🔎Big Tech is uninvestable here.

Too expensive. Too much uncertainty. Too much in wrong incentives.

About a week ago, I posted the tweet below on the valuation of Big Tech companies. I declared them uninvestable. I believe that these companies are caught in a prisoner’s dilemma that makes it unlikely for them to earn appropriate returns on their investments.

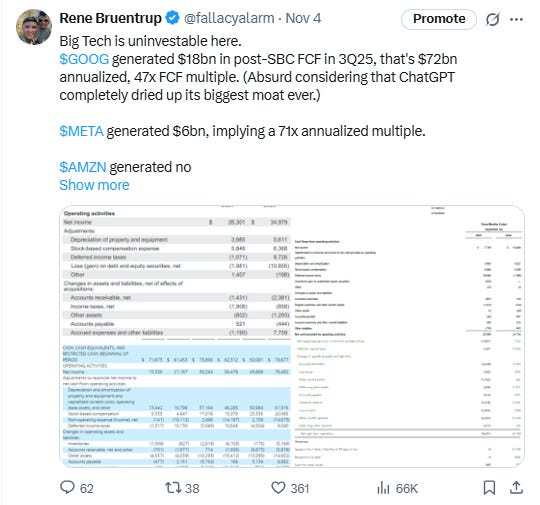

The tweet struck a nerve. Many people seem to agree with my sentiment. It got 66,000 views, 361…