🔎Garmin & Strava: Betting on CycleTech

Cycling is on the rise and it's associated with the most exciting IPO this year: Strava.

TLDR Summary

Professional cycling hit rock bottom almost exactly twenty years ago, when its biggest stars got caught in the perhaps biggest doping scandal ever. Subsequently, no other sport was as much associated with systematic doping as road cycling.

Since then, the sport has staged a remarkable comeback. A new generation of sponsors and athletes are making it shine again and hobby athletes are spending ungodly amounts of money to get the latest gear. For sponsors and investors alike, this sport offers very attractive returns.

It’s challenging to bet on cycling as a stock market investor because most of the industry’s assets are private. Garmin is one of the very few accessible assets. Their fitness segment is growing rapidly at 30% annually. They have the right products at the right time and a long runway left.

A second flagship asset will likely be listed soon when Strava hopefully goes public. Strava is like Instagram, only tailored for an affluent and highly monetizable community. The business is closely associated with professional cycling. But it has gamified exercising more broadly. It made a social experience out of lonely cold evening runs & rides. It’s addictive for its users in a good way. Its long-term potential is enormous.

How cycling collapsed and rebuilt

On June 30, 2006, professional cycling got caught up in perhaps the worst doping crisis any sport has ever faced when a Spanish anti-doping investigation removed various high profile riders from the Tour de France. Many of them never competitively cycled again afterwards. Years of more revelations followed. Former dominator Armstrong was implicated in 2012 and the UCI stripped him of all Tour de France titles.

By that time, it had become clear that most members of the peloton and virtually every Tour de France winner of the last decades had been cheating. Lots of prominent sponsors left the sport and TV audiences declined sharply.

The sport then had to rebuild from a lower basis. By the mid-2010s, new lead sponsors were coming in and viewership stabilized. Cycling learned from the mistakes of the past and established one of the most transparent and rigorous anti-doping systems.

This recovery has accelerated into a boom in the 2020s. Racing has become more dynamic and more exciting for audiences, often with smaller victory margins than in the past. A new generation of stars competes more aggressively. They sprint every finish rather than riding defensively and gifting stages. Pogacar and Vingegaard have perhaps formed the sport’s greatest rivalry ever. Their appeal is closely linked to the reascent of this sport. And they still have many years left to add chapters to that rivalry.

At the same time, cycling is booming among hobby athletes. It fits the self-optimization zeitgeist perfectly. Cycling hits two birds with one stone. It’s a way to keep you fit and it’s a way to signal your social status through a sophisticated setup. The pandemic accelerated this phenomenon. As a result, cycling has become an extremely lucrative economic niche. Before I discuss this niche more concretely, I want to contextualize first why it matters today more than ever to identify and target specific consumer niches.

The Great Fragmentation: From mass audiences to monetizable micro-economies

Our society and hence our economy used to be much more cohesive than it is today. In the past, we all read the same newspapers and watched the same TV channels. If a company could win a mindshare in the dominant lead culture, it could reach and monetize a large share of the population at once. Sell the same thing to everyone. That’s how the big consumer brands formed.

Digital distribution, social media, and algorithmic feeds have fractured attention into countless micro-economies. These bubbles are not defined by geography, but by shared interests, identities and behaviors.

From an investor perspective, it’s useful to employ this mental framework of micro-economies to target the niches that are attractive for monetization, i.e. those with members that are affluent and that have a high propensity for spending. Cycling ranks extremely high on both dimensions.

Cycling has always been popular. But cycling with ambition used to be a niche without much commercial relevance. Many people frowned upon the men in their tights and colorful jerseys. That has changed. Men and women alike are now spending fortunes on their setups. It has become part of personal branding.

I bought my carbon frame road bike in 2015. At that time I paid $2,000 for it which felt sinful and made me nauseous. Do you want to know what a high end road bike costs today? In the US, Pogacar’s Colnago Y1R is selling for $15,000! Is that bike really 7x better than mine? I doubt it. I actually believe Pogacar would win the Tour de France even on my bike.

It’s not that the tech is getting so much better. It’s that the eagerness and financial resources of consumers is rising. And that is an important signal for sponsors and investors. There is a lot of money to be earned in cycling.

Cycling is attractive for sponsors and investors

The affluence and spending propensity of cycling enthusiasts make the sport extremely attractive for sponsors and investors. But there is more to it than that.

In cycling, sponsoring doesn’t just happen via annoying commercial breaks or ads/banners. It’s directly embedded into the product. Emirates isn’t just sponsoring Pogacar’s team. They are the team. This lifts the connection between brand and consumer to another level.

Furthermore, the largest events have a huge reach with long and repeated exposure. The Tour de France comes with 3 weeks of daily coverage with hundreds of hours of airtime, billions of cumulative TV impressions and millions of roadside spectators. It easily rivals the Super Bowl (120 million viewers), the FIFA World Cup final (a billion viewers) and the Olympic games.

At the same time, operating the global cycling circus is remarkably cheap compared to other sports. There are no expensive stadiums. They use public infrastructure. Communities even pay money to host stages. Personnel costs are fairly low. Yes, stars like Pogacar, Vingegaard or Evenepoel make $5m a year and soon perhaps $10m or more. But many domestiques are on $200k or less. You can probably employ the entire Tour de France peloton for the salary of one Cristiano Ronaldo or one Stephen Curry.

Having left the doping scandals of the past behind, cycling as a sport also comes with many positive associations. It combines technology with strategy, endurance and perseverance. Its stars are very likable and rarely controversial.

All of these factors make the IRR of cycling very attractive for sponsors and investors. Cycling is very effective and a very efficient way to find customers.

Let’s talk about some companies.

An uninvestable industry?

As a public equity investor, it’s surprisingly difficult to bet on the proliferation of cycling. Many of the industry’s most valuable assets are in private hands.

The only publicly listed bike OEMs are Giant and Merida which are both listed in Taiwan. Giant is widely viewed as the largest bicycle manufacturer globally by volume. Merida primarily manufactures for third parties. They also have a significant stake in Specialized, one of the high end brands.

The share prices of Giant and Merida have been doing extremely poorly over the last few years. They are down 75% from their 2021 ATHs when their sales volumes boomed due to the pandemic. The pandemic pulled demand forward which is why sales volumes are depressed right now. It might be worth looking into them as a cyclical recovery story.

The industry’s most important sponsors (Emirates & Red Bull) aren’t listed either and even if they were, you probably wouldn’t be able to express a view on cycling specifically through them. The same is true for those sponsors that are listed. Their industry backgrounds are too diverse to make them useful as bets on cycling. Telefonica is the leading Spanish telco carrier and sponsors the Movistar team. Masco MAS 0.00%↑ manufactures home improvement products. They own Hansgrohe which co-sponsors Red Bull-Bora-hansgrohe. FDJ is the French national lottery company and co-sponsors Groupama-FDJ. PostNL is a logistics company and co-sponsors Picnic–PostNL.

In terms of technology suppliers, Shimano stands out as they dominate the bike components business (drivetrains, shifters, brakes etc.) with market shares north of 70%. Their primary competitors are SRAM (US) and Campagnolo (Italy) which are both private. Shimano’s dominance makes them attractive to look into. However, there is very little upside for more market penetration and more value add.

The opposite is true for another cycling technology company that successfully combines hardware and software: Garmin.

Garmin: Currently the best way to bet on CycleTech

Garmin was founded in 1989 and initially focused on GPS navigation for aviation and marine markets. In the 2000s, they started expanding into fitness and outdoor recreation which have now become their core businesses.

Cycling computers

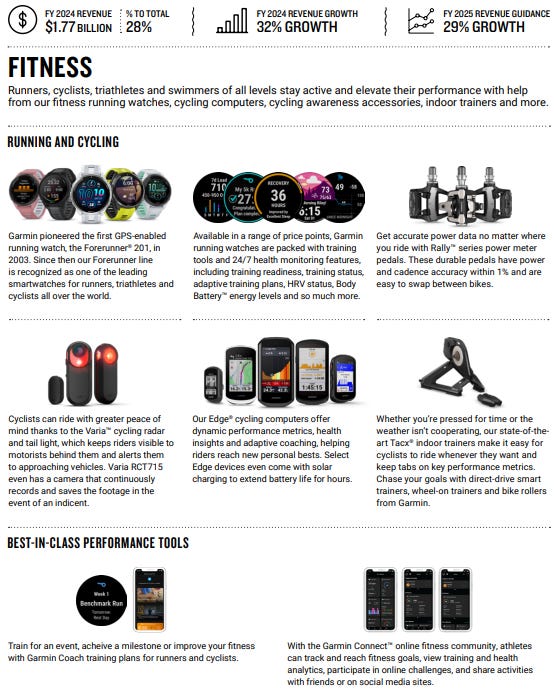

In the past, even ambitious hobby cyclists spent not more than perhaps $50 on a cycling computer, the sole purpose of which was to measure speed and distance. Today, cycling computers have evolved into high tech performance tracking devices that integrate various devices to not only measure speed and distance, but also power, heart-rate and cadence. They also provide routing & navigation and structured workout plans. They are ideal cross-selling hooks. If you equip the athlete with the cycling computer, you are in the pole position to sell them various other products and services for their cycling experience.

Garmin utterly dominates cycling computers, primarily because they were the first mover and because they have an unmatched penetration with professional athletes. The majority of the Tour de France teams are sponsored by Garmin. The only other relevant supplier is Wahoo which is privately-owned by its founder.

Garmin’s first cycling computer, the Edge, was introduced in 2006 and currently dominates the GPS bike-computer category with a global market share north of 33%.

Watches

Watches aren’t of direct relevance for cycling specifically. But they are the most important value driver in the fitness industry generally and hence for Garmin. Garmin’s revenue with watches exceeds their cycling computer revenue likely by at least about five times and the segment is growing rapidly. Watches have become half of Garmin’s entire revenue.

There are globally around 600 million smartwatch users right now which is up from just 100 million in 2020. User adoption will likely head into the billions by the 2030s. Apple dominates this market, of course. Their market share is about 23%. But Garmin is successful at defending a very lucrative niche through their status as first mover and their focus on athletes.

Garmin introduced the Forerunner 201 running watch in 2003. At that time it was one of the first GPS-enabled sports watches and set a new standard for fitness tracking. They expanded their smartwatch offering in the 2010s, most importantly through the multi-sport watch Fenix in 2012 and the smartwatch Vivoactive in 2015.

Today they sell about 6-10 million watches per year (for reference Apple sells about 30-45 million). Garmin targets a premium segment of the market with an ASP presumably 30-50% above Apple. They also enjoy an extremely high customer loyalty among endurance athletes. I personally own one of their smartwatches which I charge once a month and replace once every ten years.

Garmin Connect

Garmin continues to be a hardware company. But they are adding software capabilities to enhance customer loyalty. Garmin Connect is the backbone of their software ecosystem. It integrates all devices a customer has into one training history and performance log. This makes it very costly should the customer eventually want to switch to competitors such as Apple or Polar.

Segments

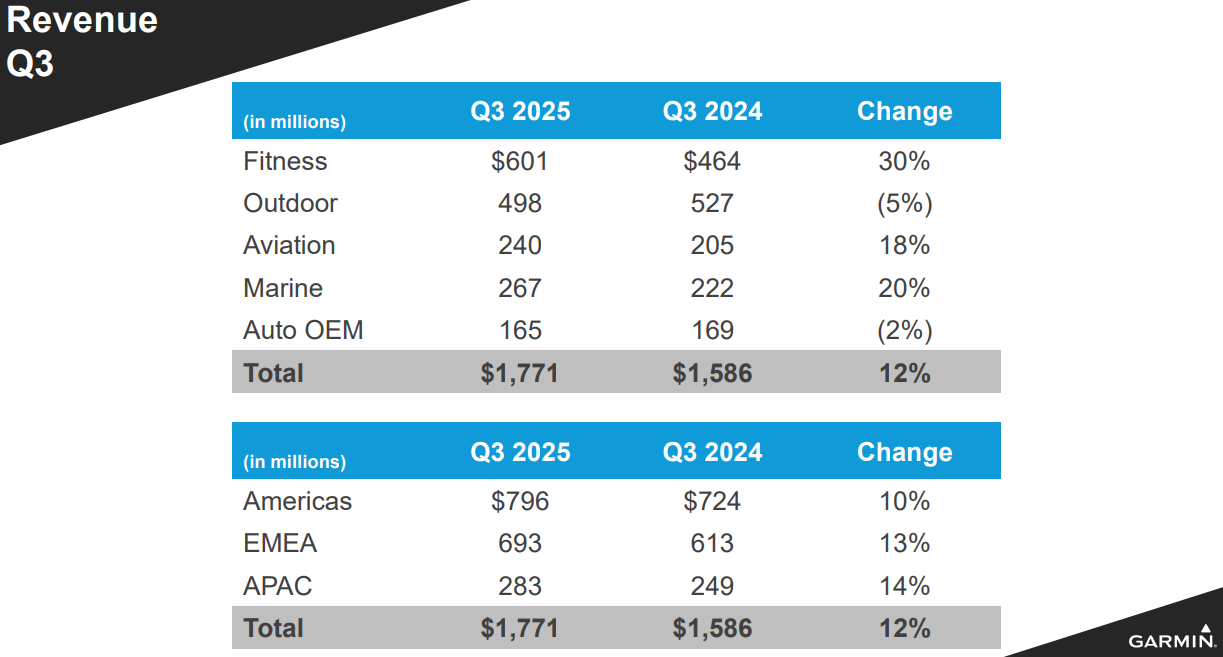

Today, Garmin’s fitness segment accounts for 28% of revenues, growing at almost 30% annually.

How many billion dollar discretionary consumer businesses do you know that are growing at comparable rates? Think of Garmin’s fitness segment as their version of what Big Tech achieved through cloud computing: successfully using core competencies to reinvent the company and greatly expand operations.

Financials & Valuation

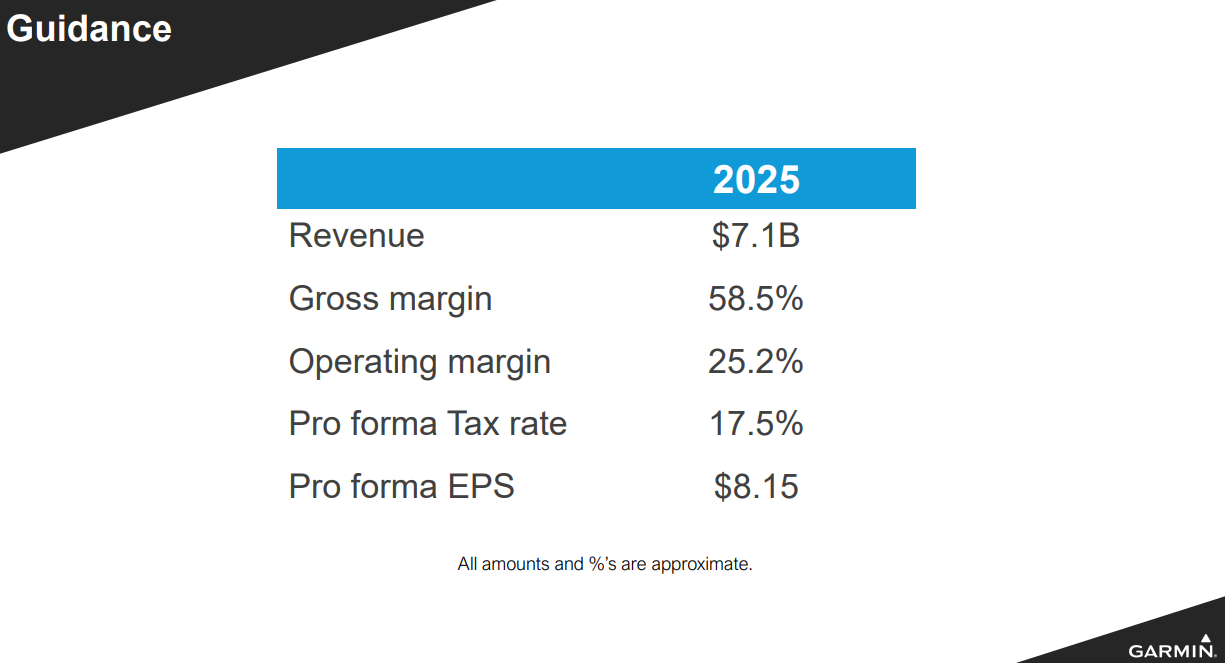

Garmin will report 2025 full year earnings on February 18, 2026. They will then likely report total revenues of $7.1bn and $8.15 EPS.

At a $205 share price, this values them at 26x earnings and about 5x revenues. In return for that price, investors get a business that is growing its topline at 12% with its core business growing at 30%.

I’m optimistic that Garmin will continue to do well. They have the right products at the right time and they have repeatedly proven their ability to skate where the puck is going. However, they are also quite mature at a $40bn market cap. Hard to see them 10xing anytime soon.

Another company in this space has that potential though: Strava.

Strava: Destined to become the industry’s hottest asset after its IPO?

Strava is in my opinion by far the most exciting private company with potential to be listed. On February 2, 2026, they announced that they have confidentially submitted a draft S-1 with the SEC. If all goes well, they will go public later this year.

You are probably familiar with them. In case you aren’t, it’s the Instagram for endurance athletes, mostly for cyclists, but also for triathletes and runners.

“If it’s not on Strava, it didn’t happen” is perhaps the most fitting company slogan ever created. It’s not even from the company itself. It originated organically from the user community and it encapsulates the importance of the app like nothing else. Strava has gamified exercise. It made a social experience out of the lonely cold evening runs & rides. It’s addictive for its users in a good way. Which other social medium can claim that for their users?

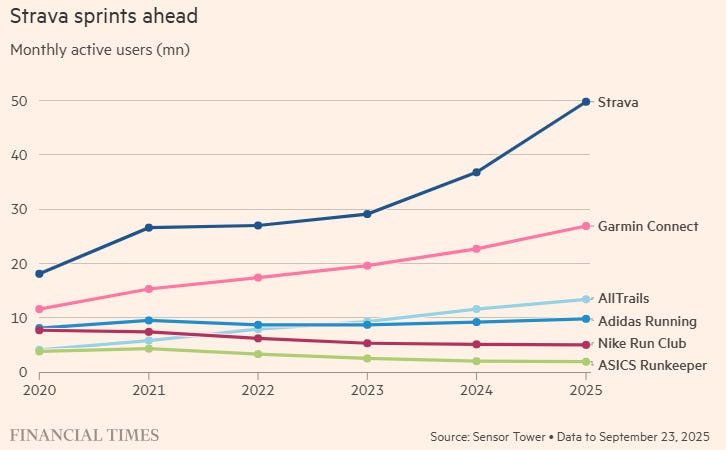

The app has 50 million monthly active users, rising rapidly. It has about twice as many active users as Garmin Connect and continues to extend its lead.

Strava’s biggest strength is its device indifference. Garmin Connect creates a moat for Garmin to keep its users. But that comes with a strategic risk. To use Garmin Connect, consumers first have to buy an expensive Garmin device. That is not the case for Strava. It’s open source. That’s why it can grow faster and eventually reach dominance when social training has matured.

I think Strava will be the most suitable vehicle to play the cycling trend outlined earlier. It just makes sense to bet on continued fragmentation of online communities and Strava users are disproportionately likely to pay for digital services offered to them.

There is also a near endless potential to expand the service offering:

They can offer personalized coaching.

They can become a marketplace for other athlete services (bike fitters, training camps, physio).

They can organize and monetize events.

They can establish a creator economy similar to YouTube or Tiktok.

They can play the ads game.

The most ambitious long term potential could be the integration of AR and VR. You won’t just cycle with your friends in the digital worlds of Watopia anymore. Instead, they will be right next to you when you climb your local hills while they climb theirs. Strava can play a role in making that possible.

Financials & Valuation

Strava was valued at $2.2bn in its May 2025 funding round I can imagine the IPO will happen at a much higher valuation. Let’s say they go public at $3bn. How attractive would that be?

Let’s say 10% of the 50 million million users are on premium plans. That’s 5 million people paying about $100 annually and suggests $500 million in revenues. This would value the company at about 6x revenues. Expensive for a company that is probably not yet profitable, but not egregious. They are probably growing their topline at more than 30% right now.

What about user count? 50 million users at a $3bn valuation implies a market value of $60/MAU. This is a fraction of Meta ($600) and lower than Spotify ($100), all while Strava’s users are likely disproportionately monetizable.

Strava is a unique asset in an economic niche that is extremely attractive. I think it’s a $10bn asset at least. Let’s see when and where they start trading. I might provide an update then.

Sincerely,

Rene

Some brokers offer grey market trading for Strava. (For example IG Bank uses the market cap after the first day of trading as a surrogate for share price, which can be traded now as a CFD.)

1) Any thoughts on taking a position there?

2) Market cap implied in these contracts is currently 4.4B . Any thoughts on that?

As a runner, it's fantastic read.