What might Tesla Finance look like? (Excel Model included)

Building up a midterm EPS forecast using legacy auto as a benchmark.

In my latest article about updating my 2023 EPS estimate, I mentioned that there may be a near-term opportunity for TSLA 0.00%↑ to venture into Consumer Finance.

The occasion for that was Adam Jonas’ question on the earnings call to which Zach Kirkhorn responded that ‘the plumbing is in place’.

What originally got me hooked on this idea was the Twitter thread below by a relatively small and underrated Twitter account that provides fantastic Energy related content:

I wanted to give this a bit more room in a full article because I think it is both underappreciated and material to earnings going forward.

So, today I will attempt to quantify how large Tesla Finance could become for the overall EPS growth story. My underlying model is attached for paid subscribers at the end of this article. This article is part of a bigger assignment I have given myself as I working at the moment on quantifying the overall mid-term EPS potential for Tesla.

The Financing Opportunity

Automotive consumer financing is a highly profitable business for legacy auto companies and sometimes it makes the difference between a profitable and an unprofitable year. There are two main reasons why Tesla has not done anything to unlock this value:

As MadManx pointed out above, they did not have an investment grade credit rating for the longest time, which limits their access to cheap capital and puts them at a disadvantage compared to alternative financing providers. This has changed recently:

Economies of scale are extremely important in financial services. Loan administration becomes much cheaper with a larger volume. That’s why we continue to see consolidation in the banking industry, producing bigger and bigger financial institutions. For example, the largest 4 banks in the US are now accounting for >50% of the total market cap of all listed banks.

While Tesla’s market share in terms of annual unit sales has actually become meaningful recently (~2%), it’s market share of the total global vehicle fleet is still miniscule (~0.2%). As Tesla ramps up to become a true mass market automotive manufacturer, the case for building out their own finance operations becomes more and more obvious. So, once Tesla Finance is initiated and ramped, what is the earnings potential?

Obtaining the key inputs

To answer that question, we first need to understand some banking basics. A bank makes money by originating a certain loan volume and then earning an interest rate spread on that.

So, how much can Tesla then originate and earn?

To quantify this opportunity, I have looked at some relevant benchmark metrics from Mercedes-Benz, VW, BMW, GM 0.00%↑ and F 0.00%↑ , which I obtained from their 9M22 reports:

There are a few key observations we can make here:

The finance divisions of these companies are meaningful profit drivers and accounted for ~10-50% of total operating income in 9M22.

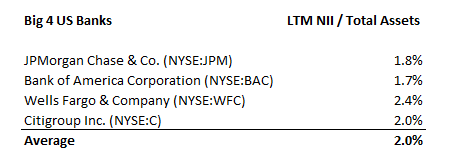

By dividing the finance operating income by the total finance assets, we can calculate the earnings power of the finance division for every $1 that they lend or lease. From a banking perspective, think about this like a net interest spread after all operating expenses. This spread ranges from 2-4% for the companies above, which is quite decent. For reference, the table below show the Last Twelve Months Net Interest Income divided by Total Assets for the 4 largest US banks, which averages 2.0%.

To make this comparable to the 2-4% shown above, you’d have to deduct these companies’ operating expenses associated with managing the loan book and customer deposits. So, you’d likely end up with a ratio that is quite a bit below 2%, which demonstrates that the automotive consumer financing business is fairly attractive. Selling a vehicle seems to be a fantastic method to sell loans.

If we divide the Finance Assets by the annualized automotive revenues, we can calculate a metric that represents the number of years of deliveries currently financed by the company’s finance division. You can see above that this metric ranges from 0.8-1.2 years for the companies above. This will be relevant for a reasonability check that I will perform below.

Building the Tesla Finance EPS Model

With this information we have all inputs required to come up with a very high level model to quantify the potential EPS impact, which I have done below:

Here is some context on my assumptions and calculations above:

I have assumed a more moderate production ramp than what is effectively guided by Management, ramping to a total units sales volume of 5.5m per year by 2027. I think this is reasonably conservative, which for me is not so much thinking about it from a market share perspective, but more so to reflect risks associated with ramping the production cost effectively.

I have assumed that the share of sales financed by Tesla would ramp from 10% in 2024 to 40% in 2027. New vehicles are overwhelmingly financed with debt, which is by the way the key reason for the hefty recession we are seeing in the automotive industry at the moment due to the interest rate increases. The financing share of new vehicles has been hovering around ~85% in recent years in the US.

So, there is an opportunity for Tesla to ramp to a much higher level than 40% in the long term. But I believe it will take them time to roll this out in all jurisdictions and there is a good amount of uncertainty that comes with ramping this business. As a reasonability check: I pointed out above that the finance receivables of legacy auto are approximately equal to their annual automotive revenues. In the current calibration of my model, I arrive at 0.8x Finance Receivables / Auto Revenues by 2027, which falls toward the low end of the range of the peer group. It’s admittedly an optimistic assumption to assume Tesla can ramp to the peer group levels within 5y. But I don’t consider this unreasonable.

I have assumed the ASP to fall to $42k by 2027 to reflect that they will need to ramp their coming Generation 3 platform meaningfully to get to unit sales north of 5m annually.

I have assumed that their Finance Operating Income / Finance Receivables Ratio will ramp from 0.5% in 2024 to 2.5% in 2027 to reflect that they will operate this at subscale initially. Ultimately, I am confident that Tesla will be able to operate the Finance business with above average profitability because they have a very efficient sales funnel in place. Buying a Tesla is a highly digitized experience.

After incorporating a 20% tax rate and a moderately rising share count, I get to approx. $1 EPS power by 2027.

So, this won’t necessarily be a game changer, but it will likely contribute meaningfully to earnings in the near to midterm. For reference, they earned $4 EPS in 2022 and I expect about $6 EPS this year.

Let me know what you think of my assumptions.

Sincerely,

Your Fallacy Alarm

Excel Model below.