Revisiting goeasy (incl. updated workbook)

Would you like to buy SoFi stock at $6? Or Affirm at $13?

Last year in April, I published the piece below on goeasy, an alternative non-bank lender in Canada. I hypothesized that rate cuts will improve the proclivity and ability of Canadians to borrow and that well-run alternative lenders will take a disproportionate share in that.

The stock did indeed climb for a while subsequent to my article. However, it started consolidating again from summer 2024 to spring 2025 as the Bank of Canada’s rate cut cycle stalled. Curiously, the stock has started picking up steam again recently. It’s up 50% in just three months. Time to revisit the underlying story. I have also updated my Excel workbook which includes the latest quarterly financials and comp tables against some useful peers.

TLDR Summary

Canada is in a recession with falling real GDP, rising unemployment and weak demand for credit. You would think that this sends a subprime lender like goeasy into a world of pain. Yet they keep growing and they keep printing money. Their loan portfolio is up 24% YoY, revenues are up 12% and net income is up 32%. Return on equity currently stands at 29%, a level than all major Canadian banks and most US fintechs would dream of. The company is rapidly taking share in the Canadian lending industry. Its market share has tripled in just four years and has an endless runway left.

Even after its recent run, the stock is still trading at just 12x LTM earnings. Investors don’t pay more for a Dollar of goeasy earnings than they pay for the earnings of major Canadian banks. All while getting exposure to a strong structural growth story that remains fully intact and doesn’t show signs of investor exuberance.

The story offers further upside potential should Canada regain some economic momentum. The Bank of Canada is currently strangulating the economy with an utterly deluded monetary policy. Further rate cuts would be far more consistent with the country’s fiscal situation and the financial circumstances of Canadian households. Once the rate cut cycle resumes, goeasy should be a major beneficiary.

Investment case recap

As an alternative lender, goeasy doesn’t finance its lending operations with deposits, but instead through a combination of debt and equity. This gives them flexibility and a competitive edge as they are not held to the same regulatory standards as banks.

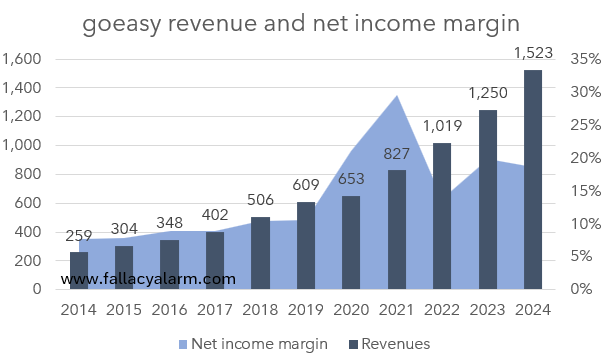

Their business took off after the GFC. goeasy filled the void opened by banks that tightened their lending standards due to regulatory changes. Between 2014 and 2024, revenues exploded from C$259m to C$1,523m and the net income margin expanded from 8% to 19%.

This market share taking by well-run alternative lenders is a structural theme in the Canadian financial services industry and it will likely continue for the foreseeable future. Over time, goeasy has the potential to leverage its customer relationships and its branding to transform into a more diversified financial institution with an expanding product offering.