🔎Aurora Innovation: Robotruck opportunity

A clear technological and commercial frontrunner with a total addressable market ten times bigger than robotaxis. And Mr. Market doesn't care much yet.

In all these years of discussing and thinking through autonomous driving, there is one thing I have never understood: Why does everyone believe that urban robotaxis are the first logical application?

Isn’t long-distance robotrucking way more obvious? Establish a few hubs along highway interchanges and let the semis travel autonomously between them. If necessary, local drivers can then pick up the trucks and do the last 10 miles to the destination. Highways have way less edge cases to solve. High definition maps can be maintained more easily if there is less route variation. And cargo is less needy than city dwellers looking to be driven home from a party.

The mission of Aurora Innovation AUR 0.00%↑ is to figure out the answer to precisely that question. Let’s check how serious and promising their efforts are.

TLDR Summary

The global freight trucking market is worth almost $3tn annually, about ten times bigger than the global taxi market. It’s highly labor intensive and offers huge potential for automation.

Aurora has emerged as a clear technological and commercial frontrunner in this space. Their proprietary technology has solved full-self driving on highways, a feat that even Waymo and Tesla have not yet achieved.

As a result, they are the first company that has commercially launched robotrucking operations in the US. They are building a virtual railway system on US highways that will be very flexible in expanding, densifying and changing depending on what customers need and want.

I doubt that markets have even started to price in the potential of this company. Their $10bn valuation is still low given the addressable market size and the product leadership. The stock is currently even down 30% from the day they started commercial operations in May.

The opportunity

The global taxi market is valued at about $300bn annually, which includes ride-hailing from the likes of Uber and Lyft. This is the pie numerous autonomy companies are fighting over and investors are granting them trillions of Dollar of equity market value. Uber’s market cap alone is $200bn. Tesla is even at $1.4tn and presumably 90% of that value is a giant autonomy call option.

Granted, should robotaxis indeed take off, cost per mile could rapidly fall and the market could expand greatly as a response. But that remains speculative and price elasticity of demand will be sizable in robotrucking as well. The $300bn above is the prize that is currently and reliably on the table for robotaxis.

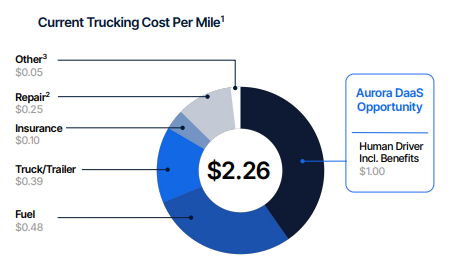

It’s a prize that is absolute peanuts compared to the global freight trucking market which is valued at about $2.8tn annually, almost ten times bigger! Trucking is very labor intensive, too. About 45% of the average trucking cost per mile is incurred for the driver.

There are about 3.5 million truck drivers in the US. They are hauling more than 70% of the nation’s freight by weight. Gross freight revenues were $906bn in 2024 which implies that truck drivers raked in $400bn in wages, more than $100,000 each on average.

And while there are many of them, there aren’t enough. The American Trucking Association asserts that there is a shortage of about 60,000 drivers, although shortages have greatly eased as part of the current trucking recession. A recession that can quickly disappear once the housing market awakes and people move and buy furniture again. That would then reveal structural labor shortages once again.

Overall, it seems obvious that enormous value could be created by automating road transport.