Better than Rocket?

This mini mortgage originator is showing promising signs in its income statement. And its valuation is pitifully low. The ingredients for a great story are there. Now it's time to cook.

TLDR Summary

Think of Better Home & Finance as a mini version of Rocket Companies: a digital-first mortgage originator trying to disrupt traditional underwriting processes with automation and gain market share from the cost advantage and user comfort.

The company is still subscale, unprofitable and has a lot to prove. However, recent income statement trends demonstrate potential for an amazing operating leverage that could very well rival Rocket’s. And all of that while Rocket’s price-to-underwriting multiple is about five times higher. A fascinating setup.

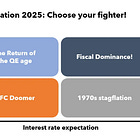

I expect falling mortgage rates. And I expect real estate transaction volumes to react very favorably to that. As a regular reader you know why, so I won’t bother you with the same old arguments. As a new reader, I recommend reading some of the articles below for more context:

For the remainder of this article, I am going to focus on the company-specific aspects of the Better bull case, i.e. their technological capabilities and financial signs of success.