What's the Value of Tesla FSD? (incl. Excel Model)

Teslas are becoming robots, hidden in plain sight. It offers tremendous upside for the stock. Here is my Tesla FSD Valuation Model WITHOUT robotaxis.

On December 17, 1903, Wilbur and Orville Wright pushed their Wright Flyer onto a field near Kitty Hawk, North Carolina. Orville got in and they launched. He landed 12 seconds and 120ft later. It was the first controlled, sustained flight of a powered, heavier-than-air aircraft. A sensation.

Or was it? When they returned home after that day, there was not much praise or celebration. One neighbor allegedly said they were only able to do it because they had favorable conditions in Kitty Hawk and would not be able to repeat that in other places. Other people said it must have been an accident or stunt. Again others said their achievement was nothing special. After all, there had been people flying in balloons in Europe for 100 years.

There was not much initial public excitement about the Wrights’ project. Flying with machines heavier than air was deemed impossible. Why would anyone get excited about something that is impossible? On October 22, 1903, just two months earlier, Prof. Simon Newcomb, a renowned mathematician and astronomer, wrote an article where he ‘proved’ that any attempts to build airplanes were pointless. He argued:

"Once he slackens his speed, down he begins to fall…Once he stops, he falls a dead mass. How shall he reach the ground without destroying his delicate machinery? I do not think that even the most imaginative inventor has yet even put on paper a demonstrative, successful way of meeting this difficulty."

Needless to say, he was not aware of the Wrights’ efforts. Nobody really was. Which is very curious because it was really not that difficult to follow what they did. Their achievement did not happen overnight out of nowhere. It was a gradual process with many setbacks. They had worked on this since the mid 1890s and started their experiments in Kitty Hawk in 1900. They were there for 3 years. On a cow pasture that was visible from a railway. Yet, there was barely any media coverage.

The development of the airplane, one of the most disruptive technologies of the 20th century, a tremendous force for good and bad, was hidden in plain sight. Dismissed by the ‘experts’ and ignored by the media.

And the same thing is happening right now with self-driving cars. In my opinion, this offers a tremendous asymmetrical upside in TSLA 0.00%↑ . In this article, I will explain why I have that view and I will attempt to put a value on Tesla FSD, ignoring robotaxis. For paid subscribers, I have attached my workbook at the end of this article in case you would like to play with the assumptions and calculations yourself.

A brief history of Tesla’s FSD program

Tesla started offering Autopilot in 2014, which was developed in partnership with INTC 0.00%↑ 's Mobileye. Tesla initiated their own project after Mobileye ended the partnership in 2016. They started with two distinct packages, Enhanced Autopilot for $5k and FSD as an add-on for $3k. Needless to say, FSD as a complete product that is worth its name did not exist and still does not today. It was an opportunity for customers to bet that it would be complete at some point.

Both FSD hardware and software installed in the cars went through several upgrades and the price was increased regularly. And in 2021, they also introduced an FSD subscription model, which is priced at $199/month at the time of this writing.

The FSD take rate of Tesla’s customers went down with these price increases as its development took more time than anticipated.

Since October 2020, Tesla has been operating their famous FSD Beta program, where a small, but growing number of customers can test the product in real life situations.

Since November 2022, it has been available for every customer in North America, which in my opinion should give the take rate a nice bump in the near term. You don’t have to bet on some future utility anymore. You can try it out almost instantly after you pay for it.

To equip all cars with FSD hardware, enable continuous software updates and develop the system in public with the help of their customers was a genius move that put Tesla miles ahead in the race to full autonomy. Today, with ~400k users, their FSD program is in my opinion the only generalized and scalable solution that has a true shot at reaching commercialization (no, activities like Waymo’s in Phoenix do not qualify as commercialization). It blows my mind every time I see it.

Cherished by the Customers

Check out the video below for example.

What’s notable, while the guy who uploaded it has 260k followers on Twitter, this video has only 5k views. I may be biased, but I think this gets way too little attention. If you haven’t found my blog via the Teslatwit community, I can imagine you may not be aware of these capabilities. My friends and acquaintances are often surprised when I show them stuff like this.

I have followed these Youtube videos for 2 years and I will for the life of me not understand why markets refuse to incorporate this into TSLA 0.00%↑ 's valuation. If Tim Cook or Mary Barra had the funds ready and if it was for sale, don't you think this technology would go over the counter for at least $2tn (just hypothetically, ignoring the symbiosis with Tesla hardware for a moment)? It's the only generalized approach out there that has a true shot at solving full autonomy which would come with an enormous present value, no matter whether it happened in 2024 or 2034.

Software can only be game changing as a generalized solution. Do you think GOOG 0.00%↑ Search would have conquered the world if they had to rewrite it for every city?

Dismissed by the Experts

Yet, there are many people who do not share my sentiment. And the degree of dismissal often correlates negatively with the educational and professional background. The only possible explanation in my mind is that there are not enough people watching these videos. How else are interviews like the one below possible for example?

It’s an interview with Andreas Beck, a German professor and professional money manager. I generally enjoy listening to him, who I believe to be an independent critical thinker. But he gets this completely wrong and his talking points are in my opinion symptomatic for the current sentiment on Tesla stock generally and on FSD specifically. It’s in German, but I am going to paraphrase his key statements below.

Here is his Bear Case in a nutshell:

Tesla is uninteresting based on fundamentals. It is valued higher than most of the automotive industry combined and their tech has fallen behind. They are filing way less patents than their competitors and other companies show more promising progress with autonomy, most importantly Mercedes-Benz.

I am not going to comment on the market cap comparison to Legacy Auto in this article because I have written about the irrelevance of that metric in detail in the article below:

I am also not going to comment on the absurd idea to benchmark technological leadership based on number of patents. Instead, I will only touch on his claim that Mercedes-Benz is ahead of Tesla in terms of solving autonomy. Check out their famous Drive Pilot in action below:

It works only within geofenced areas (initially 8,000 miles in Germany). It only works below 40mph. You can’t change lanes. It does not work when the lead car is more than 100m away. The weather must be sufficiently nice. But it does not work when the sun is shining too much. WTF?

In my opinion, this mismatch between reality and perception in the professional investment community offers huge upside. But how much?

What is Tesla’s FSD Program worth?

Let’s first look at its current financials to get a feeling of its size if it was a standalone business. On the 4Q22, earnings call, Elon said that they have deployed FSD to ~400k customers, which matches the current recall of $362k vehicles by and large. The delta likely relates to purchases outside of the US.

Below, I have built an estimate of the quarterly unit sales by taking Troy Teslike’s take rate estimates and then performing a true up to reconcile them to a current estimate fleet size of ~400k.

Then, I multiplied these unit sales by the FSD price for each quarter to come up with quarterly revenue estimates. For simplification purposes, I have ignored that some of the FSD deployments may be subscription based.

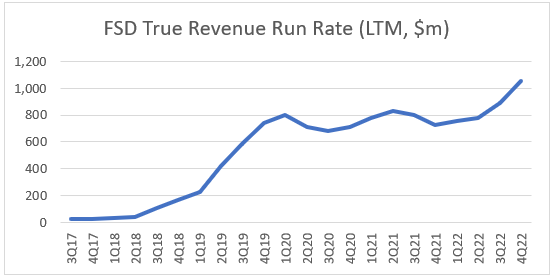

I have summarized my revenue estimates as LTM figures in the chart below:

As you can see, Tesla FSD is likely close to a $1bn annual revenue run rate per 4Q22. A 40% increase vs. 4Q21 and a 100% CAGR since 4Q17.

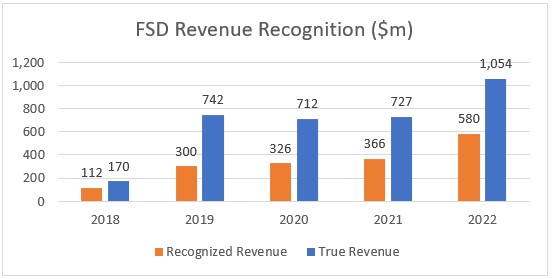

While Tesla does get this cash instantly, most of it does not hit the P&L though. Tesla records this as deferred revenue, which is a liability on the balance sheet that gets transferred into equity once revenue recognition criteria in terms of product/service delivery are fulfilled. The chart below shows the delta of Recognized Revenue and the “True” Revenue I have estimated above. Note that the Recognized Revenue is overstated in this case because per Tesla’s filings, Deferred Revenue relates to “access to FSD features, internet connectivity, free Supercharging programs and over-the-air software updates primarily on automotive sales”. In short, there is more than just FSD in the orange column below.

So, having established that Tesla FSD is a business with a $1bn revenue run rate, the obvious question is: Where will this go?

Here is how I think about Tesla FSD as an investor: I can comfortably justify the current stock price (and more) without any earnings contribution from FSD. So, I actually don’t have to worry about it. It’s a free call option.

But I am curious about the potential anyway. I could value this call option by building up fantastical Woodish robotaxi projections. Perhaps combined with a fancy simulation with a gazillion parameters to impress you with my toolbox:). But while I find Tesla’s “Uber meets AirBnB” robotaxi model outlined in their 2019 Autonomy Day very compelling in the long run, I find such valuation attempts pointless. If Tesla really solves autonomy fully and deploys robotaxis, its valuation will likely increase 10x or even 50x from here because they will capture a lion share of the entire mobility industry. It really does not matter to me anymore at such levels. Instead, I am going to assume we will not get our robotaxis for the foreseeable future. Instead, there will be a continuation of gradual improvement in the software that will over time make FSD compelling and accessible for a growing number of customers.

To value this scenario, I will consider two approaches, which I call the Fleet-based Subscription Model and the Unit Sales Model. I will focus only on the US market for this purpose. So any international expansion remains unquantified upside.

Approach 1: Fleet-based Subscription Model

The basic assumption here is that there will be a certain portion of the US vehicle fleet that will find FSD compelling and affordable enough to subscribe to it at any given point in time. While it is mostly a toy for enthusiasts at the moment, I think Tesla FSD will be a fabulous subscription model, even if there won’t be robotaxis for a long time. As the technology matures, its utility will grow significantly, especially for those driving a lot. It would be great for cargo use cases and the Semi for example. And with a subscription you can opt in and out as you see fit and you don’t need to make a bet on the future potential for FSD.

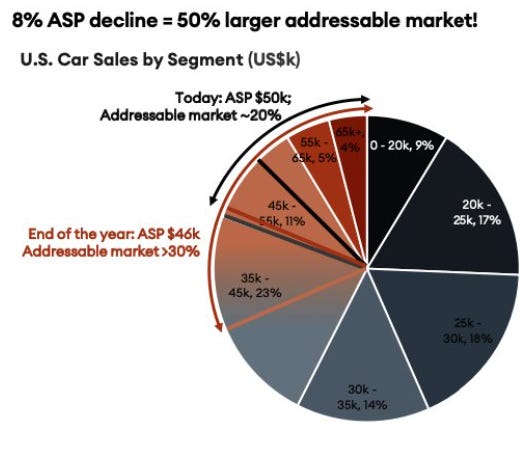

The US vehicle fleet is approximately 290m strong. Presumably, FSD is only interesting for the higher end given it increases the cost of ownership considerably as long as it requires human supervision. About 20% of the vehicles sold are priced at $45k and higher based on the chart below that I sourced from Pierre Ferragu’s New Street Research. I believe that is the hunting ground for FSD.

I believe 20% of those vehicles will ultimately want FSD even if it requires driver attention. That would be in total ~12m vehicles, 4% of the entire US fleet. It’s a small fraction of all cars, but it will take a while to get there.

If Tesla manages to have ~12m FSD subscribers who pay $2,500 per year, that would be $29bn in revenue. Adding in some assumptions on margins, taxes and a valuation multiple, this would in my opinion warrant $270 value per share.

A 50x P/E multiple may feel rich in your view. But I think at 4% penetration, Tesla would still have considerable room for further penetration and the technological moat with 12m FSD vehicles on the road would be enormous. The technology would advance rapidly at that point. Revenue and profit generation would also have a fantastic track record by then. Remember, this has grown at 100% CAGR between 2017 and 2022. I have further articulated my thoughts on Tesla’s P/E multiple in the article below:

Approach 2: Unit Sales Model

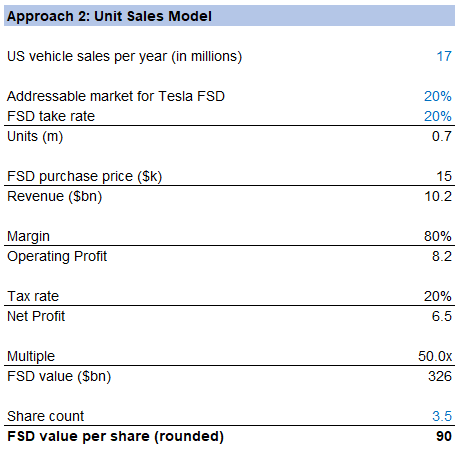

But what if people do not like to pay for subscriptions? For this purpose, I have instead based the valuation on annual car sales in the US, the cycle of which seems to have 17m units per year as the midpoint.

Again, if 4% of them purchased FSD for $15k apiece, we can translate that into a value by making a few margin and valuation assumptions, which would imply $90 per share.

Time Horizon

So, I see a mid-term potential that Tesla FSD can be worth $90-$270 per share without considering robotaxis. Obviously, this is not a present value as of today. It will take years until 12m FSD vehicles will be on the road and/or Tesla will be able to sell 700k of them per year. I have a 3-7y time horizon in mind when I look at these two approaches. This gives me confidence that Tesla’s FSD program has a promising trajectory to become a meaningful driver to the EPS growth story even if robotaxis do not come to fruition for a while.

Let me know what you think.

Sincerely,

Your Fallacy Alarm

Excel Workbook below