Update of my TSLA 2023 EPS Estimate based on 4Q22 Earnings (Excel Model included)

Gross Profit per Vehicle, Guidance, Energy and Financing

On Dec 27, 2022, I published the article below. The stock had crashed to $106 and many people called for the total collapse to way below $100. In that article, I hypothesized that chances for a quick V-shaped rebound are actually quite good. Today, one month later, the stock actually sits at $160, 50% higher. I have a much bigger V in mind, but I have not had many wins to celebrate over the past year. So I am taking the opportunity to celebrate this one.

The anticipation and the digest of 4Q22 earnings were obviously a big factor in this run up. In this post, I am going summarize what I found most interesting in that release and the earnings call with the objective to refine my 2023 EPS estimate that I originally built up in the article below.

I have attached the updated Excel workbook of my EPS estimate for paid subscribers at the end of this article.

Generally, I was not too impressed with these earnings to be honest, especially with respect to cost improvements. But the stock’s reaction actually gave me confidence. Considering how mediocre this earnings report actually was, the stock’s pump thereafter confirms how ridiculously low expectations have been going into earnings. We have to wait of course if the initial reaction persists. There is always a chance it’s just a temporary short squeeze, but I am generally optimistic that it can continue to run based on these figures and upcoming catalysts.

It is also important to note that 4Q22 is actually a less relevant quarter to inform us about the company’s future trajectory. It is the last quarter before the IRA became effective and also the last quarter before we will likely see significant increases in Tesla Energy. So, I am only going to highlight some key observations I made. I don’t want to overanalyze this quarter.

1. Incremental COGS per Vehicle

Incremental COGS per car came in almost perfectly in line with my regression model. You might be familiar with the chart below from my original 2023 EPS article. The orange dot is the 4Q22 data point. The interpretation of this is that every additional vehicle sold costs them $32k.

I was actually a bit disappointed with this data point as I had hoped that the ramp up of Austin and Berlin would bring them onto a flatter cost curve. But it is what it is for now.

2. Delivery Guidance

Management guided for 1.8m vehicle deliveries this year:

To be honest, this came as a shock to me initially. Sure, my original 2m estimate for 2023 is not too far off from that, but I had secretly hoped for a much faster ramp. After all, 2023 is the first prime year for Berlin and Austin and we hopefully won’t have the 6 weeks lockdown in Shanghai again. I thought that should set up vehicle growth for much more than 50% YoY. 1.8m would only be a 37% increase over the 2022 delivery number of 1.3m. And taking the annualized 4Q22 production run rate of 1.75m vehicles into account, deliveries would effectively be flat for the year.

But I believe this guidance needs to be viewed in a broader context. First of all, it is a number which Tesla has to have a high degree of confidence to surpass this year. Even with unforeseen challenges, Wall Street has little mercy with companies failing their guidance. Secondly, Elon has been obsessed with the idea that we will have a severe recession this year. He has talked about that numerous times in recent weeks and repeated that numerous times during the call. I think he underestimates how quickly interest rates will come down in case there is a recession, which will then fuel the demand for cars which are dependent on financing conditions. He has said before that he thinks we are in a deflationary environment already. So why would rates not come down quickly?

Demand for Tesla cars (and cars in general) came down dramatically in 2H22 because they were too expensive to finance. I think Management is a bit in shock about that, which is why their guidance is overly pessimistic. The automotive and real estate industries are already in a recession due to the interest rate shock. If the broader economy goes into a recession, these industries do not have that much room to fall left as they are ahead of the curve.

I have a decent level of confidence that Tesla will significantly surpass 1.8m deliveries this year. But even if I am right, it will take time for markets to price that in. So, I have decided to reduce my 2023 delivery estimate from 2.0m to 1.9m for now.

3. ASP

Recent demand concerns have caused a lot of vehicle pricing uncertainty. Management used the opportunity in the call to put a floor on price decrease expectations.

“We believe that we'll be above both of the metrics that are stated in the question. So 20% automotive gross margin excluding leases and regulatory credits and then 47k ASP across all models.”

Zach Kirkhorn, 4Q22 earnings call

I had worked with an ASP of $48k in my original 2023 EPS estimate. Zach’s comment gave me confidence that this is a reasonable and prudent figure. With a $32k incremental COGS per vehicle, this puts the incremental gross profit for every additional vehicle that Tesla sells this year vs. last year to $16k, which is extremely strong.

4. Energy

There has been a lot of controversy on Tesla Energy recently with some people arguing it is a giant awakening, while others are more skeptical. Regardless of how fast you see them ramping and what margins you ultimately anticipate, it is hard to argue against a step change in Tesla Energy following the start of production in their Lathrop factory. Lathrop has 40GWh capacity once fully ramped. Total storage deployed in 2022 was only 6.5GWh. So, we’re talking about a 7x increase in business volume here with a 2y horizon.

Tesla’s Energy business (incl. solar and battery storage) grew by $193m in revenues from 3Q22 to 4Q22 which came with $55m incremental gross profit. This suggest an incremental gross margin of 28%. There is a lot of uncertainty about what is actually in this number and how it will change once Lathrop hits the P&L fully, but I found this to be an encouraging data point.

I have kept my Energy assumptions the same which I consider conservative.

5. Production Tax Credits

As part of the IRA, Tesla will receive so called advanced manufacturing production credits. When asked about the impact from that, Zach said this:

“Our best understanding at the moment, we think on the order of 150 million to 250 million per quarter this year.”

Zach Kirkhorn, 4Q22 earnings call

Before, I had not specifically added any impact from the IRA to my 2023 EPS estimate because of the uncertainty associated with it. But given this guidance is actually quite precise, I have added $800m to my estimate for the full year which is roughly a $0.18 EPS impact.

6. Financing

I found Adam Jonas’ question at the end of the call quite interesting.

“Is it time for Tesla to significantly expand the captive finco when you only have like 4.5 billion of these receivables? It's basically nothing compared to other big auto companies.”

Adam Jonas, Morgan Stanley, 4Q22 earnings call

Zach Kirkhorn's response was generally positive.

Now, why is this important? To understand that it is first important to understand how a legacy auto company makes money. I am using Ford F 0.00%↑ to illustrate that and I have summarized some key metrics for that in the table below:

As you can see, Ford has two main segments: Automotive and Credit. Automotive is about manufacturing and selling cars. It generates most of the revenues, but it also incurs most of the costs. Its operating income was actually negative in 2021. In the Credit segment, they originate and service car loans and they make money by earning an interest spread like a bank. Credit is actually responsible for more than 100% of Ford’s entire operating income. At least in this example in 2021.

Legacy Auto companies are effectively consumer financing companies using the vehicles they manufacture to acquire customers. And it’s remarkably profitable. In Ford’s case, they earned $2k for every vehicle sold. This comparison is not 100% accurate because obviously Ford Credit earns its operating income based on the entire fleet they are financing at any given point in time. But given Ford’s business is fairly steady, I think it is nevertheless a decent metric to compare it to vehicles sold in a period.

I haven’t changed anything to my 2023 EPS estimate because it is too early, but this is definitely something to keep an eye on in the future. There is certainly an opportunity for Tesla here to squeeze out more margin.

Update to 2023 EPS Estimate

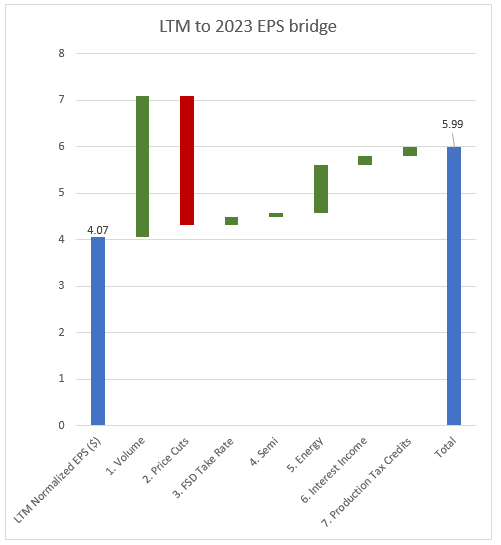

Taking my observations above into considerations, here are the changes to my 2023 EPS earnings bridge:

Updated the base to full year 2022.

Decreased deliveries from 2.0m to 1.9m.

Kept ASP and incremental COGS the same.

Kept my FSD assumptions the same.

Reduced Semi deliveries from 5k to 2k and gross profit per MWh to $200k based on feedback I received on the original article. I think the Semi is a strong product that will be very EPS accretive for Tesla, however I want to be more conservative regarding the ramp given volume production is not yet in place. Ultimately Tesla wants to build 50k Semis a year and has just announced a $3.6bn investment in a new production facility. So, I think with a 2-3y time horizon, the Semi business alone has a ~$2 EPS earnings power. It will be wild. For 2023, the EPS impact is miniscule.

Kept my Energy assumptions the same.

Kept my Interest Income assumptions the same.

Added in Zach’s production tax credit guidance.

Incorporated a 20% tax rate to every EPS impact.

With these admittedly rather simple extrapolations, I arrive at a 2023 EPS estimate of $5.99:

This is lower than my previous estimate of $7.28. But is is significantly ahead of the analyst consensus, which has crashed to below $4 in recent weeks.

I really don’t think my assumptions are outlandish and I am hopeful Tesla will exceed my expectations. If you have any idea where this difference most likely comes from, let me know in the comments.

Sincerely,

Your Fallacy Alarm

Excel Model below.