TLDR Summary

The US housing market is a coiled spring. Five years of extreme interest rate volatility has trapped homeowners. At some point this has to unravel. Transaction volumes will likely be very sensitive to falling mortgage rates and, purely macro speaking, Opendoor is a suitable vehicle to bet on that.

Whether it’s also an interesting opportunity from a micro level depends on whether they have figured out how to price properties reliably and convert that into profits. The latest financials are encouraging and the story has potential to fly. Carvana is valued at $75bn for the opportunity to disrupt the $500bn used car market. What could Opendoor be worth if it was priced to disrupt the $2tn existing home market in a similar way? Quite a bit more than the $2bn it is trading at today, no?

Recent weeks have added a social component to the fundamental case. The retail monster is roaring, ready to eat the next story. Powerful influencers are campaigning hard and have just unseated the CEO whose caution doesn’t jive with the grand ambitions reserved for a 2025 meme stock. This creates potential for huge momentum in the near-term. But it also raises risks that the company may get distracted from its mission.

Company background

Opendoor was founded in 2014 as an ‘iBuyer’ platform, i.e. they would buy real estate near instant with the intention to sell it later and profit of a spread. Such a business model is not per se novel. Trading businesses have operated this way for a long time. Most goods retailers and wholesalers operate like that and most securities brokers do so, too. In theory, you should be able to extract a positive return if you provide liquidity and convenience to sellers and buyers, especially when you are taking price risk in appreciating assets.

However, every real estate property is unique which makes price discovery challenging. This creates huge resale risk for the iBuyer, for example if the notoriously cyclical housing market turns sour or if the iBuyer fails to value the acquired assets properly. Opendoor is therefore a bet that has both a macro and a micro dimension. Let’s check out both.

Macro

The company went public in late 2020 with perfect timing for the pandemic housing party. It quickly tripled within three months and then crashed almost 99% over the coming three years as rising interest rates started freezing the housing market.

The 30-Year fixed mortgage rate was just 3% in late 2021 and hit almost 8% just two years later. To some extent, Opendoor stock is a highly leveraged bet on that mortgage rate as illustrated in the chart below.

Just yesterday, the Wall Street Journal published this article on the paralysis in the housing market. Millions of Americans have either bought or refinanced homes at ultralow rates during the pandemic. This has shielded them from rate hikes so far (and in turn completely impaired the traditional transmission mechanism of monetary policy). But it also put them into golden handcuffs. They can’t move without severe financial disadvantages from losing their cheap mortgages. The problem is not that RATES are too high. It’s their VOLATILITY that has been too high in the last five years.

This volatility has paralyzed the housing market because it removes both buyers and sellers of existing homes. As a result, home prices aren’t necessarily crashing, …

…but existing home sales have been close to the lows of the GFC and in fact close to the housing market consolidation of the mid 1990s subsequent to the savings and loan crisis. Back then, America’s population was about 70 million people smaller by the way. You would think that the population increase would increase the number of housing transactions, especially when household sizes are shrinking.

Transactions being so low is a huge market distortion and it is happening while Millennials, America’s largest generation ever, are still in prime homebuying age.

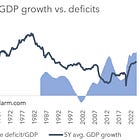

And it’s also happening during record high fiscal deficits that have created a buying mania for everything that is deemed a protection against government currency debasement.

Stocks, gold, crypto. Whatever is considered scarce is being bid to infinity. Except homes. The vast majority of people believes it’s a bad time to buy them.

The lack of affection for real estate is not just a phenomenon among US households by the way. Per the August 2025 BofA fund manager survey, REITs have reclaimed the top spot as the most hated sector.

Granted, this pertains more to commercial real estate than residential real estate and as such it is subject to other challenges, esp. with office buildings and changing working environments. But it does add to the mosaic pointing to very low sentiment to the entire asset class. Capital intensity is being shunned (unless it relates to data centers).

I believe that housing transactions will come back with a vengeance and will prove to be very sensitive to falling mortgage rates. Life circumstances keep changing regardless of where rates are, esp. due to the big three Ds for real estate (death, divorce, debt). Pressure is building up during this paralyzed time.

It’s by the way not necessary for the stock market to keep pumping alongside such a real estate recovery. The housing market was very strong during the bear market in stocks in the early 2000s. In fact, I believe homes might become targets for those trying to diversify their gains from current momentum assets. Do you really want to stash away your savings in code form forever or do you want to secure it in something more tangible eventually?

Purely macro speaking, Opendoor stock is a suitable vehicle to bet on such a turning point. However, the story only becomes compelling if the business model actually works.

Micro

Opendoor is not the only company that has ever tried iBuying. Other companies have done so as well. The most prominent ones are the online real estate marketplaces Zillow and Redfin. Both of them shut these businesses down in late 2021 and early 2022 because they couldn’t get the pricing right and lost a lot of money. Today Opendoor is the only serious iBuyer in the US.

The failures of others illustrate the challenges with Opendoor’s business model. But they also demonstrate how much value there could be for a company if it could figure it out. The harder the problem, the bigger the upside.

As an example, Carvana plays a similar role in the US automotive market. They are commanding $75bn market cap for their potential to disrupt the $500bn US used car market.

The market for existing homes is about four times bigger if we assume midcycle sales of 5 million units and an ASP of $400,000. Opendoor could become a huge company.

To take advantage of that opportunity (or more importantly in today’s narrative driven market environment: to be priced as being likely able to take advantage of the opportunity), Opendoor has to prove that they can price homes reliably and convert their trading activities into profits.

After they went public, they expanded aggressively into an exuberant market. In just a year, quarterly home sales surged tenfold to more than 10,000 units and inventory swelled to 17,000 units from just 1,800 units shortly after going public. In the first eight quarters as a public company, they burned through almost $7bn in free cash flow.

When investors stopped financing this expansion, Management cut home purchases and inventory aggressively. For the last 8 quarters, they have hovered at around 4,000 unit sales per quarter and about two months of inventory on their book.

Interestingly, the company’s contribution profit per home sold has recovered for some time already. It’s lower than during the 2021 boom time, but it remains stable at about $15,000.

Contribution profit is effectively gross profit plus a few adjustments for inventory valuation and additional costs for selling and holding the properties.

The back-of-the-envelope long-term bull case for Opendoor could look like this: Assume they get 5% of an existing home sales market of 5 million units annually at midcycle. That’s 250,000 homes sold in a year. If they can generate $10,000 profit per unit, that’s $2.5bn operating profit, possibly $2bn after-tax. At 15x earnings, this could value the company at $30bn which is 15x upside from today.

For reference, Rocket owns about 5-10% of the US mortgage origination market, depending on how that market is defined. A serious industry consolidator can get to such levels.

2Q25 earnings

Opendoor released their 2Q25 earnings on August 5. The company grew revenues moderately 5% YoY and more importantly delivered an improved bottom line with positive gross profit, contribution profit and Adj. EBITDA.

However, the stock sold off sharply that day, finishing down 25%.

Management had sounded very cautious in their communication, both in written form and verbally reiterated later in the call. Here is a key quote from page 3 of their shareholder letter:

“While our full quarter performance was strong, we observed a consistent slowing of the housing market as the quarter progressed. In response, we further raised spreads, exiting the quarter with a materially lower acquisition pace than we entered, which will impact our second half outlook. Looking ahead, we believe housing market weakness will persist, and we are not assuming any near-term catalyst for improvement. We expect to see sequential acquisition and resale volume declines driven by a combination of macro dynamics, typical seasonal patterns in our cash offer business, and the early-stage nature of our platform pivot, which will take time to mature. We are transitioning our business model during a historically difficult macro environment – the benefits of this evolution will take time to materialize.”

It’s a remarkable emphasis on caution. Quite a different vibe compared to the exuberance in Rocket’s earnings call a few weeks ago.

I believe they did this deliberately in response to the huge investor interest of the last few weeks, clearly hoping to avoid ‘memeing’ too hard and bear the potentially negative long-term consequences that come with it. Many meme stocks flame out eventually and lose track of their mission with questionable and brand-damaging financial engineering acrobatics.

CEO Carrie Wheeler has received a ton of criticism for this from the stock’s promoters online. She resigned yesterday in response to what has to be called a campaign against her.

Opendoor’s most vocal online promoter is arguably Eric Jackson, a hedge fund manager whose posts are often borderline legal and I wouldn’t be surprised if he was eventually investigated by the SEC. He celebrated Wheeler’s departure triumphantly.

It’s clear that those building the Opendoor investor community right now are hoping to create excitement and momentum in the stock. The most benevolent interpretation of their actions is that they want to raise the valuation to improve the company’s competitiveness. The higher the valuation, the lower the cost of capital, which would be very helpful in such a capital intense business. It could be immediately positive for the company’s bottom line.

The more critical interpretation is that these promoters simply want to financially benefit from creating a hype and later dump into it. That creates unnecessary volatility and the fundamental investor is at risk of buying too high which then lowers future returns.

I am sitting on the fence with this one. How about you?

Sincerely,

Rene

And if you are looking for other potential names to research, I’m curious about hydrograph as well! Is that tech the real deal? 🤣

It’s been entertaining if nothing else. (https://x.com/robert4nothin/status/1957134369501450686) I appreciated you taking the time to write about it. I’m on the fence myself, but I think we are heading towards frothing markets and euphoria so just as a meme story it may be worth a small allocation of LEAP calls?