The Dawn of the Natural Gas Age

It's the cheapest form of generating & storing energy that creates huge economic value for the US and abroad. And its leaders are demonstrating that they can capture this value for their shareholders.

Disclaimer: The information contained in this article is not and should not be construed as investment advice. This is my investing journey and I simply share what I do and why I do that for educational and entertainment purposes.

Technological magic happens, when humans mimic nature. The wings of an airplane are inspired by birds for example. Nature cycles energy through the formation and destruction of hydrocarbons. Photosynthesis consumes energy to build them. Burning them releases energy. What happens in an organism eating plants is the same what happens in an internal combustion engine. An ICE is based on a process mimicking nature. An EV is not. Something to think about.

Even if the Oil Age is ending, we may very well be at the dawn of the Natural Gas Age. Actually it may be 10am already. In this article, I will explain why and I will look into EQT 0.00%↑, the largest natural gas stock market pure play, to assess how investable this theme is right now.

TLDR Summary

All in, natural gas is the cheapest form of energy generation and storage. This is true globally and for the US in particular, which have achieved tremendous productivity gains in this space. In addition to its low cost when viewed in isolation, natural gas is also an ideal complement to renewable energy sources such as solar and wind as its production can flexibly match their erratic production profiles. All of this makes natural gas a cornerstone of the energy economy of the future.

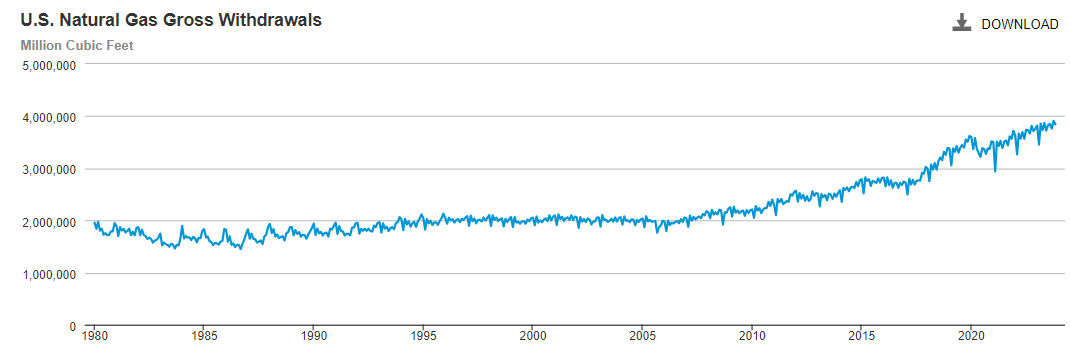

Over the past 20 years, the US have doubled domestic natural gas production from 2,000 billion cubic feet (bcf) per month to 4,000 bcf per month. Or in annual terms, from approximately 25,000 bcf to 50,000 bcf. This has grown its share in domestic primary energy consumption from 22% to 35%. There is potential for an even higher share in the future. But the true opportunity is blessing the world with US natural gas. They are currently ramping their export capacity which will likely increase the room for production growth of another 30% by the end of this decade.

It’s clearly a growth industry that will rise in importance over the coming years and decades. But investor sentiment is fairly bleak. There was much excitement a decade ago. But much of the promises have not yet transpired into the bottom lines of natural gas companies. FCG 0.00%↑ is an ETF that is compromised of natural gas companies. It’s down 75% from its IPO. Things went really south when the industry went into a cutthroat price war in the mid 2010s. Covid was then seemingly the final nail in the coffin. By April 2020, the ETF was down 94% vs. its IPO.

But it has seen a revival ever since. Natural gas prices remain low and the price war is in full swing. But the leading producers have leveraged productivity gains to maintain profitability. Operating expenses per cubic foot are consistently falling at a rate of 2-3% annually. The result is that a powerful industry has emerged that provides the US (and in fact the global) economy with a critical product for success: cheap, practical and reliable energy.

It’s a beautiful game of riding favorable cost curves and associated economies of scale that would make even Tony Seba ecstatic. It happens more gradually than in the hot industries like in chips and batteries. But it’s commercially proven and utterly neglected by investors. FCG’s median forward P/E is chilling at less than 10x.

From many angles, the natural gas industry is about a decade ahead of the battery industry in its lifecycle. Both promised innovative solutions to the issues we face with energy generation, distribution and storage. Both are riding down favorable cost curves. But in both cases, commercial success came with much delay vs. expectations. However, the battery economy has still a lot to prove. EVs and battery energy storage have to be scaled to much higher levels until we can have confidence about its merits and relevance for the economy in general and for shareholders in particular. Natural gas has succeeded in that regard already. I am optimistic it will show up in future asset returns.