🔎Summit applies for ivonescimab approval! (incl. Excel workbook)

The potentially biggest blockbuster drug ever is one step closer to its commercialization. Insiders are hyped up. Investors don't seem to care much about it yet.

Some of you may recall my article on Summit Therapeutics from a bit more than a year ago. The story is heating up right now which is why I feel compelled to give you a quick update today.

TLDR Summary

Keytruda was the biggest blockbuster drug ever before GLP-1s conquered the world. It revolutionized oncology by activating the immune system against cancer cells.

Summit’s ivonescimab has the potential to replace Keytruda and address an even larger market beyond that. It’s a clear technological leap. Earlier this week, Summit announced that they have applied for FDA approval for lung cancer. They are also running various trials for more indications. The drug has a good chance to become a blockbuster. It’s not too far fetched to see the stock 10xing if that happens.

The stock market is not too hyped up about that right now. The $13bn market cap is arguably already anticipating a fair bit of success. But the stock has been consolidating for a while. At $17, it’s currently at the low point of the trading range that started subsequent to the earthquake news in 2024 that I covered in my original article.

Background

Today, there are in principle four treatment options for cancer:

Surgery: Physically remove the tumor.

Radiation therapy: Damage the tumor DNA locally to stop further growth.

Chemotherapy: Systemically kill rapidly dividing cells, incl. cancer cells.

Targeted therapies: Target cancer cells biologically, either by blocking their growth, destroying them directly or by activating the immune system against them.

Most cancer treatments involve one or a combination of these approaches.

Immunotherapy is the commercially most relevant category within targeted therapies. It started proliferating roughly two decades ago when clinical trials demonstrated that cancer cells can be very effectively fought by activating the immune system against them.

Under normal circumstances, our immune system is tightly regulated to prevent it from attacking the body’s own cells. Cancer cells exploit these natural safeguards by closely resembling normal tissue, allowing them to remain largely undetected. Immunotherapy works by selectively lifting these immune constraints, enabling the body’s defenses to recognize and attack cancer.

Merck’s pembrolizumab (Keytruda) is such an immunotherapy. In 2024, it raked in revenues of $29.5bn which puts it into the same league as the GLP-1 blockbusters semaglutide and tirzepatide. Tirzepatide has likely surpassed it as of 2025.

Summit stock exploded in September 2024 when they announced Phase 3 data for ivonescimab. In their study, they pitted ivonescimab directly against Keytruda and it beat the incumbent handily.

11 months of progression-free survival (PFS) vs. 6 months,

50% objective response rate (ORR) vs. 39%, i.e. the share of patients with shrinking or disappearing cancer during the trial and

90% disease control rate (DCR) vs. 71% , i.e. share of patients without disease progression.

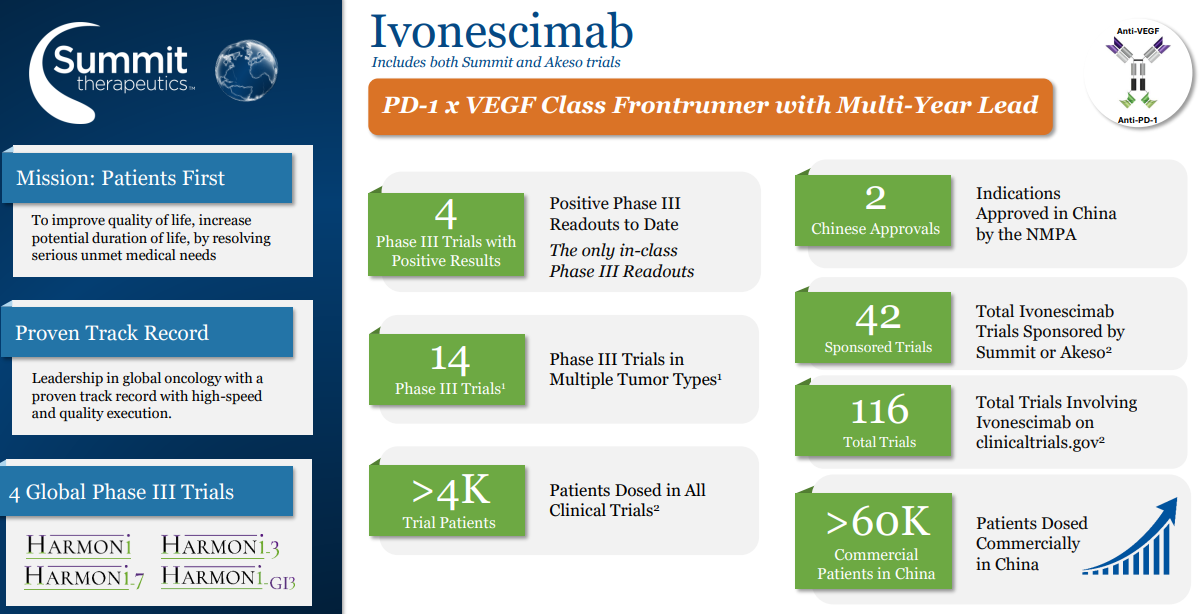

On January 12, 2026, Summit announced that it has submitted an application to the FDA seeking approval for ivonescimab for lung cancer. They did so during a presentation at the 44th Annual J.P. Morgan Healthcare Conference. The drug is already approved in China for two indications and there are 14 Phase 3 trials right now for various tumor types.

Investors are not yet too hyped up about this. The $13bn market cap is arguably already anticipating a fair bit of success. But the stock has been consolidating for a while. At $17, it’s currently at the low point of the trading range that started subsequent to the earthquake news in 2024 that I covered in my original article.

One of the most fascinating aspects about this company is the enormous insider conviction. Many Biotech start-up use positive data releases to raise money from outside investors. In Summit’s case, they prefer to raise money from insiders and institutions via private placement.

Insiders are also buying directly in the open market. Over the last twelve months, not a single insider has sold shares. Even not when the stock hit $37 in April 2025. They have bought all the way. And buying has heated up. In the last three months, insiders have bought 29 million shares which are currently worth $500m at a current share price of $17.

Observing this conviction and the rich valuation raises two important questions that I will elaborate on below: What makes ivonescimab so special? And what could it make Summit ultimately be worth?