Resetting expectations for Tesla (incl. Excel workbook)

Repricing the stock to lower growth and less ambitious valuation levels.

For my initial read on Tesla’s 3Q23 earnings, please check out the article below. This is a follow-up on that assessment.

This article is entirely free to read. For premium subscribers, it comes with an Excel workbook for the valuation considerations towards the end.

In my 1Q23 earnings digest on Tesla, I told you about Apple’s story after the launch of the iPhone.

That product launch made the stock increase tenfold between 2009 and 2012. But then it suddenly dropped 30% on demand and margin concerns. We’ve seen similar things play out for Tesla over the last two years.

Apple’s margins never recovered and they kept losing market share to Android which is today the leading mobile computing platform. But that did not stop Apple stock to increase tenfold again over the next 10 years. My take from this analogy was that the only thing that eventually matters is whether the company has the right assets (technology, leadership, culture, brand, strategy, product roadmap) to create value for their customers and consequently capture it for shareholders. If that is the case, financial success will follow. And it might take a shape that is not captured by KPIs investors are obsessing about today. Using Apple as the blueprint for Tesla drives optimism that things will turn out fine. But Apple is obviously an outlier in business history.

Today, I want to use a different analogy: Qualcomm QCOM 0.00%↑.

What is Qualcomm?

Qualcomm is a wireless technology provider. At the end of 1998, the stock closed at $3.24. A year later, it closed at $88.06. That’s a 27x for the 1999 calendar year which coincidentally pretty much marks the entire bull market move for the stock.

On October 23, 2019, Tesla announced their 3Q19 earnings. It was a pivotal moment for the company because it was shortly before they announced a surprise profit that finally propelled the company out of its notorious and infamous loss making. Before earnings were released, the stock closed at $16.98 (split adjusted).

What followed was a manic run as investors realized that EVs are the future and Tesla is in the pole position. A massive short squeeze ensued which ended on November 4, 2021, shortly before Elon’s famous announcement that he will sell shares to satisfy political pressure on billionaire taxation. Before that news dropped, the stock closed at $409.97. A 24x. It took Tesla longer than Qualcomm, but the magnitude of the move is comparable.

What made Qualcomm so popular in 1999? It was the promise of the dawn of the mobile computing age. Qualcomm was a pioneer in so called Code Division Multiple Access (CDMA) technology, a digital cellular technology that offered significant advantages over the older analog cellular systems. CDMA provided better call quality, increased capacity and most importantly the potential for data transmission. This technological leadership positioned Qualcomm as a key player in the rapidly growing mobile telecommunications industry.

Qualcomm's primary business model revolved around licensing its CDMA technology to other manufacturers in the mobile phone industry. This licensing model allowed Qualcomm to collect royalties on virtually every CDMA device sold worldwide, creating a steady stream of revenue that was highly profitable.

In the late 1990s, cell phone adoption was in the middle of a sharp S-curve:

What’s curious is that the investors buying into the 1999 investment theme were right. It was indeed the dawn of the mobile computing age, even more than they could ever have dreamed in their wildest bull cases. It’s not just that we all own cell phones today. It’s the intensity of the usage. Many of us cannot even visit the bathroom without staring at the magic device.

And Qualcomm has successfully capitalized on that. In 1998, their revenues were $3.3bn. In 2022, they achieved $44bn. In 1998, their operating margin was 8%. In 2022, it was 30%. Between 1998 and 2022, operating profits increased by 4,400%.

Looking at the past two decades, Qualcomm is a success story without doubt. But here’s the catch: Even if the bull case was correct in 1999, it took 20 years for the stock to reclaim its all-time high.

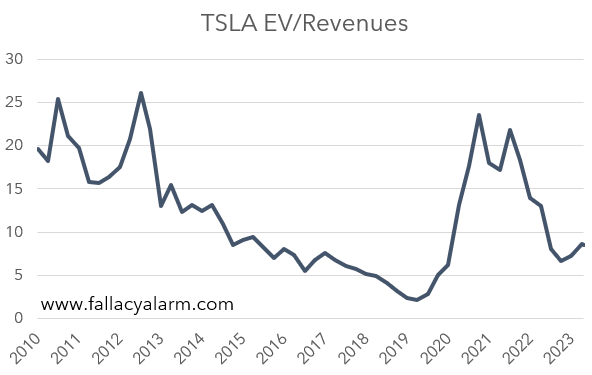

At their peak in 1999, they were trading at 23x revenues.

Coincidentally, this roughly matches where Tesla was trading in late 2021:

The takeaway is obviously quite different here vs. the earlier Apple analogy: Even if a company has the right assets to capitalize on a megatrend and create value for their customers, it’s absolutely possible that the present cohort of shareholders won’t capture it.

So what is Tesla then? The next Apple or the next Qualcomm?

It depends on how the EV adoption curve will look from here vs. expectations. If EVs win, Tesla will win. I don’t see risk from competition. But that also means, if EVs don’t win (or don’t win fast enough), Tesla will not win either.

I have seen people claiming that nothing has changed after this earnings release. Personally, this is not true for me. I feel very alienated as a shareholder due to various management comments such as Elon’s platitudes that are getting old, the generic statements on the progress with the 4680s and the uninspired comments about demand weakness relating to “wars”. What’s happening in Ukraine and Israel is heartbreaking. But will it impact a vehicle buyer in Chicago? C’mon!

But those comments were not even the worst. I feel most irritated about the comment that Giga Mexico is being delayed for macro reasons. This came in conjunction with casually walking back their stated 50% annual long term growth goal (Elon: “You can’t grow 50% forever, otherwise you will hit the mass of the universe” Sigh!)

I was very much aligned on Tesla’s mission and believed in their flywheel of riding down the cost curve and thereby expanding their addressable market. In my opinion, either they have a superior revolutionary product or they don’t.

If they do, I expect the company to ramp “full tilt” (in Elon’s words) regardless of the macroeconomic conditions because that is the only way to push the cost curve down further and drive up EV adoption.

If they don’t, then I don’t want to buy the stock at 90x annualized 3Q23 earnings because it is unlikely that their earnings will eventually demonstrate the non-linear pattern that we all expect and that is required to support the current valuation.

This earnings release and more importantly management commentary suggests that they don’t have such a product. Or at least it somewhat dilutes the thesis, this is obviously not black and white.

The origin of the demand issues

Tesla has demand issues. It can’t be denied. They are running their existing factories below capacity and they are delaying new ones.

The key question is where do these issues come from? If these issues are due to macro then I am fine waiting out for the normalization to come. But if there is a technological adoption problem, I will be very concerned.

Let’s take a look at total vehicle sales in the US:

The weak industry performance since 2020 is quite remarkable even if there are good arguments such as supply shortages followed by interest rate increases. We have never really claimed back pre-Covid levels and the average age of the US vehicle fleet is getting excessively high.

But the chart also tells another story: recent momentum clearly points up. Year-to-date, sales are up by 14%. For 1H23, Ford’s F 0.00%↑ revenues are up 16%. GM 0.00%↑ ’s are up 24%. Both are profitable with improving margins. This comes at a time where Tesla momentum points the other way.

There’s more than just interest rates at play. Economic growth remains strong fueled by enormous public deficits. Just today, the first 3Q23 GDP estimate came in at a staggering 4.9%.

Also, the world is full with EV purchase incentives. Since January, US consumers get up to $7,500 to buy an EV. I am very disappointed how little that has done to Tesla’s income statement so far. Or perhaps it has and we’re simply spared from worse for now?

Yes, EVs are still gaining market share. But the adoption curve is showing signs of stalling which is evidenced price wars and production plans being cut back.

Advertising to the rescue?

There is a big narrative in the Tesla investor community right now that the company needs to finally adopt large scale advertising because too few consumers know about Tesla’s functionality, features and recent price cuts.

I don’t have a strong opinion on whether advertising makes sense or not. It’s a business decision and I trust that management will make a decision that maximizes shareholder value. After all, if I did not believe they were capable in doing so, there is no reason for me to own the stock in the first place.

I want to raise another point with respect to awareness: If it is truly the case that consumers don’t know enough about Tesla’s products and prices, then perhaps it’s because they simply don’t care enough? Perhaps they are simply content with their current mobility solution?

The key question is this: What problem does an EV solve for the customer? The cell phone introduced the ability to communicate with others no matter where you are. The smartphone added data to that. Now, we have all of humankind’s knowledge in our pockets. Amazon provided us with a manyfold improved access to products at much cheaper procurement costs.

What value'-add does an EV have? Sure, you might enjoy there is less pollution at the source. You might enjoy charging at home. You might prefer the driving physics of an EV. You might enjoy less need for maintenance. But these are all usage details. These are not game changers like having a phone in your pocket when you had to find a booth before.

Don’t get me wrong. I do believe that electric vehicles will eventually be the dominant technology for individual ground transport. But there is no cell phone like adoption pressure. In the late 1990s, people stormed the stores for cell phones. Sure, there was also advertising, but that simply decided whose store they stormed. They would have bought a phone anyway. With EVs, you can wait without much pain of not having the product. That will slow adoption down.

What now?

An investment case for a single stock requires two things:

a view that differs from consensus in any (ideally all) of the following dimensions: valuation, operations, sentiment.

a margin of safety to account for imprecisions in your assumptions.

If you don’t have that, you should just put your money in the S&P or in the MSCI World.

In my opinion, Tesla’s current operating performance and management’s commentary thereon will deflate a lot of the growth imagination priced into the stock. Their growth curve will likely look flatter than what I expected it to be and I need to account for that.

The Tesla investment case must become much more compelling to be attractive. That requires resetting expectations. For this purpose, I have prepared the simple valuation model below, which I attached for premium subscribers so you can play with the assumptions yourself.

It reads like this: If you believe that markets will price in that Tesla will in the near-term

be able to sell 3m vehicles for $5,000 operating profit apiece,

deploy 40 GWh of energy for $100/kWh operating profit and

deserve 30x multiple on those earnings to reflect the risk and growth profile of these earnings,

then the stock would be worth $130. With these assumptions you would then get the FSD/AI opportunity and additional fleet monetization potential (insurance, financing, supercharging) for free on top. And at 30x P/E you would get further growth optionality in automotive and energy relatively cheap. I would find that level for an entry very attractive.

My current assessment is obviously subject to uncertainty. I can and will be wrong. That’s why I still own Tesla stock and it is still my largest single stock position despite thinking it is overvalued right now. But I have cut my exposure a lot after these earnings.

So far, the stock price performance is proving me right, but I don’t measure my investment performance in days, weeks or months. I am willing to buy in again at significantly lower levels. If that does not happen and the story is less broken than what I believe it to be at this point, that is fine for me. It’s about the ex ante risk return proposition. It’s not attractive to me at this level. I believe the thesis needs to be retested again which will come with pain.

Sincerely,

Your Fallacy Alarm