Quantifying the Tesla Insurance Opportunity (incl. Excel Model)

Insurance is a capital game. It's about acquiring policies cheap and not losing money on them. Here's why Tesla is primed to win that game.

This article is part of a series where I am attempting to quantify the midterm EPS potential for Tesla. Eventually, I will build a 3-5y model with an approach that is similar to how I modelled my 2023 EPS estimate here.

To develop this model, I have so far looked at Tesla Finance and Tesla FSD. Today, I will cover why I believe Tesla Insurance has the potential to contribute meaningfully to the earnings growth story in the coming years. I have attached my valuation model to this article for premium subscribers. For free subscribers, I have included excerpts from the most important model sections as screenshots throughout.

In Tesla’s 4Q22 earnings call, Zach Kirkhorn gave some encouraging comments on their nascent insurance business.

“We're currently at a $300 million annual premium run rate as of the end of last year. We're growing 20% a quarter so it's growing faster than the growth in our vehicle business. And in the states in which we're operating, on average, 17% of the customers in the states are using a Tesla Insurance product. And that number continues to tick up as we spend more time in markets. And we see most of the adoption occurring when folks take delivery of a new car, as they're setting up insurance for the first time as opposed to going back and switching when they already have insurance set up. Just as a broader reminder on kind of the motivation for starting this business, it was to improve and still is to improve the total cost of ownership of our cars, given that we're seeing high premiums of insurance from third-party companies. And that remains our priority here. We'll obviously run this as a healthy business, but we want to make sure we keep our costs low and insurance stays affordable to our customers.”

Zach Kirkhorn, 4Q22 earnings call

How do insurance companies create value?

Before we dive into the specifics of Tesla Insurance, it is important to develop a foundation about insurance valuation because we have to assess it a bit differently than the hardware and software business.

If you buy insurance for your car, you are effectively buying a conditional cash-settled put option on your car. If the value of your car drops due to factors covered in the insurance policy, the insurer will pay you the difference. From this perspective an insurance business can be summarized like this: Take some capital as collateral to sell put options on assets for which the collected premium ideally exceeds the expected payout. Then invest the proceeds received upfront wisely in assets that will either appreciate or generate income. The better you are at doing this, the higher your return on that capital (RoE) will be and the more premium your share price will command on top of that capital (P/B).

The risks that carriers insure are wide ranging. But generally two forms of insurance have crystallized to categorize carriers: Life Insurance and Property & Casualty Insurance (i.e. insuring assets and bodily harm). I will focus on the second category because Life Insurance is distinctively different from P&C Insurance.

The regression analysis below illustrates the close relationship between RoE and P/TB (tangible book) for the largest P&C insurers in North America, Europe and Developed APAC. I am looking at tangible book value as opposed to book value because I do not want to have distortions from M&A activities in my analysis. The book value of a company can be inflated after a large acquisition when the buyer capitalizes the target’s goodwill and intangible assets.

There are principally two ways how an insurance carrier can create value:

Acquire policies cheaper than their peers: Insurance policies are are highly commoditized with price being the primary decision factor for customers. So, the cheaper you onboard new customers, the higher your margins will be.

Make customers more profitable: Reduce costs associated with fraudulent and valid insurance claims.

I believe that Tesla is in an excellent position to enter the insurance industry and scale profitably.

Acquire Policies cheaper

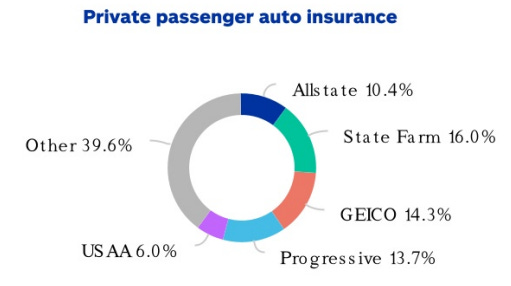

There are lots of companies active in the P&C space, but car insurance specifically is fairly concentrated. I will focus on the US market for this analysis because it is the first jurisdiction for Tesla to meaningfully enter the insurance market. But I believe that my analysis will be relevant for the subsequent international rollout as well.

The chart below shows the largest players in the US, which I obtained from Allstate’s IR materials:

I will primarily look at Allstate ALL 0.00%↑ and Progressive PGR 0.00%↑ , which are the #3 and #4 players. #1 (State Farm) and #5 (USAA) are mutual insurance companies. This means they are owned by their policyholders, which limits access to comprehensive financial information. Geico is owned by Berkshire Hathaway. They have decent financial disclosure of their insurance operations. However, it is quite a bit diluted by their life insurance business and it is also difficult to infer its implied valuation.

Since insurance (particularly car insurance) is a highly commoditized product, carriers need to spend a lot of money to acquire policies. Progressive typically pays ~8% of the premiums earned in any given year to acquire new policies. For Allstate, it is even ~14%.

They have to spend hundreds and sometimes thousands of Dollars to insurance agents and other distribution channels to get one customer signature. Selling insurance products is a very attractive business model. Brown & Brown BRO 0.00%↑ specializes in this field for example. They have a market cap of $16bn and are trading at 5x revenues.

And a good amount of the money that the insurance carriers spend is required to compensate for customer churn by the way. So it’s not just money they have to spend for growth. It’s required spending to stay in business.

Tesla enters this game in a very strong position because in contrast to the other insurance carriers they own the relationship with the end customer via their direct distribution model. They can be a combination of Progressive and Brown & Brown so to say.

The whole process of buying a Tesla is also highly digitized. A customer often does not even talk to a sales rep. Adding in a step to sell insurance should be fairly easy.

Therefore, fully scaled Tesla Insurance operations will likely have a 5-10% margin advantage vs. Progressive and Allstate. They can either choose to enjoy superior margins or they can undercut their competitors’ prices to aggressively ramp their product. Or both.

“Insurance could very well be 30-40 percent of of the value of the car business […] with a much better feedback loop. Instead of it being statistical, it can be specific. Obviously, somebody does not have to choose our insurance but I think a lot of people will. It's just going to cost less and be better so why wouldn't you?”

Make customers more profitable

The lower the loss ratio (claims and admin costs divided by premiums earned), the more profitable the customer is. The more data the insurance actuaries have to assess the risk for a claim, the more likely they can price the policy correctly and the lower the loss ratio can reliably be. The secret sauce to do so in car insurance is telematics, i.e. gathering data about a vehicle’s and driver’s habits.

LMND 0.00%↑ is a newcomer that attempts to leverage telematics to disrupt the insurance industry. I have articulated my bearish view on the company here. In terms of proven present capabilities, Progressive is the top dog in telematics. They are the first mover in the US with a widely available product (Progressive Snapshot) since 2011. They have continuously iterated on their platform over the past decade which has over time allegedly improved their pricing capabilities and customer mix. They had an insightful investor day on Feb 28. 2023.

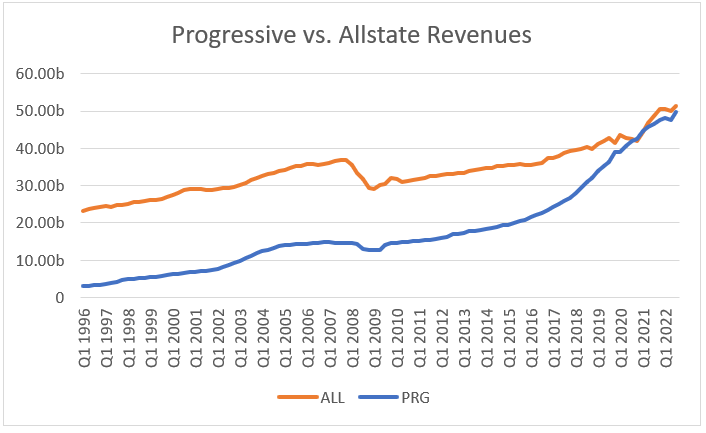

Allstate did not launch their telematics offering until 2016. Progressive has outperformed Allstate in terms of revenue growth massively over the past decade. I have not looked into the company in detail, but I can imagine their technological capabilities supported that. As pointed out above, they have been able to outgrow Allstate with lower policy acquisition costs.

Consequently, their share price has outperformed by a lot, too.

Today, Progressive is worth three times more than Allstate even though they look quite similar in terms of revenues and earnings. Progressive is trading at a P/TB of 5x, while Allstate is trading at 2x. The most plausible explanation for this difference is that markets are giving Progressive credit for their technological lead. The bottom line here is that having a technological edge seems to pay off in the insurance industry.

Now, Tesla is entering the game. And no matter how much data Progressive has and how sophisticated their algorithm is, Tesla’s will eventually be better. The vertical integration of Tesla’s hardware and software is unparalleled. And their pace of innovation is staggering.

“It is also giving us a good feedback loop into minimizing the cost of repair because we obviously want to minimize the cost of repairing a Tesla if it's in a collision and for Tesla Insurance. And previously, we didn't actually have good insight into that because the other insurance companies would cover the cost.”

Elon Musk, 4Q22 earnings call

For example, here are some data fields that Tesla’s inside camera can track:

How many Non-Teslas even have inside cameras? If you find this an invasion of privacy, I agree. But so far, it does not seem that customers care. Our entire society is on the path to more surveillance. As long as it gives them utility in the form of saving money and/or having a better user experience, I believe it is likely customers will accept this just like they accept being tracked on their phones.

And Tesla is expanding their data capabilities constantly. Here is for example a gem from their recent Investor Day:

“We recently released a feature that automatically predictively adjusts and raises the suspension for ride Comfort before the car hits a section of rough road. We do that by leveraging the fleet to generate a map of Road roughness everywhere our cars drive. […] Our navigation server aggregates the anonymized Telemetry from the fleet and annotates our map with things like updated speed limits Lane topology and now Road roughness the onboard navigation engine which looks ahead of the route that the car is traveling on and determines whether things are about to get rough.”

Teslas are mapping the world as their customers are using them. The way this company is leveraging their own customers to improve their product is unprecedented.

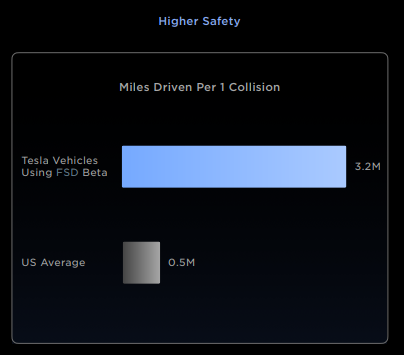

Once Tesla solves autonomy, the insurance product will be even more compelling. No other carrier will be able to price the collision risk for a self-driving Tesla as well as Tesla themselves. The adoption rate of Tesla Insurance for cars with FSD enabled should over time approximate 100% in my opinion. And the profitability of the insurance product will be fantastic because collision risk drops dramatically with FSD.

Quantifying the Opportunity

Okay, Tesla Insurance will likely be a banger. But how much can it really contribute to the EPS growth story and the company’s valuation? To gauge this, I have build a high level model based on estimates regarding Tesla’s fleet size, insurance adoption rate and likely profitability.

I built up the projections for premiums earned, claims and operating expenses based on Allstate’s and Progressive’s performance over the past three years. The details of these calculations are included in the attached model. Based on my calculations, I see a good chance that Tesla insurance will contribute $1-2 EPS within 4-5 years.

This is based on an operating margin of eventually 26%, which is quite a bit higher than what Progressive and Allstate have achieved in recent years. Their combined average was 14% in 2020 and 2021. I have excluded 2022 from this average because I consider that an outlier year in terms of investment returns being unusually low.

While it may appear ambitious to have such a margin assumption, I consider it justifiable. Allstate and Progressive pay a combined 10% of premiums earned every year to acquire policies, which should be much lower for Tesla. Tesla’s product mix also provides higher premiums for each vehicle insured which improves operating leverage with respect to policy administration.

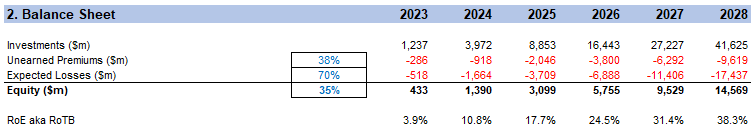

My model also includes simple balance sheet projections. As I pointed out above, insurance is first and foremost a capital game. Allstate and Progressive typically operate at a 25% equity ratio. I have assumed 35% for Tesla to reflect that it’s a more nascent business with additional uncertainty.

Even with such a rather punitive capital structure assumption, Tesla Insurance will eventually have a shot at achieving ~40% RoE. In this scenario, they would require $15bn in equity by 2028. They should be able to finance this entirely out of operating cash flow. It’s would be an excellent use of capital as opposed to an equivalent share buyback for example.

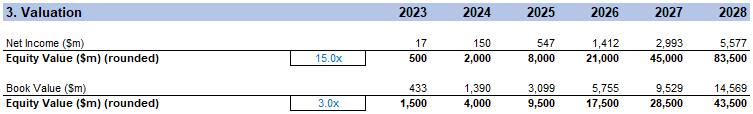

Based on these income statement and balance sheet projections, I came up with a valuation based on P/E and P/TB. Large P&C insurers currently trade at 15x forward P/E and 3x P/TB. Progressive is trading at 22x and 5x. Allstate is trading at 15x and 2x. Selecting 15x and 3x for Tesla appears reasonable/prudent to me. I don’t want to have overly ambitious valuation assumptions because my operating assumptions are already quite ambitious.

This would value their insurance business between $40bn and $80bn by 2028.

Progressive is currently trading at a market cap of $83bn, Allstate is at $28bn. So, Tesla has a shot to recreate an insurance carrier with the size of a Progressive or an Allstate within the coming 4-5 years. It will be an additional pillar to the earnings growth story and it’s a fantastic avenue for Tesla to take to further take advantage of their vertical integration.

What do you think?

Sincerely,

Your Fallacy Alarm

Model below.