Trump vs. Musk

Their feud poses a serious risk for the Big Beautiful Bill which might hurt fiscal liquidity creation. But for Tesla investors, it would be positive in the long run if this bromance unraveled.

Disclaimer: The information contained in this article is not and should not be construed as investment advice. This is my investing journey and I simply share what I do and why I do that for educational and entertainment purposes.

This article is entirely free to read.

TLDR Summary

Elon Musk’s early and decisive bet on Trump created a lot of political capital for him that was priced into Tesla stock after the election. Their partnership was however fragile from the beginning because they are not fully aligned on all important aspects.

Musk is likely very disappointed with the mediocre results of DOGE and this has triggered him to shoot against the Big Beautiful Bill, Trump’s first big legislative package, designed to deliver on a number of his campaign promises. The curious thing about this bill is that it’s actually not the deficit acceleration that many make it seem. In fact, the projected deficit increase is $1.6tn LOWER than original estimates regarding potential TCJA extensions.

But that doesn’t matter. Musk has made up his mind how he feels about it and launched his attack. The bill has passed the House, but passing the Senate later this month is not a given. If Musk rallies enough troops he could stop it which would be a major blow to Trump’s second term.

Musk’s separation from Trump has destroyed a lot of value for Tesla shareholders. However, it may be a blessing for them in the long run because the politization of the brand has hurt the business badly. If this process helps bring the stock back to a more reasonable valuation, it might allow rational investors to eventually buy into the company again.

The beginning of the bromance

Elon Musk made a bold bet in 2024 by endorsing Donald Trump early on, supporting him financially and then even actively campaigning for him, especially in the extremely important state of Pennsylvania. It was a bold bet because it came with the risk of incurring the left’s wrath after a potential loss against them in the election.

That did not happen, of course. Trump succeeded and Musk was possibly the greatest election winner of all. The previous administration had ignored him completely. Now, he had a direct line into the Oval Office and would likely be able to influence major decisions in his favor. Markets celebrated this scenario by pumping the stock from $250 pre election to $480 at the peak. $800bn wealth creation in just six weeks without any corporate news. That pump had nothing to do with delivery or production data or with FSD progress. It was just the creation of personal political capital.

Two days after the election, I voiced concerns that this bromance might prove to be fragile. Both men were united through a common enemy. But they are both alphas who do not necessarily share the same agenda on every important matter.

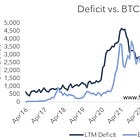

In addition to his fight against the ‘woke mind virus’, Musk’s political motivation was primarily about cutting the excessive Treasury deficit which he considered wasteful and the root cause of America’s lingering inflation problem. This put him at odds with Trump who likes to present himself as a fiscal hawk as well, but does not have the greatest track record with fiscal conservatism. In fact, his first term came with an acceleration of deficits, even before the pandemic stimulus. That deficit acceleration was important fuel for the 2017-2019 bull market that set him up nicely for reelection, should the plague have not happened.

Also, the crypto community was an important guarantor for Trump’s 2024 election win which gave them influence in the White House as well. Trump’s oldest sons are directly involved and fully committed to the crypto grift.

Deficit spending is oxygen for this community. The entire asset class would likely not exist had the Treasury run a balanced budget for the last 15 years. Their incentives are diametrically opposed to Musk’s interests which made for an explosive triangle in the White House. I discussed that in more detail in the article below.

DOGE

After the election, Musk was given authority to cut government spending through the DOGE initiative. In one of Trump’s rallies, he boasted that he can cut spending by $2tn annually which would close the entire deficit.

Musk and DOGE were very vocal about the findings of their investigations, but overall the initiative has dramatically fallen short of expectations. On their website, they claim to have achieved $180bn in savings so far. This is less than 10% of the original promise and more importantly it reads like a one time effect, i.e. this is the total DOGE spending cut, not the spending cut per year going forward.

It’s a huge disappointment for anyone who had put hopes into this initiative and it must hurt Musk himself the most. It’s possibly an important driver for his attacks.

The content of the Big Beautiful Bill

The so called Big Beautiful Bill is Trump’s first big legislative package, designed to deliver on a number of his campaign promises. Most importantly, it cuts taxes and makes the tax cuts of his 2017 legislation permanent. It also includes spending cuts on social security and it provides additional funding for defense and border security.

The bill passed the House last month and the Republicans aim to get it passed the Senate before the July 4 holiday. It only needs a simple majority which the Republicans have (53-47). But it is controversial and there are Republican senators voicing objections for various reasons. Some are opposed to the social cuts, but fiscal hawks are getting more media coverage.

Based on Congressional Budget Office (CBO) data, the Committee for a Responsible Federal Budget (CRFB) estimates that the BBB will increase the federal debt by $3tn over ten years. That certainly sounds like a lot of money. $300bn annually compared to a $2tn total deficit.

However, context matters as usual. A lot of this additional net spending is not an increase in absolute terms, but compared to previous budget estimates instead. The expiration of some of Trump’s 2017 tax cuts had been subject to debate for a long time. Even before the BBB, Congress estimated that extending them would cost $4.6tn over ten years. The Peterson Foundation, a political think tank, illustrated the composition of that increase in June 2024 in the table below.

In my opinion, it is safe to argue everyone expected a permanent establishment (or at least a long-term extension) of the 2017 tax cuts subsequent to Trump’s victory. I would argue that it’s the scenario priced into US stocks (with a small uncertainty premium perhaps). However, the CBO takes a more mechanical approach to their revenue and cost estimates. These are not to be viewed as a forecast of what will likely happen. They are rather calculations that illustrate what will happen if current legislation remains in place.

From the perspective of a political and financial analyst, it’s obviously more relevant to compare new developments to actual prior expectations. So, if Trump extends the 2017 tax cuts in a combined tax and spending cut package and the budget impact is $3tn vs. the $4.6tn estimate earlier, it actually implies a $1.6tn spending reduction over ten years vs. prior actual expectations. And the CBO does not explicitly incorporate GDP growth from increased interest payments into their calculations which provides upside to tax revenues.

Musk’s criticism of the BBB

Musk had been criticizing the BBB for days on social media. He feels that the deficit expansion of the BBB works directly against the efforts of his DOGE team. When asked about Musk’s criticism, Trump claimed that Musk had been familiar and comfortable with the BBB for a long time and only started lashing out once he realized that it included a phase out of EV tax credits. He also suggested that a lot of government money could be saved by firing Elon’s companies.

This accusation and threat triggered Musk and he went completely ballistic on Trump yesterday. He accused Trump of lacking gratitude for helping him win the election, pitched the idea of founding a new party, threatened to decommission SpaceX’ Dragon spacecraft, fired shots against the President’s trade strategy (“tariffs will cause a recession later this year”) and ultimately even suggested that Trump is named in the infamous Epstein files.

Investors digested the destruction of Musk’s political capital with the current administration by dumping Tesla stock which dipped into the $270s briefly, 20% lower than a few days before. As of this writing, the stock is somewhat recovering to above $300. But uncertainty remains to what extent Musk’s estrangement from Trump harms the value of his companies.

The bigger picture

Where this feud goes next is anybody’s guess. Maybe they will become arch enemies. Maybe they get on the phone tomorrow and become best friends again, who knows. But there are in my opinion still two important considerations from an investor perspective, the first being micro and the second being macro.

Firstly, a potential decoupling between Musk/Tesla and Trump is not necessarily bad for the stock. Politicizing the brand was a completely unnecessary value destruction and has probably cost the company a lot of sales. It’s hard to quantify that exactly because management has made a lot of strategic mistakes in the last years that contributed to the drop in revenues and earnings. But it’s likely a sizable driver for their disappointing operating performance. The political left was ideologically aligned with electric vehicles. California is Tesla’s strongest market.

The $800bn market value increase subsequent to the election was highly concerning because it came with zero fundamental justification. Trump was obviously going to be a net negative for EVs and battery energy storage in the US and that’s half of Tesla’s revenues. Deflating the political capital in the share price is good and might allow rational investors to eventually buy into the company again.

Secondly, whether or not the BBB is actually a step in the wrong direction from a fiscal perspective, Musk is highly influential and has decided to fight it tooth and nail. It’s not unthinkable that he might be able to axe it in the coming weeks. Decision makers might jump on the Elon train for their own political calculation. Many people have become successful in his slipstream before.

If that happens, it may create a fiscal overhang. The BBB is a deficit reduction against actual expectations, but not against current legislation. Should Trump fail to make the tax cuts permanent, they will expire in December 2025. That would be a fiscal cliff that probably nobody has on their agenda, especially considering that tariff revenues will be ramped up irrespective of the BBB drama.

Sincerely,

Rene