Building the roadmap for 2024

Quo vadis, bonds and stocks?

Disclaimer: The information contained in this article is not and should not be construed as investment advice. This is my investing journey and I simply share what I do and why I do that for educational and entertainment purposes.

In February 2023, I published my call for the S&P to reach 5,000 by year-end, suggesting a 22% rally from 4,090.

I am not aware of anyone who made such an outlandish call at that time. The Wall Street consensus was 3,700-4,600. It was macro doomer prime time.

Today, the macro environment and sentiment looks quite different. There is now an overwhelming consensus that 2024 will be what people call a ‘soft landing’, i.e. a non-recessionary slowdown including further disinflation and falling interest rates. To the extent that investors entertain other scenarios, a ‘hard landing’ seems to be the only alternative. Nobody deems ‘no landing’ a possibility.

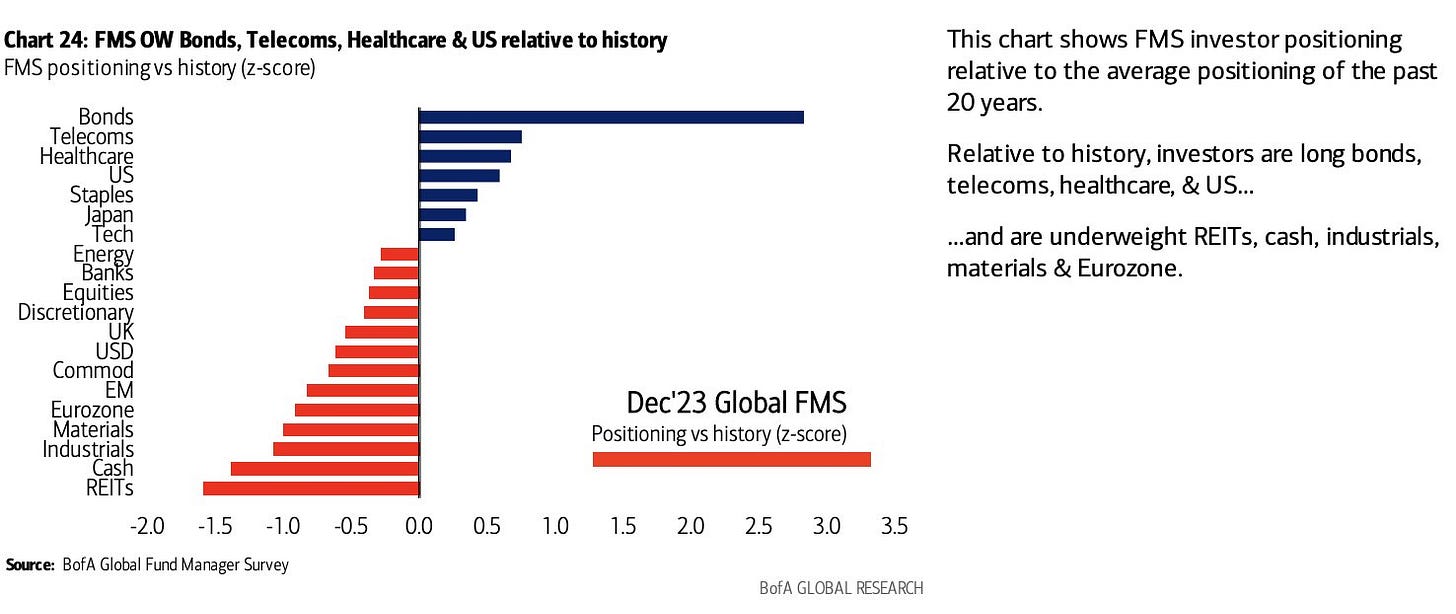

As a result, investors have longed hard into duration assets, most importantly bonds. Per the December 2023 Bank of America fund manager survey, bond positioning is not just extremely elevated still, it has been longed even more than before!

For reference, a 3 standard deviations move typically happens once every 700 months, pretty much twice a century.

And by the way, not just institutional investors have bought bonds in droves. US households have done the same, increasing their bond holdings by 30% since the hiking cycle started.

Equities are now close to a neutral positioning. Aside from REITS, the most hated asset is now…Cash! Can you believe it? We have the highest cash yields in decades and the allocation to cash is underweighted by 1.4 standard deviations vs. historical average levels.

What we are seeing right now is a monster duration bid. Potentially one that has no precedent.

This survey has a very strong historical correlation with forward returns. Beloved assets rarely do well. And bonds are currently the most beloved asset of all. Therefore, the starting point of my assessment is to come up with scenarios that would inflict pain on bond investors.

It’s challenging to get that right because it all depends on what politicians decide next year with respect to deficit spending. This is quite unpredictable, especially in an election year. But as investors, we have to come up with a base case against which we can new evaluate new developments.

At this point, there are basically two scenarios that I can think of:

Yields back up

Yields down, but trailing stock market

Let’s think through both.

But first a TLDR summary upfront to make all of this more easily digestible.

Summary

YTD, the S&P is up 24%, while the TLT is down 2%. A rebound in net fiscal spending was in my opinion the main force for this divergence. The main drivers for this fiscal spending increase have been higher interest expenses and lower tax receipts.

This divergence has reversed since treasury yields topped in October. The S&P is up 15% since then and TLT is up 20%. This indicates that the recent rally in the stock market is primarily driven by speculation on rate cuts.

While the last six weeks certainly feel like a wind of change, the portfolio imbalances of institutional and individual investors still persist. They are still moderately underweight stocks and extremely overweight bonds. The ultimate bond capitulation has not yet happened.

There are two ways how such a capitulation can happen. It can happen in absolute terms with yields shooting back up, presumably alongside an inflation echo as a justification. Or it can happen in relative terms with falling yields, but bond returns trailing equity returns.

The relative scenario feels less likely given a) stock valuations are already quite rich and b) they might in fact not benefit from falling interest rates. Falling rates will stall the fiscal impulse because they will reduce the public sector deficit and hence the private sector surplus. It is possible that this negative impact on the fiscal impulse will be offset by a stronger credit impulse because lower interest rates make borrowing more attractive. But I doubt the math checks out. Lower rates might very well reduce USD liquidity next year.

The recent market rally is therefore happening for very questionable reasons which will likely have to be retraced. The S&P is governed by reversion to the mean. As the market overshoots and undershoots in trying to figure out the actual reality, periods with strong performance follow on periods with weak performance and vice versa. The very few instances where a strong initial move received a powerful and lasting follow up were times with a huge fiscal impulse. The opposite is true today as we may be beyond the top of this fiscal cycle.

I therefore expect that we will see a correction in both stocks and bonds in the near-term. I believe stocks will emerge from that rather unscathed because their dependence on interest rate is less fundamental than it is sentimental. In my opinion, bonds won’t catch a lasting bid until there has been a true capitulation.

Let’s look into all of this in detail.