How (not) to handle the Tesla Beast in the 2020s

My mental model to avoid the Shake-Out

Mental vs. analytical aspect of Investing

It is not difficult to infer from my articles so far that I am a huge Tesla bull. I mention them in almost every piece I write, which is why I am actually concerned this obsession will repel some of you over time. But I hope my posts are generalized enough in nature that you can take away something useful from them for your own investing journey even if you have different stock choices.

I will likely not publish a full blown deep dive on the company as I have done on others since there are already tons of people active on social media who cover Tesla in much more detail and with much greater skill than I ever could. However, since I started investing into the company in 2017 and over time have spent hundreds of hours on it, I think there is some value I can add on certain aspects which appear underappreciated by most sources.

One aspect that fits for this purpose in my view is the mental aspect of holding a long term winner. I believe the main challenge in investing is not finding them, but holding them over long periods of time. How many people do you know who bought Apple after the iPhone reveal and are still holding them? How many are still holding Amazon from their IPO, especially after the excruciating >90% drop in the early 2000s?

Investing is a mental game, much more than it is an analytical one. There is a good reason why I repeatedly refer to Mr. Market in my writings. To me, Mr. Market is a devil sitting somewhere in hell below me, constantly trying to deceive me into making the wrong choice. For big winners, this is always about seducing (in pumps) or scaring (in dumps) investors to sell. After all, eventually there will only be a small number of shares available to participate in the company. It is a natural process to weed out those who are not worthy.

A crucial part about holding a big winner is building a long term investment case as a benchmark. But it is secondary how close one’s predictions come to reality. The primary objective is to build an investment case that leads to good decision making. Tesla will not forever look as cheap as it currently does where even a monkey has no issue building up a compelling bull case. There will be times again when it will look hopelessly expensive. It is precisely during those times when people with a conservative/traditional mindset will lose their shares to the devil.

How not to do it

Gary Black is a quite popular investor on Twitter who often provides useful insights on stock catalysts, institutional asset manager sentiment and overall company newsflow. While I will criticize him below, I would like to emphasize that I generally appreciate his tweets which are a relevant component in my investment process.

I recently came across this tweet from him below which is in my view symbolic of the type of forecasting carried out by a good amount of investors, especially those with ties into professional money management.

There is nothing wrong with having a $1,600 near term price target for Tesla. It is in fact quite close to where I see the current fair value, which I will elaborate on below. The problem here is the approach and calibration of the parameters that he uses to derive a long term terminal view on the company. His price target is based on market size x market share x ASP x margin x multiple. Not only are virtually all those 5 parameters way to conservative, the approach is also flawed for the following reasons:

From pumping out cars to XYZ as a Service

Tesla’s terminal value is not about volume x price, but installed base x revenue per user. This will especially be true with the rise of autonomous vehicles (AVs), when annual car production will slow down after an initial period of replacement wave from ICE cars to EV/AVs. Nobody will price Tesla in 2030 based on volume x price. Therefore, it is pointless doing that in 2022 when trying to build a 2030 terminal value.

It is about scaling production, not about finding customers

The whole idea to incorporate market share as a limiting/contributing factor for Tesla’s valuation is deeply flawed, especially when using conservative assumptions like Gary Black does.

Using a terminal market share assumption suggests that there is a demand ceiling on Tesla’s annual production/installed base based on what other manufacturers are doing. This may become true at some distant point in the future, but certainly not by 2030 or at any point in time relevant to build a price target right here right now in 2022.

This view does not take into account that the competitive economics in the automotive industry will change dramatically over the next few years. No other manufacturers (neither legacy players nor new pure EV start ups) are currently demonstrating meaningful progress in terms of catching up with Tesla in terms of scaling up AND doing that profitably. For instance, Volkswagen is building a new factory that is supposed to become the foundation for competitiveness with Tesla. It will start construction next year and the first car is expected to be rolled out in 2026. And if you look at the car crash (pun intended) financial statements of Rivian or Lucid, you get a glimpse into the EV startups inside legacy players in terms of the cash burn rate.

Don’t take my word for it, let’s look at what the manufacturers are saying themselves to infer where they will be in the future. The tweet below summarizes Morgan Stanley’s list of the automotive industry’s electrification plans:

Premise: 100% of vehicle demand will be electric in 2030

To clarify my premise before I go into the details of the table above: I am working off the assumption that by 2030 global vehicle demand will be exclusively targeted at EVs. If you look at the battery cost curves presented by Tony Seba, the Wright’s law presented Cathie Wood, the progress that has been made on EVs over the past 10y, the superior physics economics on EVs and the user experience, I do not think a case can be made that ICE cars or any other propulsion technology can stand a chance against EVs 8y down the road. If you find that premise odd, I invite you to check out this video below. And if you disagree with the words above afterwards, please let me know as I am curious about the arguments.

Electrification Plans of Legacy OEMs insufficient

Having set this as the base, let’s check out how the math works out to get us to those EV production levels. For some context, the annual global vehicle demand is roughly 90m units. I can imagine this will bump significantly during the peak ICE to EV transition period as the superior economics of EVs and later AVs become so obvious that consumers will rush to replace their old ICE vehicles. On the other hand, the long term demand will likely be much smaller due to urbanization and the rise of AVs. Let’s assume by 2030, global vehicle demand will be 100m to keep it simple. Let’s further assume that an average vehicle will have a 75kWh battery, which is what a typical Model Y currently comes with. This would put the global battery demand for vehicles alone at 7.5TWh.

Tesla plans to have 3TWh installed capacity by 2030, which would be enough for 40m vehicles. But given that Tesla plans to use this capacity also for alternative uses, such as stationary energy storage, and has stated a long term annual production goal of 20m vehicles, it is more reasonable to assume that they will have 1.5TWh available for their vehicles business. This means that the remaining OEMs will need to have a capacity of 6TWh to provide the remaining 80 million vehicles. Now, what are their plans? Let’s look at the top guys from each continent:

Volkswagen? 240GWh, enough for 3.2m vehicles

GM? 60GWh, enough for 800k vehicles

Ford? 129 GWh, enough for 1.7m vehicles

Toyota? 200 GWh, enough for 2.7m vehicles

Fair enough, some of these may have different timelines from Tesla and perhaps they will increase their guidance soon. But capex plans for complex product manufacturing companies are very long term in nature. This is what makes them so powerful predictors of business volume. These four companies currently have electrification plans in place that will barely bring them to 10m EVs annually combined. Even if they double that and all the other OEMs will invest courageously as well, it appears unimaginable that the automotive industry ex Tesla will be able to produce 80m EVs by 2030, let alone half of that.

The bottom line of all of this is that for the coming decade, whoever makes a compelling EV, will sell it. Market share considerations and the plans of other manufacturers will play zero role for building out production and delivery estimates for Tesla. It is just not an input parameter for a good valuation process. When it comes to Tesla’s hardware business, it is solely about their ability to scale production, which will be a monstrous endeavor. Their own plans require them to 20x their production capacity within the coming 8 years. Establishing supply chains and fighting opposing political forces is what I worry about, certainly not that VW will pump out Tesla killers in 2026.

Discount Rate

If you spend too much time in business school (like I did) and you wrap your neck with a tie for too long (like I did), you will feel the inexplicable urge to present-value everything (like I did). Moving numbers back and forth through time will feel like a superpower to you and cloud your mind on the most important topics.

Even if Gary Black is correct with his numerator (he won’t), with a denominator of 12% he will never reach his price target. Mr. Market will never allow Tesla to compound at 12%. A Compounder like Tesla will compound at north of 30%. That is Tesla’s drift. If Mr. Market thinks that Tesla will likely be worth $1,300 next year, he will price it today at $1,000. This is important to know. A company like Tesla will always be undervalued by definition. Only then it is possible to compound faster than the market (which it will). So, if you work based on a 12% discount rate and the market will reach your price target, you will have to revisit your assumptions. Because almost certainly those are not the assumptions that the market uses to price the stock. And if that happens you are in very dangerous territory because you are out of touch with the drivers in charge which increases the probability dramatically you will make the wrong choices.

How to do it (in my view)

So, with this mindset on overall methodology and assumptions, in my opinion, Gary Black is guaranteed to be shaken out of his Tesla position in one of the rips in the coming years. I don’t want that to happen to myself. So here is how I do it:

When holding a generational company, a big winner that you expect to multiply in value over the coming years and decades, it is in my view pointless to develop a terminal value scenario and present value this to today. If you valued Amazon in 1999, could you have foreseen AWS? If you valued Apple in 2005, could you have foreseen the rise of the iPhone, the most disruptive product of the 2010s which has an insane innovation cycle that is still unfolding? A big winner will look very different 10 years down the road than one you can envision today. The good thing about Tesla is that they have laid out their next 10y plan extremely transparently already which makes it much easier to build conviction than for Amazon for instance, where it is impossible to say whether they have another AWS in the cards or Apple where it is impossible to know how they will compete with Meta on augmented reality hardware.

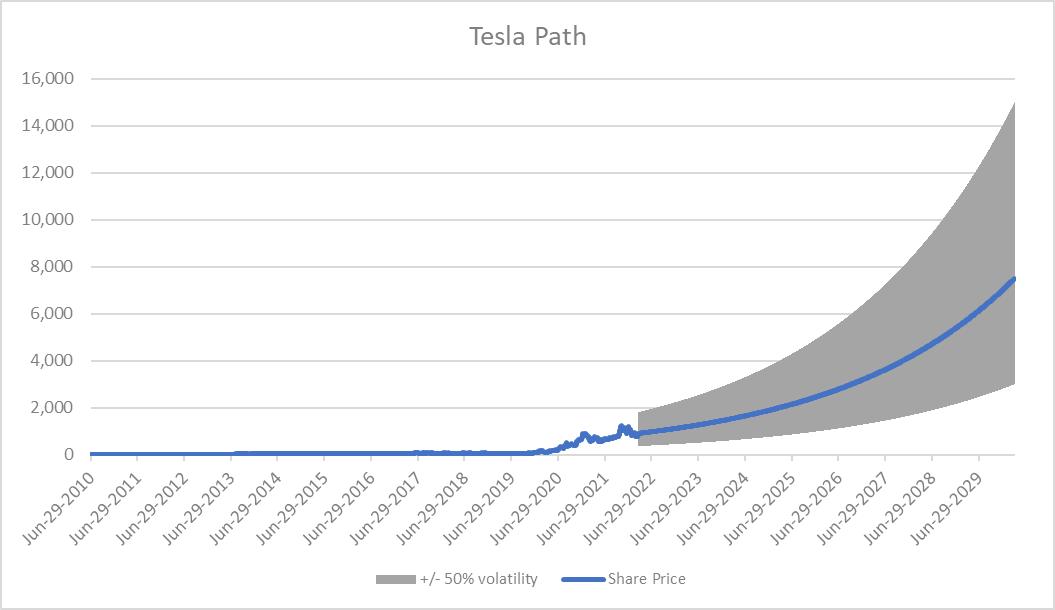

So instead of focusing too much on how their business will look like in a terminal steady state, I am going to look at trajectory. If you have read the article below, you will know that I work based on the assumption that a Compounder will move with returns following normal distributions with a drift of 30% and a volatility of 60%, which they do based on remarkable stable trajectories.

Big Tech have been the most famous Compounders in the past two decades. I believe they will continue to do well, but I am not sure they will repeat it at the pace they have done in the past, at least not all of them. However, Tesla is positioned extremely well to enter the hyper-scaling stage. In particular, I see similarities to Apple and Amazon in terms of competitive dynamics, market positioning, customer focus and disruptive forces. Since a lot of the forces that blossomed Big Tech are converging in Tesla, since its founder is operating at a level above the founders of the others and since the market opportunity is substantially larger, I believe there is a good chance that Tesla will achieve a drift higher than all of these peers above.

Plotting a 30% drift at 60% volatility to 2030 would look like this:

It looks pretty crazy on a linear chart, but on a log-chart it is essentially just a continuation of the path since IPO:

But Mr. Fallacy, that is a fallacy if you do not look at fundamentals

Very true, which is why I continue to monitor how the company is doing based on micro and macro news flow, which is phenomenal right now:

For Mr. Market, Tesla is an earnings growth story, pure and simple. News flow on FSD Beta or the energy division does not move the stock. Only earnings revisions do based on the business segments that are operating at scale and are hitting the P&L right now. Based on this, I see the company’s current fair value at $1,500 a share, which is reassuring for my Compounder model above. I illustrated in the Twitter thread below how I came up with this fair value. And I believe the company is currently compounding at a 30% rate based on that fair value. Brace for a monstrous melt-up very soon.

On top of tracking the current news flow, I also have some sort of long term fundamental trajectory in my head, which I believe however to be a floor for the valuation given it will very likely undershoot what the company will be able to achieve in terms of additional innovation adjacent to their core business model of today (insurance, AV ride sharing, hardware & software supply to OEMs) and unrelated disruptive innovation based on their strengths today (battery technology, electric powertrains and actuators, visual neural net systems) in terms of generalized real-world AI applications.

In this long term fundamental trajectory model, I consider consensus estimates and management guidance. Analyst consensus expects them to grow into $430bn of revenues by 2030. See below:

However, Tesla has repeatedly confirmed a guidance of 50% revenue growth over the coming decades, which is supported by its battery capacity plans and its car production goals. Granting them a 6x multiple based on 2030 expected revenues (which is not unthinkable given the other Big Techs are at 4-8x today), would value the stock at approximately $12-13k, which suggests a ~30% CAGR vs. ~$1000 today.

What to do this all for?

As you can see, I am following this company from various angles and mindsets that I triangulate in my head to maintain a near term and long term mindset. My goal with these analyses is to get a feeling for whether future manic melt ups in the stock are deviating substantially from the likely trajectory to be able to assess whether those deviations may be warranted or not. I expect the stock to go completely bananas very soon, fueled by the realization that EV are not just the future, but that there is really nobody out there able to challenge their position. The stock 10x’ed after the world realized in 2020 that EVs are the future. It will multiply again once the world realizes that Tesla = EVs.

I would actually like full TSLA bull thesis from you - please write one.

You have put precise words to some of my thoughts. I love your articles.