October 2025 Market Strategy

The Great Debasement Trade. How it came to be. Why it went too far. And how it will likely unwind.

In my September 2025 Market Strategy, I argued that inflation fears from potentially politically motivated rate cuts are overblown. Instead, these rate cuts will likely coincide with an overall slowdown in the economy. This would then require a rerating of the US stock market to a lower growth trajectory. However, before that can happen, a sufficient number of investors needs to be trapped in overextended long positions. Let’s check how the picture has evolved since then.

TLDR Summary

Investors keep chasing the bull market in a giant pain trade. From a fundamental perspective, this is primarily a bet on rate cuts which are deemed politically motivated and inflationary. Assets are considered protection against this anticipated monetary debasement.

Fiscal momentum is currently neutral and in my opinion it has more downside than upside risks. Credit momentum is positive, it’s however starting from a smaller base. Overall, I have doubts that US Dollar liquidity creation will be strong in the coming 12 to 18 months.

Should I have a point, assets will have to rerate lower eventually. It’s extremely hard, if not impossible, to anticipate the timing of that moment. But it seems obvious to me that portfolio risk must be reduced until it gets a proper price again.

Performance Summary

The infinity bid continues and it seems to be only a question of time that the S&P 500 reclaims its all-time high from before the trade war scare last Friday.

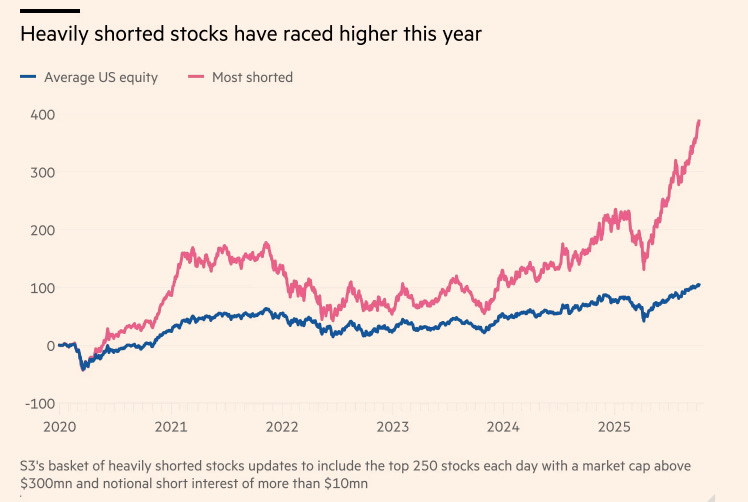

The hottest market segments are currently Gold, which is up 25% in just two months, and meme stocks which are greatly outperforming broader indices. A basket of the 250 most shorted US stocks is up 57% this year, the best run since the 2020/21 retail-driven surge.

Some of them may be doing so for fundamentally justified reasons. Companies like Open Technologies and Better Home & Finance have clear cyclical catalysts ahead.

But many of them seem to be completely detached from their operating fundamentals, most importantly in quantum computing, nuclear power and data center operators.

The junkier they are, the better they are doing. That’s concerning for the stock market as a whole.

Recession Watch

GDPNow keeps signaling strong economic momentum in the US. The latest estimate for 3Q25 GDP growth is 3.8%.