When Short-Squeeze?

Investor Positioning & Sentiment, Fund Flows, Margin Debt, Short Interest, Short Volatility Bets, Option Positioning, Household Cash

I am very optimistic these days as you might have noticed in my articles this year.

I believe we’re close to the liquidity bottom (if we haven’t passed it already) and markets are in the process of anticipating that. They might just steamroll over short-term challenges and even if they don’t, downside volatility will likely be short-lived. One source of this optimism is the incredibly bearish investor positioning that has built up throughout the correction we’ve been dealing with over the past 1-2 years.

You will see 8 metrics below outlining how MUCH buying power is currently on the sidelines. Against this backdrop, it’s absolutely incredible with how much resilience the S&P is defending the 4,000 mark. You could argue that there is downside to align it better with the metrics below. But I’d argue that the causality is the other way around. If the S&P can be at 4,150 in this environment, where can it be when optimism returns and demand for risk assets rises? Fat tails are real. But this time, it is the right tail that is underappreciated.

1. BofA Fund Manager Survey

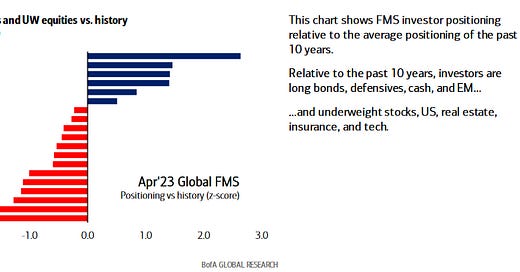

Today, Bank of America published their monthly Fund Manager Survey (FMS). The The most important chart in their report is the one below, which shows investor positioning in various market segments.

The z-score is the number of standard deviations that a data point is below it’s (historical) mean. If we can assume that investor positioning is by and large normally distributed, then a z-score of -2 is only expected during 2% of the time. Investors participating in the fund manager survey are currently underweight equities more than 98% of the time.

But there is more we can infer from this positioning: Compared to their historical positioning, investors are long bonds, cash and defensive stocks (Staples, Utilities, Healthcare). And they are short equities, particularly cyclical industries (Industrials, Materials, Tech). And they are short industries with negative correlation to interest rates (Insurance, REITS, Banks).

Overall, this positioning is consistent with a consensus that expects persistently high interest rates with disappointing economic growth and a corresponding negative impact to asset prices that is not yet fully priced in. This means that investors are mostly concerned about a stagflation scenario, i.e. an economy with little or no real growth, but with persistent inflation. An absurd scenario, if you ask me.

And the almost amusing aspect of this is the lack of self-awareness. You might have noticed that investors are incredibly short in US assets, in equities in general and in Tech. But when asked what they *think* is the most crowded trade? The say Big Tech…

Markets seek maximum pain for the greatest number of people. The greatest pain that could be inflicted on this set of investors would be a surge in equities (that they would miss out on) followed by a drop in interest rates. They would benefit somewhat from the rising bond prices, but not as much as they’d miss out on equity returns. And ultimately it would force them to buy into higher stock prices in the search for yield. I believe this is the most likely scenario to unfold in the coming 1-2 years. Brace for naysayers calling for exuberance by measuring ultralow equity risk premia.

You can find all slides from the BofA FMS here.