August 2024 Market Strategy

My macro bull case is unfolding as anticipated. Inflation non issue. Deficits down. However, positioning imbalances have regressed into old habits. This means some bond pain is in the cards again.

Disclaimer: The information contained in this article is not and should not be construed as investment advice. This is my investing journey and I simply share what I do and why I do that for educational and entertainment purposes.

TLDR Summary

From a fundamental perspective, nothing has changed over the past month. Inflation remains a non-issue and deficits continue to decline. This eases pressure on future inflation prints and therefore interest rates. The macro base case that I have outlined so many times is continuing to play out as expected.

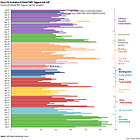

The recent market sell-off has however triggered some changes from a sentiment and positioning perspective. I argued previously that the landing trade had fallen apart and a new consensus had not yet formed. As it turns out, this landing trade got revived rather than put to rest. The 2024 inflation echo was too short lived and driven by temporary distortions that were not sustainable. Investor consensus on lower bond yields is as firm as it has ever been before and rate cut expectations are going berserk. Even a 50bps panic cut is priced in before year-end.

Yen positioning sends encouraging signals. Before the recent market correction, short interest was much higher than it ever was. The violent Yen appreciation has cleared this imbalance. Traders are now net long Yen for the first time since December 2022. At that time, the US Dollar bottomed against the Yen. The carry crash is done which removes a risk factor from the equation.

Short volatility bets had surged into this event, which added fuel to the carry crash. They have come down since the recent market bottom. I am undecided whether this qualifies as a sufficient capitulation.

Recession fears are top of mind once again. One can reasonably wonder how that happened. After all, economic stress is absent wherever you look. Aside from rate-sensitive industries, the economy is doing well, consumers are financially healthy and banks are resilient. I have covered all of that in numerous articles.

As always, the art of the market strategist is to come up with a scenario that is consistent with fundamentals and at the same time makes sure that the crowd gets screwed over with maximum pain in style. I am mostly on board with the falling interest rate narrative this time. Fundamentals are too compelling, the Fed has already accomplished their pivot verbally and there has already been a lot of pain on bond investors.

Where I differ from consensus is that I am not concerned at all about any recession fears. Yes, there will be rate cuts, presumably alongside a temporary weakening of GDP data. But the economy will be much more responsive to these rate cuts than most people believe. They will cause a credit impulse that will be beneficial for corporate earnings and federal tax receipts. That means bonds will likely have a positive return going forward. But stocks will likely have to keep outperforming them for a little longer.

The near-term might be a bit wobbly though. The 50bps rate cut in November is too odd to ignore. The Fed likes to act smoothly to signal that they have everything under control. A 50bps cut would only be realistic with a sharp economic weakening that I don’t see happening. Walking back these imminent rate cuts may cause some temporary volatility.

Rate scares and growth scares

Over the past three years, virtually every single stock market correction has been a rate scare, triggered by concerning inflation data. It was the catalyst for various pullbacks in 2022 and for the fall 2023 bear trap. Even the March 2023 banking crisis (by its very nature a growth and deleveraging scare) was preceded by a surge in rates. This has made investors hyperaware of interest rate risk. It has been ruling the ranking of the most popular tail risks for years.

As a result, the correlation between stocks and bonds surged. Bonds stopped being a safe haven asset and lost their function as a portfolio hedge.

You’d think that nobody would want to own bonds in such an environment. However, in a somewhat odd twist, investors still poured into bonds with an obsession that one could suspect they were afraid the world will be running out of debt instruments at some point. They were betting on deflation, while still fearing inflation passionately.

In this environment, I had warned about bonds the entire time. The path of maximum pain (and therefore least resistance) had to be a strong stock market performance causing the bond crowd to be left behind and forced them to chase stocks in an environment of stubbornly high rates and improving corporate earnings. It was the time of ‘the landing trade’ which had to fail before it could work.

In the spring of 2024, investors finally started capitulating by selling their bonds and pouring into risk assets. I considered this a pivotal moment. A very firm consensus broke apart. It was however not replaced by a new consensus. Positioning and sentiment data became fuzzy and stayed that way for a while.

I argued that we would have to wait for a new consensus to form. In the meantime, it was obvious to me that we would enter into a new market paradigm. Rate scares would be replaced by growth scares because the long duration trade was not crowded anymore and declining deficits would ease pressure on interest rates and inflation. This means that bonds will not sell off alongside stocks for the first time in years. They will in fact rise into a correction.

In late July/early August we got exactly that. The S&P sold off 9% and the 10-Year Treasury yield dropped firmly below 4%. At the surface, the catalyst for that was one weak jobs report. But in actuality, this can’t really explain what happened. The trigger was rather that rate expectations had fallen below a crucial level that it triggered a mass exit of the beloved Dollar/Yen carry trade. If there is one pocket in the global financial economy that might have excessive leverage, then it’s this carry trade. I have highlighted the risks associated with it several times over the past months.

This brief summary of recent history is important context to think about what’s ahead. More growth scares or are we regressing into old habits?