Time to Catch Up!

The balance sheet of US citizens is remarkably strong, which offers upside to both the real and financial economy.

In an economy that sends the weirdest signals to those trying to make sense of it, there is one chart that stands out for me personally. One of the most baffling data points that is hard to reconcile with the narrative that monetary tightening is eating the US consumer alive.

I am talking about checkable deposits and currency held US households. Look at that thing below. It’s absurd.

In the past, this has been ~$1tn. Kind of makes sense since it would be $3k for each of the 330m US citizens. This number is now $5tn. $17k per capita. And still growing against all alleged adversity.

Where does all this cash come from?

Since January 2020, the US Treasury has run a cumulative deficit of $7tn. An enormous amount of stimulus that amounts to one third of the entire 2019 US GDP.

Half of that stimulus has landed/remained in the bank accounts of US Households. In my opinion, the story that this chart tells is that US Households have not (yet) spent a large amount of the Covid stimulus. It paints the picture of an extremely strong US consumer balance sheet. It is just one data point, but it raises the question whether such an economy can enter a recession that is worth its name.

It could be that US citizens’ demand for cash/liquidity has dramatically increased over the past three years. Perhaps they prefer to have more cash in the bank as a result of inflation and other economic challenges/uncertainties. If that is the case, then this cash will just remain idle and it won’t impact the real or financial economy. They would simply never withdraw from it. Think about it like the US Households’ working capital.

But how likely is it that money demand of US Households has increased by 5x over the past three years? Isn’t it more likely that they’d be willing to exchange at least some of it for something else eventually?

Consumption for example?

They could trade their bank deposits for cars, trips and dining out. If we conservatively assume that sustainable money demand has increased to $2tn, then we’re talking about ~$3tn excess cash in the hands of US Households that they’d be willing to activate in the economy. More than 10% of annual GDP.

But what if the desire for consumption is at least temporarily somewhat maxed out. Even though the economy is objectively performing very well, there is a lot of uncertainty about the path forward. Better to keep your nest egg, isn’t it? But if you keep it in cash, it will likely slowly melt away over time. Is there something else to do with it?

Investing for example?

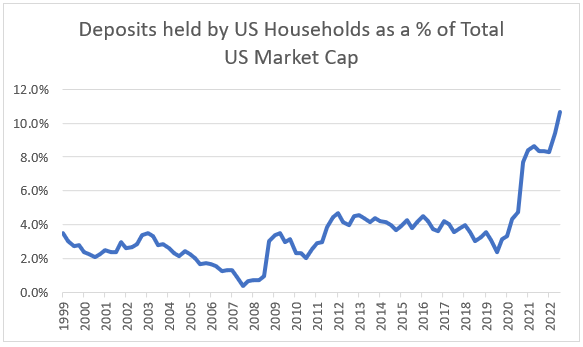

The chart below shows the deposits held by US Households as a % of Total Market Cap of US stocks.

This hovered mostly at 3-4% over the past decades. Today, we’re 3x higher. Again, if the money demand of US Households has not dramatically increased, they are severely underinvested based on historical standards. If they unleashed just half of their deposits onto the stock market, this would be a $2.5tn equity bid. Just a hypothetical scenario, but it would be a storm the magnitude of which is hard for me to fathom.

All of this sounds very bullish, doesn’t it? The excess cash of US Households provides a cushion to prop the economy and/or prop the stock market. But wait a minute, is this really all sunshine and roses?

The Inflationista Take

US Households have spent just half of the cumulative stimulus over the past three years. And that 1st half alone was enough to cause the sharpest inflation spike in decades. If/when they unleash the 2nd half, wouldn’t this suggest that inflation won’t be in the back mirror for quite a while longer? Wouldn’t that cause more monetary tightening? More stock market pain?

It’s a difficult question but I lean on answering it with a ‘no’. The recent inflation spike was not just a fiscal/monetary demand impulse. Some of it was driven by supply chain challenges due to geopolitical issues and the aftermath of the lockdowns. In addition to that: If the government runs deficits to prop the economy, but half of that fizzles out in bank deposits, doesn’t that mean there is some level of impairment in the transmission process of fiscal policy? Wouldn’t that predict even higher stimulus needs going forward? But this is pure speculation and there is little tangible analysis I can provide at this point. I will have to think about it more.

Because to be honest, it does put a bit of a dent into my ‘the hiking cycle is over’ hypothesis that I described in the article below, which will probably not age well:

For now, please allow me to keep this end loose for the remainder of this article. Because there is actually another avenue I would like to explore from here. In addition to the sheer size of the balance sheet of US households, its composition matters as well in my opinion.

The Redistribution Take

Just because half of the cumulative Covid stimulus ended up/remains in the bank deposits of US Households that does not necessarily mean it went straight into this dead end, does it? It could be that it was first handed out to all citizens equally. Then consumers spent it all and now it would be in the hands of a few beneficiaries. $1 in Bill Gates’ hand is less GDP effective than the same $1 in Joe Average’s hand.

My desire to obtain clarity on that question motivated me to dig more into the actual wealth distribution in the US.