🔎December 2025 Market Strategy

Is this the turning point? There is finally a meaningful negative fiscal impulse and investor positioning has reached alarming levels.

In my November 2025 Market Strategy, I continued to highlight the overcrowding in the Debasement Trade which overemphasizes inflation concerns and neglects macro downside risks. I also pointed to the decline in fiscal deficit spending which may burden asset prices if it actually becomes a trend. Let’s see how the picture has evolved since then.

TLDR Summary

Inflation data remain irrelevant due to tariff distortions. The labor market shows weakness which drives the latest monetary easing. The Fed’s announcement of securities purchases is considered a bullish ingredient to the macro cocktail by most. However, a closer look reveals that this will not create liquidity that is relevant for financial markets. In fact, it might contribute to a reduction of the overall risk appetite out there in the mid-term.

The fiscal deficit continues to shrink. After its first 10 weeks, the FY26 deficit is $150bn lower than the FY25 deficit was at the same time last year. If this trend continues, this might put downward pressure on asset prices and interest rates. A potential fiscal cliff is feared by nobody right now.

Institutional investors are knee-deep in the Debasement Trade, pouring into assets, the more beta the better. Cash and bonds are hated with passion. Inflation fears are as stubborn as they are irrational. The debasement crowd needs a powerful liquidity impulse next year to make this trade work. May Mr. Market have mercy with them should that not materialize.

Inflation

The November CPI release is scheduled for this coming Thursday. I have decided not to wait for that data so you can have the available data in this market strategy piece sooner. I don’t think CPI data are overly indicative of anything right now. It’s too distorted by tariffs.

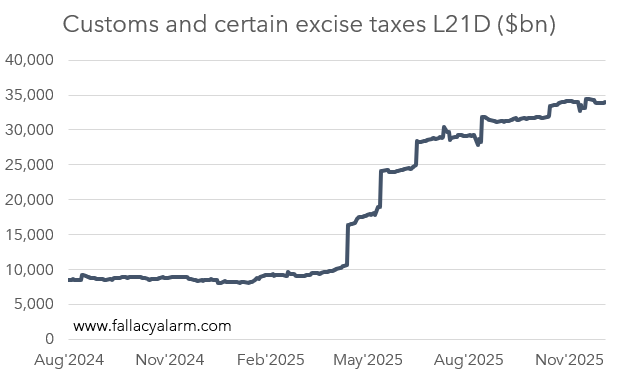

The US government currently collects $35bn per month in tariffs and growing. That’s 2.5% of monthly domestic consumption.

Some of the tariffs may be eaten by foreign and domestic companies via lower margins. But some will manifest as price increases.

Hence, we might easily be talking about a 100bps distortion in current inflation data vs prior year. If properly adjusted for this one off effect, the inflation picture might look completely different. Nobody talks or cares about it. The reason for that seems obvious: People need to keep the inflation menace alive to justify their preconceptions. The Debasement Trade needs the inflation narrative.

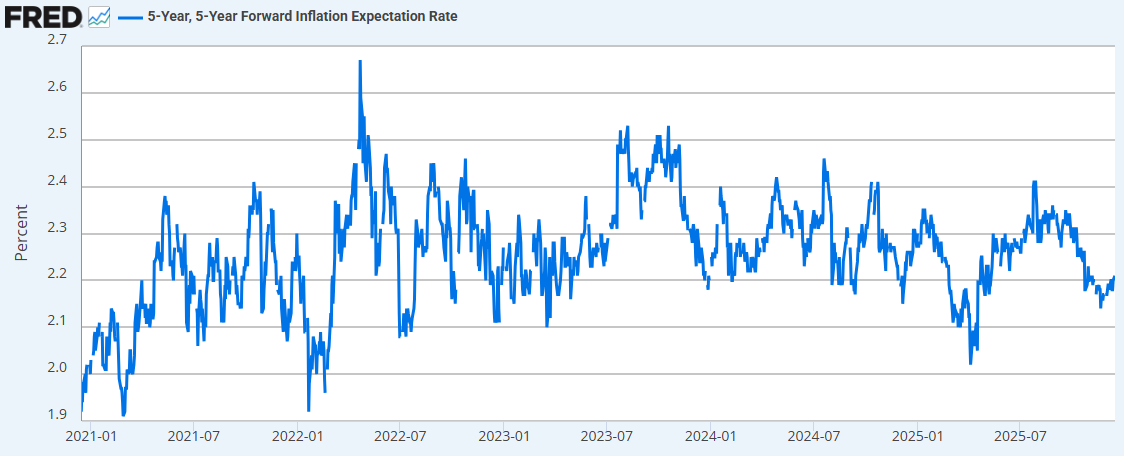

So, whatever CPI will be reported on Thursday, I don’t care much about it. I consider market based inflation estimates much more valuable for now. For what it’s worth, inflation-protected Treasuries currently signal stable inflation expectations. They are not (yet) falling decisively below the 2% mark like they did when they triggered the monetary policy pivot in 2019.

Monetary policy

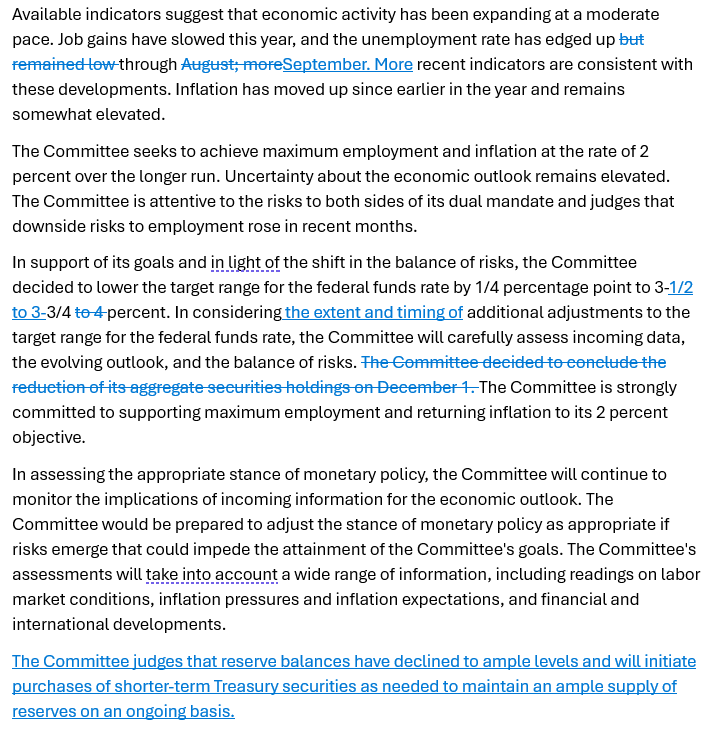

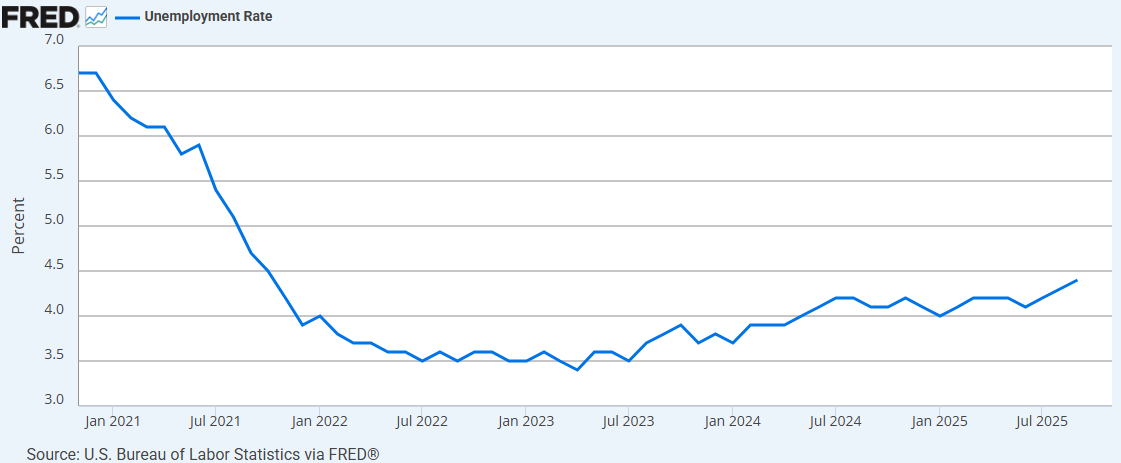

On December 10, 2025, the Fed lowered the Fed Funds Rate by 0.25% to 3.50-3.75% as expected. They justified this rate cut with an increase in the unemployment rate.

Their concerns about the labor market are understandable. The unemployment rate has in fact been trending up for 18 months, not just recently.

The US economy has created a pitiful 119,000 net new jobs in the last seven months which is just 17,000 per month on average.