenue per click. And with their recent price cuts, TSLA 0.00%↑ has also affirmed that they belong into this group.

There are some exceptions to this rule, which I call Inflationary Disruptors. Companies that disrupt an industry, both by taking market share and expanding the total market while at the same time benefiting from inflationary pressures on their products. AAPL 0.00%↑ is a great example. The smartphone is such a force, it is adding so much economic value that Apple can afford making it more and more expensive, irrespective of their cost to produce it. Their achievement is combining advancing technological functionality with a lifestyle product that has relevance to social status signaling.

In my opinion, Airbnb also exhibits the characteristics of an Inflationary Disruptor. They are taking a highly scalable share in travelling/hospitality/housing while at the same time riding the monetary debasement driven real estate appreciation. And they do not even have to put in the capital to get exposure.

Investing in scarcity is a winning strategy

Due to the recent monetary turmoil, it is sometimes hard to appreciate the disinflationary pressures in our economy, namely technology and demographics. Over time, everything that can be automated will become cheaper. This is not a new phenomenon relating to the IT revolution. Imagine the real price of a potato for a 16th century farmer compared to today for example.

And vice versa, the things that can’t easily be automated will become more expensive. Those are things with scarcity features, for example those involving skilled labor. You can invest into scarcity by investing into your own education. Or you can do so by investing into (prime) real estate or companies with moats.

Prime real estate is the embodiment of scarcity

It will always be possible to dig for more oil or build another factory producing junk. But replicating a penthouse with a view on Central Park in New York City is challenging. And it’s not just high-end real estate. I define prime real estate just as any highly sought-after accommodation across all price categories. Investing in prime real estate is likely a winning strategy in an overleveraged, ageing and technologically advancing society.

The problem is: Prime real estate today is not necessarily prime real estate tomorrow. What if consumer preferences change? What if politicians ruin the neighborhood with poor policy making? What if there are structural economic changes? Ask the people in Detroit how happy they are with their home price performance.

Even better without location risk

People travel to and temporarily stay preferably in prime locations. If a city/region/country deteriorates, they will simply shift demand to somewhere else. And supply will move along. Wherever there is a real estate bull market, Airbnb will be there to ride it. Prices for prime real estate will continue to outperform. And Airbnb will keep taking a slice of it. Think about the company like an algo finding and betting on strong real estate markets.

4. Moats are still strong

The nature of platforms

A popular argument in the Airbnb short thesis is that the company has lost its moat. This was for example illustrated in a recent report by the Bear Cave which is a popular research service focused on short-selling. The author pointed to some anecdotal examples of customer dissatisfaction with the price and quality of Airbnb’s service. But the central argument related to the rise of professional powerhosts which have started engaging directly with travelers and thereby sidetracking the platform.

Online and offline, platforms are centers of gravity. They attract people because they connect those offering something with those desiring something. In return for that service, they monetize their users via commissions, subscription fees or ads. Examples include AMZN 0.00%↑ , META 0.00%↑ , NFLX 0.00%↑ or GOOG 0.00%↑.

With rising internet adoption, these platforms have become enormous successful because the cost of reach has plummeted. However, if their value-add disconnects from the price they charge, they could run into problems and lose their moat. And the bear case for Airbnb has some charm. Why wouldn’t someone want to save Airbnb’s fees and sell directly the to customer? Anecdotal evidence for that is not hard to find on social media.

The problem is however that there is very little quantitative evidence for this trend so far. As pointed out above, they have been growing very well and they have done so profitably. As the narrative worsens and the stock crumbles, the financials are actually improving vs. prior expectations. Two years ago, analysts thought they would barely achieve breakeven in 2023 and 2024. Now, EPS is expected to be $3.50 this year.

And so far, there hasn’t been a compression in their revenue share from hosts. In fact, taking seasonality into account, the chart below illustrating their revenues as a % of GBV could even be read as slightly upward trending for the past two years.

The key question is this: If you are a powerhost, are there really cheaper alternatives to find occupants compared to the 13% Airbnb charges? And as user, would you really want to forego all the safety and convenience benefits of Airbnb’s service just to save 13% at most?

If Airbnb’s business was crap, we would have seen that in failures of other platforms with similar dominant positions in their niches before. The professionalization of Amazon resellers has been positive for the company’s maturing. The same is happening for Airbnb.

Owning customer relationships

“I always believe that the best loyalty program is people loving your products. And if they love your products, they come back. And I think that's the reason why nearly 90% of our traffic is direct to organic, and we have really strong rebooker rate.”

Brian Chesky, 1Q23 earnings call

There is a bigger argument here to make. You often hear me talking about customer relationships as assets. It is an abstract concept for many people. But to me, a customer relationship is an asset just like a factory or cash in a bank account. And its relevance as a long-term differentiator between successful and failing companies is growing. Having strong customer relationships is a necessary condition for developing a moat.

If you need someone else to find customers for you then you are operating a commodity business by definition. There is nothing wrong with earning money like that. But you won’t grow faster than average, you won’t have more profitability than average and ultimately you won’t be able to command a valuation premium.

One very simple metric to gauge whether a company has strong customer relationships is to measure their spending on sales & marketing as a % of their revenues. If they are intimate with their customers and have a differentiated product/service, they won’t need much of that. Airbnb is currently running at 18%, which significantly lower than Booking and Expedia. People search for accommodation directly on Airbnb’s website or app. For Booking and Expedia however, they take the route via Google. And Google takes a generous charge for that. That’s the story that the chart below tells us.

Booking may be the most visited tourism website in the world…

…but while users access Airbnb mostly directly…

…Booking has to pay dearly for its traffic.

I might be wrong about my perception of Airbnb’s moats. But for now, I see it as a lazy argument, primarily rooted in a theory that sounds nice, but so far does not have sufficient backing. It’s just too easy for the vultures to kick a cyclical company at the bottom of the liquidity cycle.

Cyclicality of growth

One of the biggest misperceptions in growth stock investing is to view it as a smooth exponential function. Secular growth stocks are just as cyclical as traditional cyclical stocks. They have the same interplay of demand and supply and one begets the other.

If every human listed their place on Airbnb when they don’t use it, supply would surge, prices would plummet and demand would surge as a result. And Airbnb’s revenues would skyrocket, too.

The process of getting to the maximum level of market penetration is a never-ending ping pong between supply and demand surges. And when the orange line above intersects with the blue line, investor turmoil often ensues. More often than not, this comes with a BTFD opportunity for those having done the homework and built conviction.

5. Skating where the Puck is going to be

Industry performance is a function of collective wealth levels

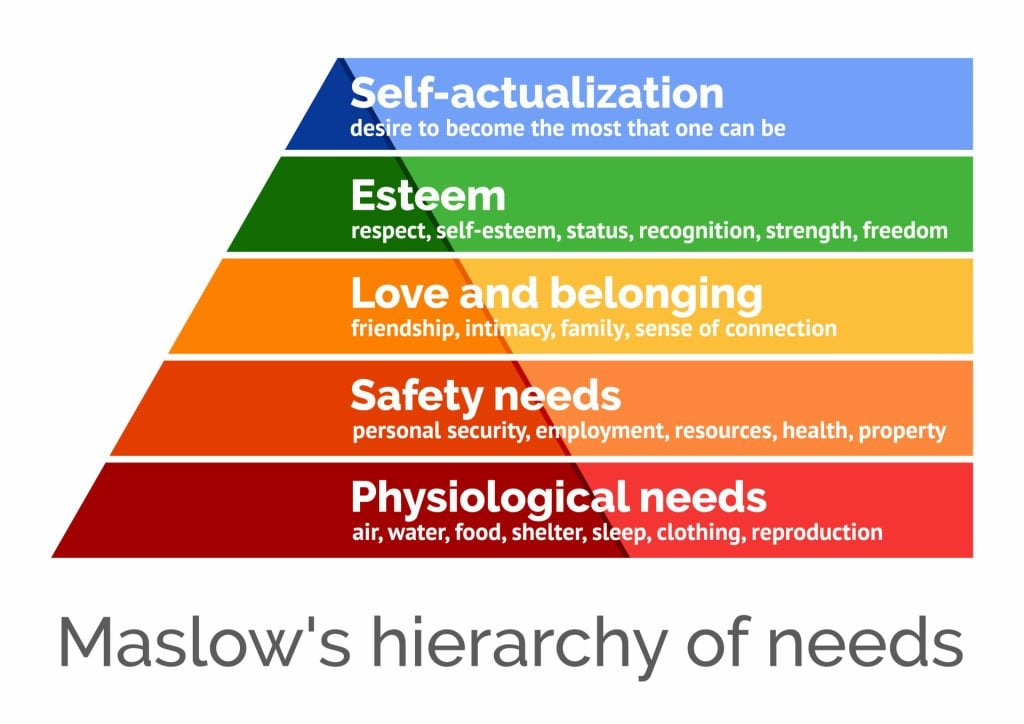

It obviously depends on where the economic development curve of a country intersects with the global technological development curve, but I believe we can generalize to some extent what types of consumption outperform at various wealth levels of a society. This should loosely correlate with Maslow’s hierarchy of needs:

When people move from subsistence agriculture to market-based capitalism, they will first start trading food and clothing. Once those desires are saturated, their demand for energy, communication, mobility and healthcare will rise disproportionately. Once all their physiological and safety needs are satisfied, they will crave for prestige and self-actualization.

Traveling and housing are important manifestations of a person’s prestige and self-actualization. Social media is full with it. You can see it in the topics covered by the most successful influencers and you can see it in people’s profile pictures. It informs us about their (desired) self-perception. Rarely does anyone pose with their car or in a work outfit. It’s usually showing interesting experiences and lifestyles. People drive 14y old cars, but their homes and travels are perfectly polished. Where do you think a disproportionate share of discretionary spending will go?

Spending on traveling and housing will continue to outperform other economic segments. And Airbnb will ride that trend.

Recreation Spending

The chart below shows the share of recreation services in the US as % of personal consumption expenditures.

This data series only captures a fraction of the argument I am making here, but it does point out two important observations:

The share of recreation spending has been rising for a very long time.

It has a long way to go to reach pre-pandemic levels. (Airbnb is 2x its prepandemic size. What does that tell us about industry dynamics?)

Housing spending

What is true for recreation, is also true for housing. The chart below shows the US rent CPI vs. total CPI. It rises over time and it’s currently recovering sharply back to pre-pandemic highs.

How much of that is monetary debasement driven? How much of it is consumer preference towards allocating a rising share of their spending to their accommodation (which could be demographically driven or wealth-level driven)? I have no idea. But I have an idea about how this chart might progress going forward.

6. Catalyst S&P Inclusion

Airbnb is currently not included in the S&P. At $65bn market cap, they would instantly be in the top quartile of all constituents if they were. Index inclusion appears to be a done deal this year.

Here are the current eligibility criteria for the S&P:

Airbnb easily clears most of these. It’s a US company with market cap, liquidity and float way above the minimum thresholds. Financial viability is the only remaining question mark. They require positive GAAP earnings in the recent quarter and in total over the past year.

1Q23 was Airbnb’s 4th consecutive profitable quarter. Most importantly, it was the first time they were profitable in Q1, which is seasonally their weakest quarter.

The latest earnings report has made Airbnb's index inclusion later this year way more likely. It's almost a certainty now. The S&P committee might want to wait a couple of quarters and see how Airbnb navigates the challenging macro environment as a cyclical company.

For reference, TSLA 0.00%↑ became eligible for inclusion in the S&P 500 index after it reported its fourth consecutive quarter of profitability in July 2020. It took then 5 months for them to be included in the S&P, the anticipation of which coincided with a massive rally of +150% in the stock. Not saying this is a blue print for Airbnb. But S&P inclusion is very important for institutional investors. On average, institutions own 86% of the float of the S&P companies. They currently own just 69% of Airbnb’s float.

7. Valuation

Multiples

It was hard to justify investing into Airbnb when it went public because it was a pure story stock. However, its recent operating performance has made it possible to compare it with a comp set of publicly listed hospitality peers.

Its valuation is still ambitious, no doubt. But it is certainly not egregious anymore. In fact, Airbnb is cheaper on forward P/E than Hyatt H 0.00%↑ for example.

DCF

Airbnb had a GBV of $67bn over the past year. The global travel accommodation market was worth $633bn as of 2021 and it is expected to grow by 11% to $2tn by 2031. If Airbnb manages to break into more long-term rental markets, it could open up an even bigger TAM. The global real estate rental market is worth $2.6tn and is expected to grow by 7% annually to $3.4tn in 2027. And Airbnb has a shot at getting a valuable piece of that pie. Long-term stays, i.e. those with more than 28 nights booked, account for approximately 20% of nights booked on the platform and they are taking action to improve their offering.

“Longer stays on Airbnb can be expensive, so we're doing a few things about it. We're reducing our fees after 3 months. U.S. guests can now save money by paying with their bank account, and hosts can easily set monthly discounts and offer more flexible cancellations.”

Brian Chesky, 1Q23 earnings call

I have built a scenario using the Stellar Fusion platform, which you can check out here. The following assumptions have guided me in my selection of the parameters:

By 2030, they will command a ~10% market share of the travel accommodation industry which will have grown to $2tn by then. GBV for Airbnb would by then grow to $200bn. Assuming a 13% revenue share would pin Airbnb’s 2030 travel accommodation revenue at $26bn.

Long-term stays will continue to account for 20% of revenues, which would then be $5bn. Commissions for 28+ day rentals will likely be significantly lower, otherwise tenants and landlords would start bypassing Airbnb. Assuming a 5% revenue share, this would be an additional GBV of $100bn, which would be a 3% share of the rental market globally by then.

In the long run, operating margins will move towards 30%. This is a level that Booking already is at today and they have to spend significantly more money to acquire traffic.

As a category definer, Airbnb will likely expand its addressable markets beyond what we can anticipate at this point in time. The more listings and users they have, the more opportunities they will have to monetize them. It is estimated that Airbnb has ~200m active users. There will be opportunities to sell additional services to them such as insurance and experiences. I can also imagine that they will at some point sell ads. It’s simply what all platform companies do at some point. All of this is unquantified upside to the investment thesis.

The scenario currently shows 30% upside and it is compounding at 11%.

Don’t get me wrong. This stock does not qualify as dirt cheap. To justify its current valuation, they need continue to be very successful. But it’s a phenomenal and unique company that has taken a beating that it does not deserve in my opinion. Great companies will never be cheap and this may (or may not) be the cheapest Airbnb will ever be.

Full disclosure: I am long Jan’25 125Cs and this is not financial advice. Just sharing what I am doing for fun and education. Let me know what you think.

Sincerely,

Your Fallacy Alarm

Great post

Great article. I used to work on the side for an app called "Task Rabbit" - essentially an Airbnb for odd jobs (mow peoples' lawns, minor home repair etc) and repeat customers always went direct. I suppose it is human nature to save on fees, although it is a bit more complicated when it comes to rental properties.

What do you think of REITs, I see many beaten down though I suppose it is more warranted with interest rates and their propensity to borrow. I like Realty Income which seems to be prime real estate.