🔎Why is gold pumping so hard?

And can that continue?

TLDR Summary

The current bull market in gold is part of the Debasement Trade 2.0, which is the overwhelming consensus that the value of the US Dollar will continue to decline due to deliberate monetary and fiscal debasement. To protect themselves against this scenario, investors have maneuvered themselves into a dangerous asset overexposure.

This consensus will get a reality check when rate cuts will fail to accelerate US Dollar liquidity creation. Numerous assets will fall victim to that. Gold will be one of them.

The current gold bubble is about the size of 1980 (which was followed by more than two lost decades for gold investors) and about two times bigger than 2011 (which was followed by one lost decade). This is by no means only driven by central banks decoupling their economies from the US. Yes, they are heavily buying gold, but they have done so for years without impacting price and they have actually been slowing down purchases into this year’s price strength. Central banks are not the marginal gold buyers who set the price.

Investors are. Especially via ETFs which have seen huge inflows this year. Their flows have much higher cyclical amplitudes than central bank flows and their swings perfectly align with price performance. Miners are also attracting a ton of investor interest which has dislocated their valuations. Investors are paying inflated multiples on inflated cash flows. It’s a toxic cocktail what won’t end well.

Commodities and non-commodities

There are two types of goods, commodities and, for lack of a better word, non-commodities. The prices of commodities typically oscillate around their production costs. They are firmly anchored and deviate from production costs only due to cyclical swings.

Production will respond to positive or negative demand impulses which will over time drive prices back to production costs plus a sustainable margin for producers. This margin is determined by the overall competitive environment among them. Generally commodities can be produced by anyone. It’s typically a polypoly or at least an oligopoly. Whether it’s water, internet or gasoline, you as a customer would never pay a price consistent with the actual value that the commodity has for you. The value is typically much higher than the market price. Instead, you pay the provider’s production cost plus margin.

Non-commodities are typically monopolies. Their prices typically gravitate towards the value they have for their consumers. Customer affordability is the limiting factor. The monopolist will choose a price that maximizes revenues and earnings based on how many customers can afford it. The margin becomes merely the residual of that consideration. Non-commodities naturally have higher margins than commodities. NVIDIA’s GPUs are a non-commodity, at least for now. The iPhone is to some extent a non-commodity because other smartphones are not a suitable alternative for many users.

Gold is a commodity, of course. You don’t care who you buy it from. It’s all the same. Therefore, production costs determine its price like no other variable. It works as a hedge against inflation because production costs increase with inflation. Mining labor, mining equipment, etc.

If the price of gold falls below production costs, mining stops being profitable and miners will stop mining. This supply response typically stabilizes price. Demand will never go to zero because there are commercial uses for gold. Therefore, the price of gold rarely (if ever) drops below production costs. This feature is central for gold’s ability to act as a store of value for millennia.

At times, the price of gold shoots greatly above production costs, especially when investors are concerned about inflation risks. The investor buying gold during those times makes the following deal: “I know that the price of gold is X% higher than production costs plus historical mining margin. I know it will eventually mean revert to those production costs which will be a performance drag for me. But I am willing to pay this price as an insurance premium against inflation. My bet is that the mining cost increases will exceed gold’s cost of capital (which is a function of its volatility).”

In other words:

The more investors expect inflation and the less they expect gold price volatility, the more will the price of gold exceed production costs.

Having established this, let’s look at where the price of gold currently stands vs. production costs and how that compares vs. history.

Gold price and production costs

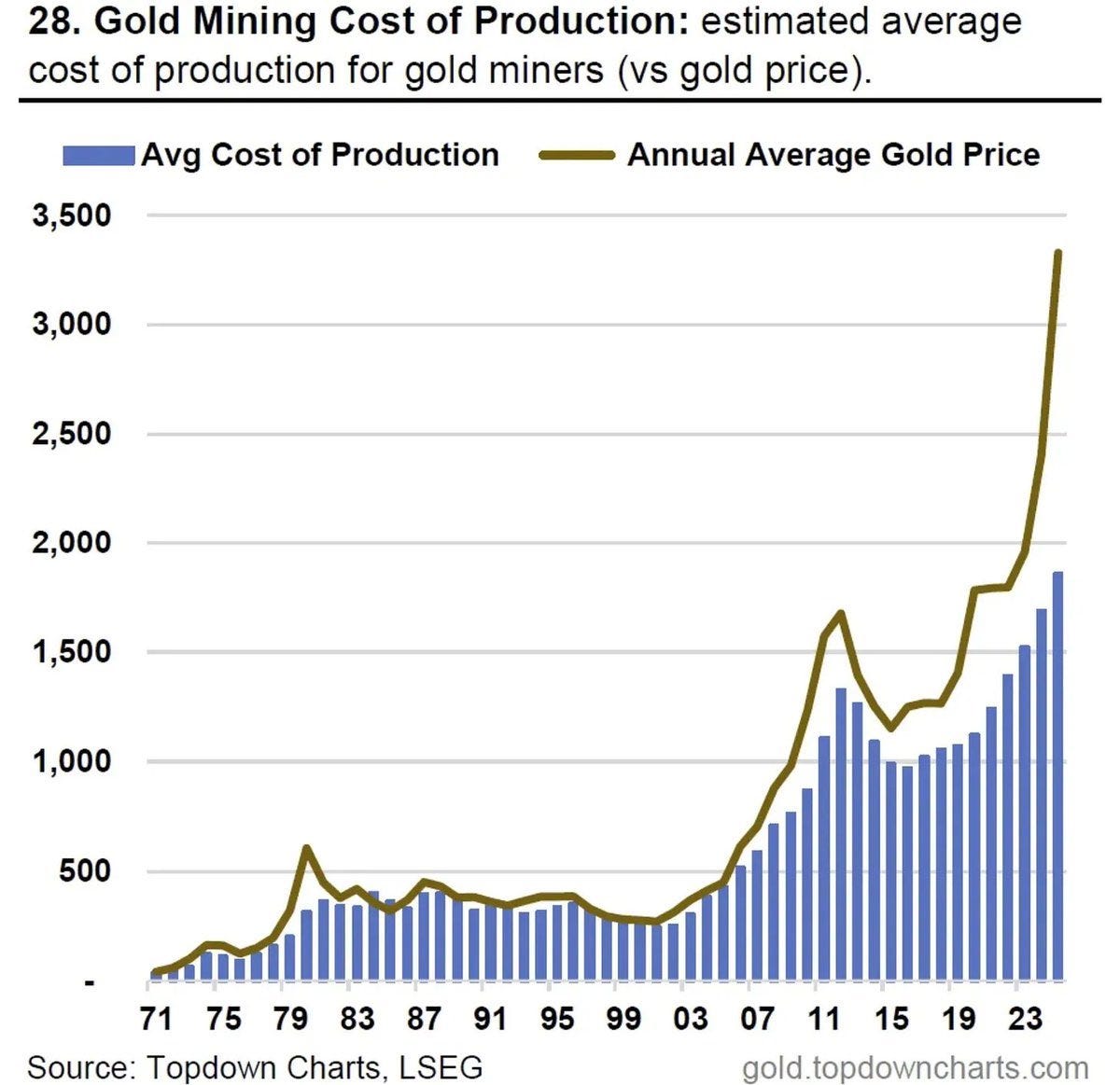

As illustrated below, the price of gold has historically tracked closely to production costs plus a small premium.

This premium expanded when inflation fears were elevated. For example, the price of gold peaked in 1980 at about $600/oz when production cost was about $300/oz, indicating about 100% price-to-cost premium. This was followed by a consolidation that took about 25 years. Gold prices and production costs fell side by side.

As another example, the price of gold peaked at about $1,600/oz in 2012 (these are annual averages by the way; the actual price peak was at $1,900/oz in 2011). At that time, production cost was about $1,300/oz which equates to about 25% price premium (or about 45% when benchmarked to the $1,900/oz peak).

I covered the period from 2004 to 2012 in great detail in the article below by the way. I strongly recommend you read this to complement the points made in this article.

The gold bull market of the late 2000s was what could be called Debasement Trade 1.0. The Fed was aggressively expanding its balance sheet and the Treasury was running hefty deficits to address the fallout from the Great Recession. Investors feared a large inflation wave would ensue from that. They also feared that the Eurozone would collapse which compromised the suitability of the second most important currency for saving purposes. Gold was deemed suitable as a hedge against this scenario.

As of today, the production cost of gold stands at about $1,900/oz. The average 2025 market price of $3,300 therefore implies a 75% price premium. The latest price of $4,200/oz even suggests a 120% price premium. So, the speculative excess in gold is currently about the size of 1980 (which was followed more than two lost decades) and about two times bigger than 2011 (which was followed by one lost decade).

Where does this speculation come from? In my opinion, it’s the:

Debasement Trade 2.0

You might already be familiar with this term because I have used it a couple of times in my monthly market strategy pieces. The core of this trade is that market participants expect a monetary and fiscal debasement of the value of the US Dollar against which they want to insure through asset exposure.

The monetary component of the Debasement Trade 2.0 is that investors expect a series of politically motivated rate cuts that are in their opinion not supported by inflation data. They believe the Fed’s political independence is compromised because Trump is putting pressure on its governors. Powell may be to some extent immune to that pressure. But his colleagues are not. They are competing for Trump’s attention to become the next Fed chair. He will most likely install a dove next year.

Meanwhile, inflation prints keep coming in at 0.2% MoM or more and the inflation expectations derived from inflation-protected Treasuries are still above 2%, significantly above the level where they were at the time of the last pivot in 2019.

Investors fear that politically motivated rate cuts will drop interest rates below healthy levels. They fear private sector credit demand will then surge and trigger new inflationary pressure.

The fiscal component of the Debasement Trade is that investors expect a continuation of excessive fiscal deficits which are still at about $2tn run rate, which is about 6-7% of GDP, outrageous outside of recessions. Nobody really knows why deficits are still so high. Sure, interest expenses have climbed a lot. But even the primary deficit is not coming down as decisively as it did after the GFC when tax receipts outperformed spending increases. And yet we are debating incoming $2,000 tariff checks that Trump wants to distribute next year. Washington has clearly lost control over the budget in the eyes of many.

As a reminder, why is there even a fiscal component to the creation of US Dollars? Because Treasuries are Dollar-proxies, especially when interest rate volatility is low and/or falling. The issuance of Treasuries effectively increases the circulation of US Dollars to the extent that investors are indifferent between holding actual Dollars or Treasuries. I wrote more about that in the article below.

I believe the Debasement Trade 2.0 is misguided:

Yes, we will get a series of rate cuts and they will likely be politically motivated rather than solely impacted by the Fed’s attention to its double mandate. But these cuts won’t necessarily be positive of US Dollar liquidity, at least not as positive as most investors seem to expect it. Fiscal liquidity creation will actually come down because the Treasury’s interest expenses will come down. The Treasury interest expense channel to liquidity creation is notoriously underappreciated. Private sector liquidity creation then first has to compensate for this fiscal drag before it actually can create net new liquidity.

Secondly, history shows that the private sector doesn’t necessarily react to lower rates with a strong desire for borrowing or in fact with any extra borrowing at all. There was very anemic borrowing in the ZIRP age of the early 2010s. Times may be different now with more headroom for borrowing in the balance sheet of US households. They are not as indebted as they were back then. But the US population has also aged which lowers the proclivity for borrowing. How confident can we really be that private sector borrowing will be strong? I don’t have much confidence in it. There is certainly catch-up demand from hard hit sectors such as housing and automotive. But asset prices make me fear that people expect too much.

Thirdly, the US administration and the general public are very firm about tariffs. These are here to stay as a new tool to drain liquidity from the economy. As I discussed in my November 2025 Market Strategy, it’s one of the most serious tax increases in US history and we are not yet feeling the full impact. It might become a second strong driver to reduce the Treasury’s deficit beyond rate cuts.

Even if I end up wrong on the Debasement Trade 2.0 from a fundamental perspective, I really doubt I will be wrong from a sentiment perspective. It’s such a strong consensus that it’s begging to be tested by Mr. Market. A sharp correction of asset prices would be ideal to test how well the Debasement Traders have made their homework intellectually and emotionally.

Gold would likely be hit very hard during such a market test. To understand why, let’s first look into the supply and demand dynamics of gold and then into the valuation of gold miners.