NVDA 1Q26: Still accelerating, but for how much longer?

The actual numbers and management commentary were very encouraging once again. I am however concerned that the cyclical component of this growth story is underappreciated.

Disclaimer: The information contained in this article is not and should not be construed as investment advice. This is my investing journey and I simply share what I do and why I do that for educational and entertainment purposes.

TLDR Summary

NVIDIA is continuing its magnificent growth story with management commentary perhaps being even more exciting than the numbers themselves. Superlatives in every sentence. Listening to them really makes you feel that humanity is currently launching an upgraded version of itself and that all of that is powered by NVIDIA. Both may very well be true.

However, even if that is the case, NVIDIA’s business still is and always will be cyclical and nobody knows if the cyclical component of the current growth momentum is 10% or 90%. It concerns me that nobody discusses this risk right now. Demand for compute is only infinite without cost consideration. All computations happening on NVIDIA hardware have to prove that they can add value to the user that exceeds their costs. Only then will companies continue to buy more chips to enable NVIDIA to reach the lofty expectations priced into its stock.

For many applications, this is not the case today. If you and me had to pay the production cost of every prompt ourselves, we might think twice every time we engage with our favorite chatbots. Demand would then collapse. The gap is currently filled by investors speculating that adequate monetization will be found later. And that is a key attribute of a bubble.

Earnings summary

If you are interested how my perspective on NVIDIA has evolved over time, here are my previous earnings reviews.

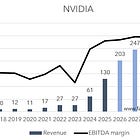

The NVIDIA growth story is fully intact with 1Q26 revenues of $44bn, up 69% YoY and diluted H20 adjusted EPS of $0.96, up 57% YoY.