ROOT 1Q24: Flooring the gas pedal even harder (incl. Excel workbook)

These earnings support the bull case. Growth continues to be explosive and profitable which drives optimism. However, with the rapid share price appreciation, risks are rising, too.

Disclaimer: The information contained in this article is not and should not be construed as investment advice. This is my investing journey and I simply share what I do and why I do that for educational and entertainment purposes.

This article is free to read. An updated excerpt of my Excel workbook is attached for premium subscribers.

ROOT 0.00%↑ just reported their 1Q24 earnings. You may remember from about two months ago how I got a little bit excited about them subsequent to their 4Q23 earnings release. The stock went into those earnings trading at $9. Six weeks later, it hit $80. The stock consolidated a bit in anticipation of 1Q24 earnings and fell back into the low 50s briefly. Another blowout quarter has just catapulted it to $90 as of this writing.

TLDR Summary

As a reminder, my bull thesis goes like this: Root is on a mission to disrupt car insurance through a superior digital strategy. Their recent operating performance suggests they have reached an inflection point. Growth is explosive and profitable. Their loss ratio is even lower than for some of the incumbents. They benefit from an inflation differential in insurance premiums and used car prices. The used car market is ready for a volume rebound which will be advantageous for a challenger seeking to gain market share. Management’s drastic reduction of the usage of reinsurance signals confidence in their underwriting ability. A near-term capital raise will be highly valuation accretive. For further reference, check out my earlier coverage on this stock here:

This earnings print is supportive of the bull thesis above. Revenue growth accelerated further (now 264% on a year-over-year basis) and even more importantly, it happened profitably and self-funded.

The company continued their shift away from reinsurance. They used to cede about half of their gross premiums written. Now it’s consistently less than 20%. This exemplifies confidence in their proprietary pricing technology and optimism about their financial health.

At a billion dollar valuation, this stock is obviously not the steal anymore that is was at the start of this year. It’s now trading in line with incumbents such as Progressive and Allstate on an EV/Revenue and a P/TB basis. Markets are valuing their growth as much as they value these incumbents’ profitability. Root’s unique operational momentum that can generate additional upside from here. A cyclical rebound in vehicle sales is still pending and may give them an additional boost in the coming quarters.

There are a few risk factors to keep an eye on. Firstly, the inflation differential in revenues and costs won’t last forever. The pending normalization comes with uncertainty regarding Root’s sustainable profitability level. We don’t know to what extent this is priced in right now. Secondly, Root’s aggressive growth has depleted their equity cushion. Their equity ratio is now below average for the industry which may limit the pace of further growth. Management’s commentary in the earnings call confirms that growth will likely slow down materially from here as they prioritize profits over scale for the time being.

Earnings in detail

This company is on an absolute tear, the likes of which I have rarely been blessed with since I have started studying financial markets 15 years ago. Revenues came in at $255m for the quarter. Year-over-year revenue growth accelerated from 173% to 264%. If this is not hockey stick growth, I don’t know what is:

And most importantly, this growth is profitable. The company just recorded its first ever profitable quarter on an Adj. EBITDA basis. And considering this trajectory, bottom line profitability is very near.

I am pleased to see that their journey to reduce reinsurance continues. The chart below plots ceded premiums written vs. gross premiums written, i.e. it measures how much of their premiums have been ceded to third party insurers. I consider this one of the most important metrics for Root because their shift away from reinsurance in mid 2023 is a very strong sign of management confidence. It demonstrates that they believe in their pricing technology and the financial viability of the company.

This is a structural growth story. But there is also a cyclical perspective to it. As I have outlined in earlier articles, Root is to some extent a bet on a rebound in vehicle sales volumes. As a challenger to established incumbents, Root needs people to switch their cars to have a catalyst to consider an alternative insurance provider.

As such, Root is a rate cut play because vehicle sales are currently suppressed by high interest rates. The chart below shows the latest momentum in new and used retail vehicle sales per Cox Automotive:

Especially used car sales are at very depressed levels. I consider this an encouraging data point. From a cyclical perspective, this should be a warm tailwind for Root soon.

Management commentary

Management used the earnings call to caution analysts and investors not to extrapolate current growth rates exuberantly. They noted that growth will slow down and they will deploy marketing dollars more selectively and opportunistically from here. Competition has picked up this quarter and they expect this to continue in Q2 which will limit underwriting growth.

Their focus is to maintain profitable growth which is understandable given the company’s recent near death experience.

“Moving forward, we intend to remain focused on thoughtful and disciplined growth and expect to continue investing in customer acquisition as long as targeted unit economics are achieved. We expect gross written premium levels in the second quarter to decrease relative to the Q1 due to seasonality and changes in the competitive landscape. Achieving GAAP net income profitability with our existing capital continues to be our primary objective.”

“We've more than doubled our GWP, our GEP and our PIF count on a year over year basis. So we are confident that we can continue to grow. But I want to make sure that it's clear that the growth going forward will moderate if we're not reaching our unit economic profitability returns, right? Our growth will continue to be very prudent and disciplined. We're not sacrificing our capital position for unprofitable growth. So while we do expect that sales and marketing will be less in subsequent quarters based on seasonality, We'll continue to be opportunistic with respect to direct marketing spend and we're actively focused on optimizing our marketing bidding strategy both within our existing channels and also testing new channels. And we believe that we've got ample growth levers that we can pull. Currently, we're only in 34 states. We would like to be national at some point and we're continuing to invest in our differentiated distribution.”

Megan Binkley, Chief Financial Officer, 1Q24 earnings call

Valuation Update

Root’s stellar share price performance has catapulted its valuation multiples into the range of incumbents. It’s trading in line with Allstate and Progressive on an EV/Revenue and a P/TB basis. This means that markets value its growth potential as much as they value their competitors’ profitability and established footprint.

An incremental uplift purely based on valuation is therefore less likely. Admittedly, this compromises my bull case a bit. The stock can continue to do well if they keep crushing it operationally. The visibility into that is somewhat muddy though given that management has raised caution about near-term growth.

Risks to the thesis

Inflation Differential

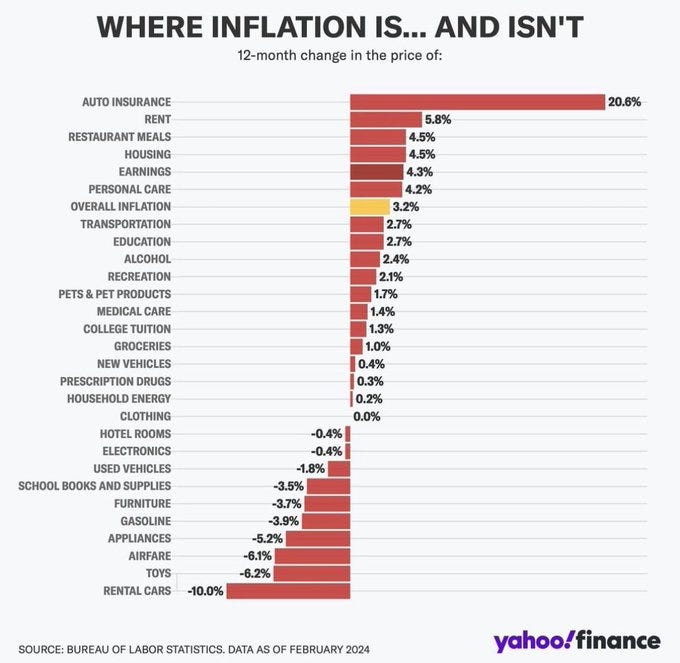

Root (and in fact the entire insurance industry) is currently benefiting from an inflation differential in their revenues and their costs. Insurance premiums are rising rapidly while there is disinflation and deflation in their costs. As a proxy, look at 12-month changes in used vehicles in the chart below.

Eventually, this windfall will be gone. We do not know yet where its sustainable profitability will settle once this happens and we do not know to what extent markets have priced in such a normalization.

Funding

Root’s aggressive growth has diminished their equity cushion.

Their equity ratio now stands at 19% which is considerably below the average level of North American P&C insurers.

This is not necessarily a problem. In fact, I believe a capital increase could be very valuation accretive if they manage to deploy that capital into additional growth. For now, they do not seem to be eager to do so.

As a disclaimer: I continue to be long in this stock, but I did reduce my exposure considerably because its portfolio weight made me uncomfortable and the margin of safety is much lower given this surge.

Sincerely,

Your Fallacy Alarm