How strong is the US labor market?

And how will it impact Fed policy?

Disclaimer: The information contained in this article is not and should not be construed as investment advice. This is my investing journey and I simply share what I do and why I do that for educational and entertainment purposes.

The market correction we had in early August was a pivotal moment. It was the first time in more than four years that we had a drawdown that was a growth scare rather than a rate scare. Bonds climbed alongside falling stocks instead of falling with them. The trigger was a particularly weak jobs report that fueled rate cut speculation. This freaked out USD/JPY carry traders and caused a deleveraging event.

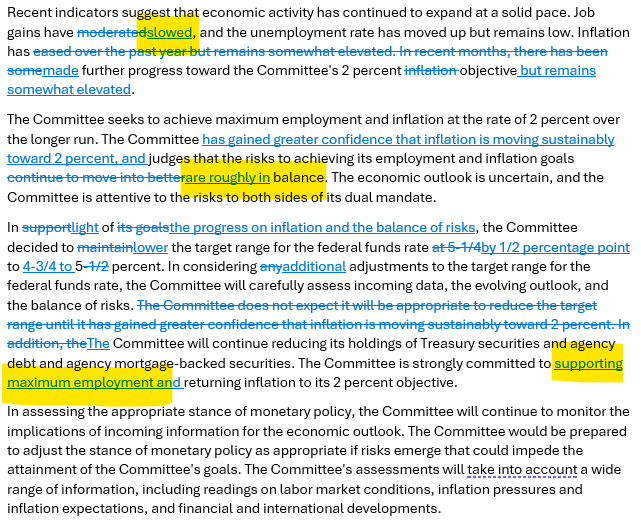

The Fed acknowledged the weakening labor market in their September FOMC communication with a few distinct wording changes from the July statement.

They highlighted that job gains have slowed, that employment and inflation goals are roughly in balance and that they are committed to supporting maximum employment.

The labor market is replacing inflation as the primary policy concern. It’s therefore worthwhile to spend some time looking into it in more detail.