🔎InMode: First the fat, then the skin.

Skin doesn't disappear as easily as fat. The GLP-1 boom should therefore trigger a boom for aesthetic treatments. This hasn't happened yet. It's a mistake to capitulate on the idea though.

TLDR Summary

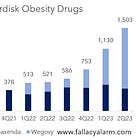

The war on obesity is just getting started. There are currently about 15 million patients on GLP-1 drugs globally. And based on the latest quarterly results of Eli Lilly LLY 0.00%↑ and Novo Nordisk NVO 0.00%↑ , their number is growing at a rate of about 30% annually. The number of ‘GLP-1 graduates’ (i.e. people who have successfully completed treatment) will likely quintuple in the next five years to then about 100 million.

Losing a lot of weight solves many physical and mental health issues. It often opens a whole new life for patients. But this life comes with new challenges. One of those challenges is that skin volume often doesn’t shrink as much as fat volume does. The result is optically unpleasant. Many patients with a renewed affinity for their own optical appearance will want to address this issue.

Natural solutions require a lot of discipline and patience and they only work within certain limits. Surgical solutions are highly effective, but they are invasive and expensive.

Energy-based aesthetic treatments are an attractive alternative. Targeting the tissue with controlled heat triggers collagen contraction, destroys remaining fat deposits and encourages new collagen formation. The results are surprisingly effective.

The companies in this space are currently struggling from an unfavorable macro environment and a cyclical saturation. One of the last remaining publicly listed pure plays is InMode INMD 0.00%↑ . Its stock is down 85% from its 2021 peak. It’s still highly profitable and now trading at less than 10x guided earnings.

The GLP-1 trade was huge in 2023 and 2024. Investors did not only long Novo Nordisk and Eli Lilly. They also played second order themes. Many of those themes have unraveled. The boom of GLP-1 drugs is strong, but so far it hasn’t reshaped the economy in a major way.

Therein lies opportunity in my opinion. Many of the second order themes require patience to materialize, more patience than many investors are willing to demonstrate. The real wave of GLP-1 graduates and their changed consumption preferences is yet to come. Demand for aesthetic treatments could then exceed expectations once again.

The war on obesity is just getting started.

Novo Nordisk’s semaglutide was approved for diabetes in 2017 (Ozempic). It has been the first GLP-1 receptor agonist that was highly efficacious for weight reduction. Since 2021, it has been approved for obesity (Wegovy). Eli Lilly followed with tirzepatide which was approved for diabetes in 2022 (Mounjaro) and for obesity in 2023 (Zepbound). Together these drugs have revolutionized the healthcare industry by moving obesity into primary care.

Today, both companies own virtually 100% of the GLP-1 market, which is also referred to as the incretin analogs market. I have covered this in more detail in the two articles below:

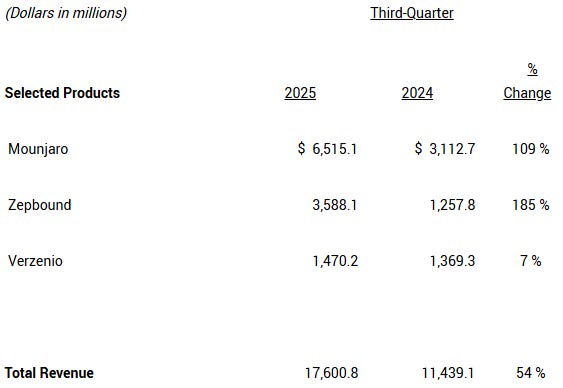

Both stocks have been consolidating for a while. However, their latest results confirm that the story is still solid from a fundamental perspective. On October 30, 2025, Eli Lilly released their 3Q25 earnings. Total revenue was up 54%, driven by Mounjaro (+109%) and Zepbound (+185%).

Today, Novo Nordisk followed with its 3Q25 report. The company is struggling against Eli Lilly, the drugs of which are deemed more efficacious. However, they were still able to grow their combined Ozempic/Wegovy revenues by 8.5% YoY.

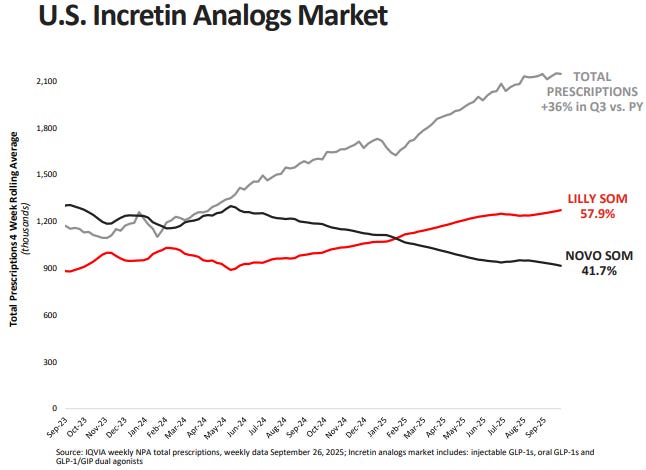

There are currently about 2 million weekly prescriptions for incretin analogs in the US. Assuming a 4-week renewal cycle, this suggests a current count of fully committed patients of about 8 million Americans. This is growing rapidly at 36% per year.

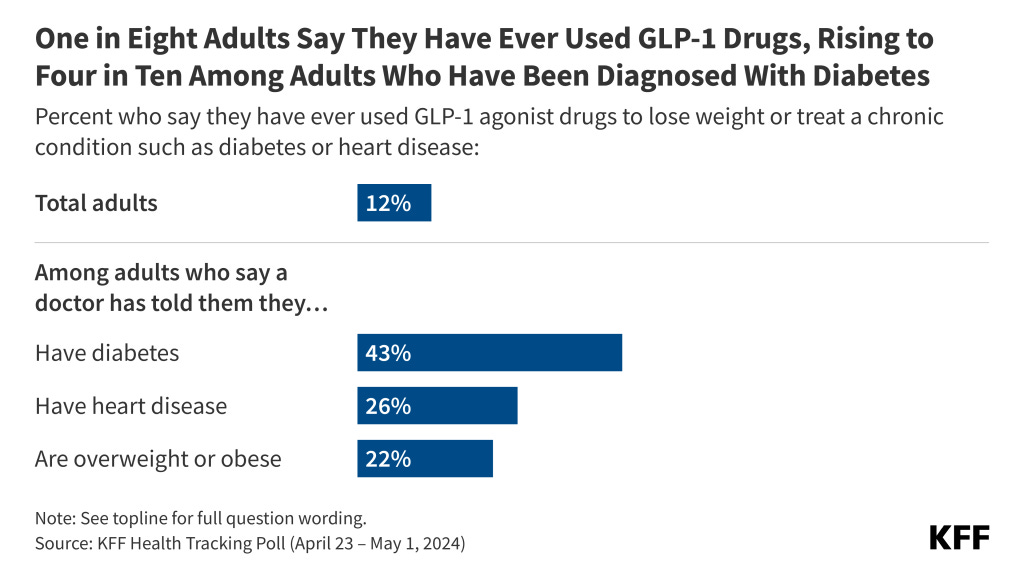

Poll-based user estimates are a bit higher. Based on a Kaiser Family Foundation (KFF) poll, 6% of US adults say they are currently on GLP-1 drugs and 12% say they have ever taken a GLP-1 drug. This suggests 15 million active US users and 30 million who have at least tried.

The poll likely overestimates the true number of fully committed users. I can imagine 10 million is a more realistic number to incorporate compounded drugs and other grey market solutions. Based on Eli Lilly and Novo Nordisk quarterly earnings data, the US likely accounts for 60% of the entire market. This would suggest that there are currently about 17 million active GLP-1 users globally.

These numbers are still tiny compared to the addressable market. Based on WHO data, there are 2.5bn overweight people globally (BMI >25) and 900 million who are living with obesity (BMI >30). In high-income countries, there are about 640 million overweight and 300 million obese.

Losing weight solves many problems, but it also creates new ones.

GLP-1 drugs solve lots of problems for their users. They need less medical treatments for obesity related diseases such as diabetes, hypertension or kidney disease. In the long run, they may even have decreased risk for dementia and cancer.

Overall, their physical and psychological quality of life increases, often drastically. However, a new life comes with new problems that will need to be addressed.

Body shape for example. About 90% of human fat is stored in adipocytes, also called fat cells. Most of this is subcutaneous fat, i.e. it is stored just beneath the skin. Smaller fat depots are around internal organs (visceral fat). The number of adipocytes are largely constant in adults. They just swell when people gain fat and they shrink when people lose fat.

Human skin primarily consists of collagen, a protein that forms its structural framework. When adipocytes grow by taking in fat storage, they stretch the collagen fibers. When the fat cells shrink again, those stretched collagen fibers don’t contract as much as the fat volume does. The result is sagged skin.

Someone dealing with that issue has in principle three options. The first option is to count on natural recovery. Work out to fill up volume with muscle mass and eat a lot of protein to support collagen repair, eggs for example. ;) This requires patience, discipline and only works within certain limits.

The second option is surgical skin removal. This is a powerful solution. But it causes lengthy downtime for the patient. It is also invasive and often leaves scars. Repeatability is limited and it is expensive. Generally, it’s a solution for an extreme subset of patients. Nothing that you would consider after losing just 20 pounds.

The third option involves non-surgical and non-invasive (or at least minimally invasive) treatments. One of them is so called energy-based aesthetic treatment which works by targeting the tissue with controlled heating to trigger fat destruction, collagen contraction and new collagen formation. It offers results that are comparable to plastic surgery, but without the shortcomings of full surgery.