Peabody: A stealth play on AI power? (incl. Excel workbook)

Coal could stage a comeback to facilitate the data center build out because other energy sources won't be able to. The company could then earn its entire market cap in just a few years.

Earlier this week, I shared the results of my operating leverage screening with you. I shared tear sheets of 20 companies that have demonstrated strong operating leverage historically as evidenced in high incremental margins of additional revenues. I asked you which of those companies you would be interested in researching further. Peabody came out as the frontrunner. So, here’s its pitch.

I have also attached an Excel tool at the end with a valuation scenario analysis in which you can experiment with various price, volume and margin assumptions.

TLDR Summary

Coal has enough spare capacity to accommodate the entire data center build out for the next six years and probably longer. It is reliable (in contrast to wind and solar) and it has proven unit economics (in contrast to nuclear SMRs). If there is any energy source besides natural gas that can capitalize on the AI boom, it’s coal.

Nobody wants to own it though. It’s dirty and unattractive. In fact, the entire energy sector is. It’s as hated as it was in 2020 and 2015 when lockdowns and shale caused existential crises for the industry. Believing in the data center build out and dismissing coal is in my opinion a contradiction. One of these two beliefs will have to be proven wrong.

The setup seems highly asymmetrical. Peabody is in a net cash position and can easily earn north of $500m in decent years. That’s a payback period of just six years at a $3bn market cap. It does come with a business in terminal decline. But it also comes with an option to get a piece of the greatest narrative out there.

Company background

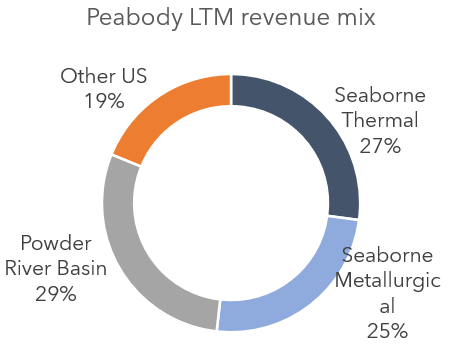

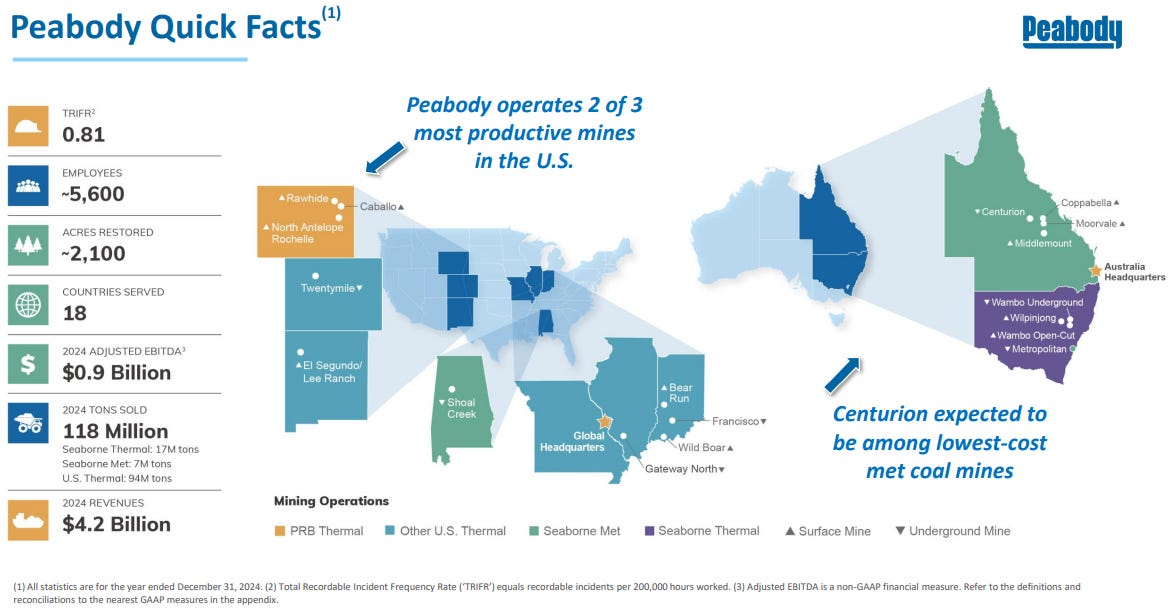

Peabody BTU 0.00%↑ produces both thermal and metallurgical (“met”) coal in the US and Australia. Met coal is primarily used in steelmaking, while thermal coal is used for electricity generation. Met coal typically commands higher prices and must meet stricter quality specifications.

Roughly half of Peabody’s revenue comes from its seaborne operations, with both met and thermal coal contributing equally. The other half of revenue is generated in the US, which is almost entirely thermal coal. Peabody’s US production of 100 million tons annually guggests a 20–25% market share of the coal burned for US electricity generation.

The company has been around for more than a 100 years, but they went bankrupt in 2017. A flood of cheap gas crushed domestic demand for coal in the 2010s.

They tried to escape it by selling met coal to China. Unfortunately this bet also coincided with cooling demand from China which seemed to have insatiable appetite for coal in the 2000s.

Peabody re-IPO-ed 2017 after shaking off $8bn in debt. What appeared to be a short lived revival (by Nov 2020 they had lost 95% of the IPO price), got intercepted by the global energy crisis in 2022 which made Peabody shine again.

After several years of consolidation and a capitulation sell-off earlier this year, the stock recently jumped again and is almost back to the 2022 high as of this writing.

How much will AI drive electricity consumption?

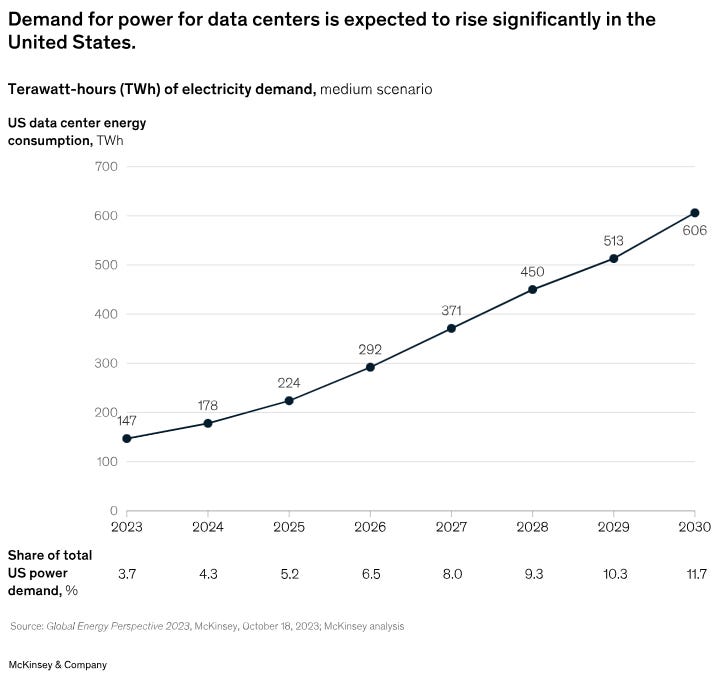

McKinsey estimates that US data center electricity consumption will more than triple between 2024 and 2030 from 178 TWh to 600 TWh annually. For reference, Germany consumes 500 TWh per year. So, US data centers are expected to add almost an entire Germany to the US grid in just six years. Germany is still the third largest economy in the world by the way. And I wouldn’t be surprised if this estimate turns out to be conservative given the pace of data center announcements recently.

The data center share in total US power demand will correspondingly grow from 4% to 12%. In other words, data centers will contribute about 1.2%-points to electricity consumption growth per year for the next six years. For context, total electricity consumption has grown just 0.6% per year in the US for the last ten years.

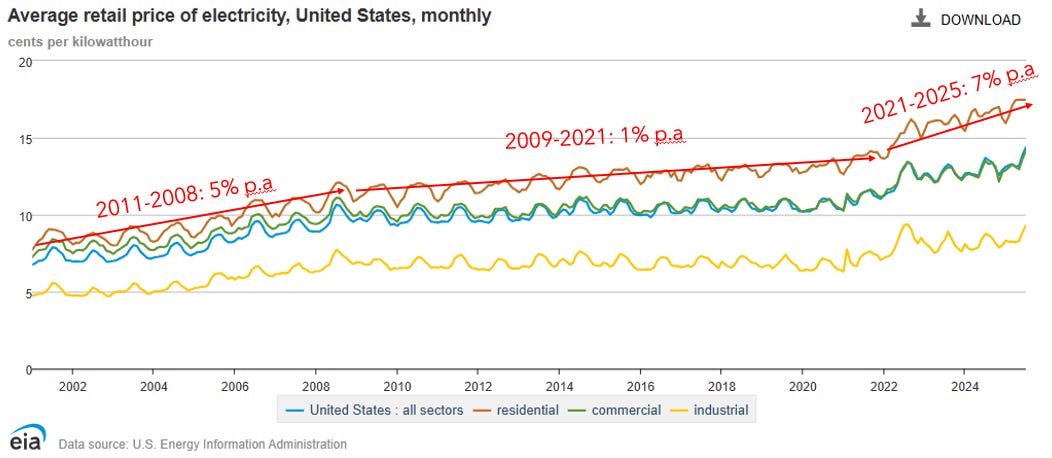

Electricity prices seem to be responding to that. Over the last four years, they have risen by 7% p.a., much faster than the 1% p.a. from 2009 to 2021 and even faster than the 5% p.a. from 2001 to 2008 which was driven by the commodity supercycle back then. As of July 2025, the LTM price increase stands at 5.0%. So this is not a 2021/22 phenomenon. It’s an ongoing acceleration of electricity prices.

Which energy sources will benefit?

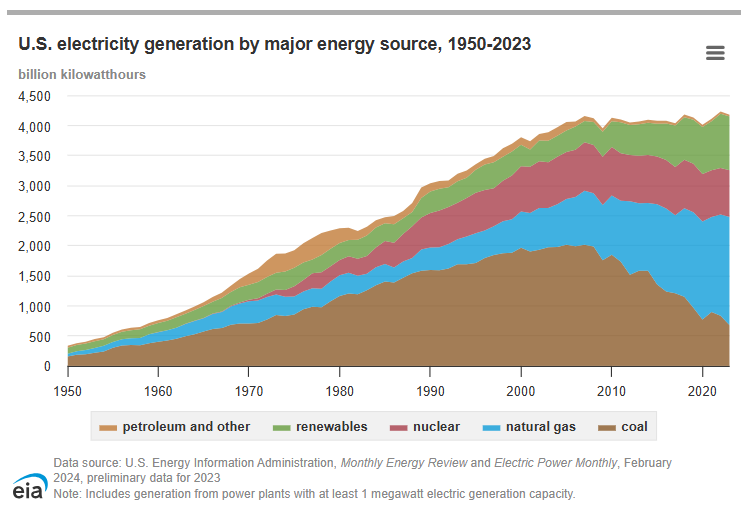

Strictly speaking about electricity, the US has become (and is still becoming) a natural gas nation.

It accounted for more than 40% of electricity generation in 2023. Natural gas is one of the cheapest and most flexible energy sources. It can provide baseload and it can complement intermittent energy sources.

I maintain that natural gas will capture the lion share of the additional electricity demand from AI.

I reckon many people agree with me on that. However, many people also anticipate other energy sources to proliferate in the slipstream of AI. Most importantly, nuclear energy is currently going through a renaissance, especially small modular reactor (SMR) technology that promises to combine state-of-the-art nuclear technology with industrial manufacturing to improve cost, flexibility and scalability.

NuScale SMR 0.00%↑ and Oklo OKLO 0.00%↑ are the most popular pure plays capitalizing on this hype. Together they are sporting a market cap of almost $40bn as of this writing. Both companies are poorly disguised scams in my opinion that will never live up to their promises and even if they do, they won’t make a difference in the energy economy because they are not competitive with existing energy sources.

Some people are also betting on an expansion of wind and solar to accommodate AI energy needs. As long as there aren’t sufficient and credible attempts to make those intermittent sources firm, these will not play a major role in the AI theme in my opinion.

This leaves us with coal as a potential AI supplier. It has a terrible reputation for its carbon footprint which is why it’s easy to dismiss. But it’s also true that coal is still one of the cheapest energy sources out there. Many economies with a high coal share in their energy mix have very low electricity prices. Examples include India, China, South Korea, Turkey and some Eastern European countries such as Poland and Serbia.

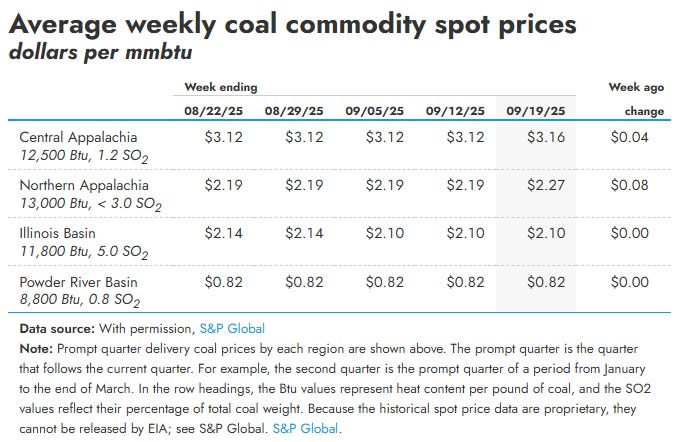

In the US, coal spot markets are currently around $2-3 per mmbtu which is right where the leading natural gas benchmark, Henry Hub, is currently trading.

Coal is not as flexible as natural gas in that its output can’t easily be dialed up and down. Once it burns, it burns. But that’s not necessarily a problem for AI use, much of which is more baseload in nature.

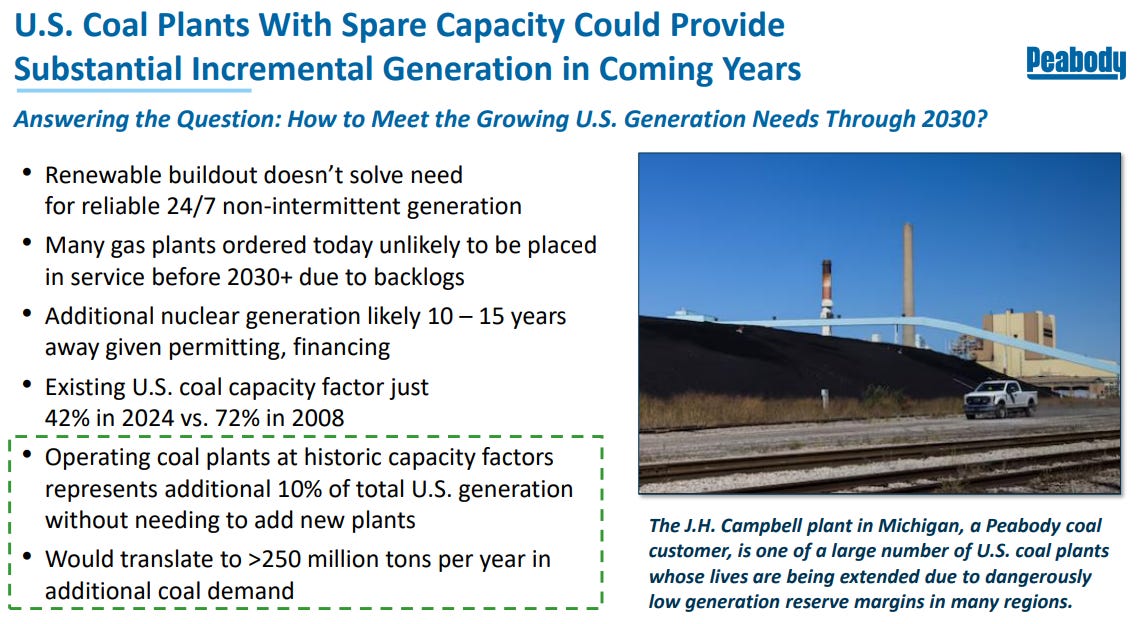

Peabody management argues that natural gas will run into capacity constraints because new plants won’t be operational by the time they are needed for the new data centers. In contrast, coal could pretty easily boost US electricity generation by 10% (!) simply by returning to its historic capacity factor in 2008. In other words, it could facilitate the entire demand growth predicted by McKinsey above and more.

In that scenario, there would be 250 million tons more coal needed per year, likely 50 million tons from Peabody at a 20% market share. It would then boost Peabody’s production volume by 50%. Prices would likely also respond strongly. It’s an extreme scenario, of course.

The current US administration is determined to keep coal in the mix to accommodate the AI demand boom. Just yesterday, Energy Secretary Chris Wright told Reuters that the Trump administration is urging to keep coal-fired power plants to run longer. And Trump is openly and repeatedly campaigning against emission targeting. Just this week he called climate change the ‘greatest con job in the world’ in his speech at the United Nations assembly.

Given that the conservative movement has a strong momentum in the US and globally right now, it is absolutely possible that emission targets will be walked back and that this will allow for a revival of coal just like what is happening with nuclear right now. If we can do a 180 on nuclear (remember it used to be the most evil thing in the world and has now been given a green and sustainable stamp), we can also change our minds a little bit on coal, can’t we?

The commodity supercycle of the 2000s was driven by the narrative of endless demand from emerging markets, most importantly China. Can’t AI drive a similar narrative? Personally, I don’t view coal as any less ethical than selling cannabis or highly caffeinated energy drinks to young people or than mismarketing medical drugs as lifestyle products.

I doubt that investors are prepared for even the slightest positive sentiment shift on this matter.

Sentiment

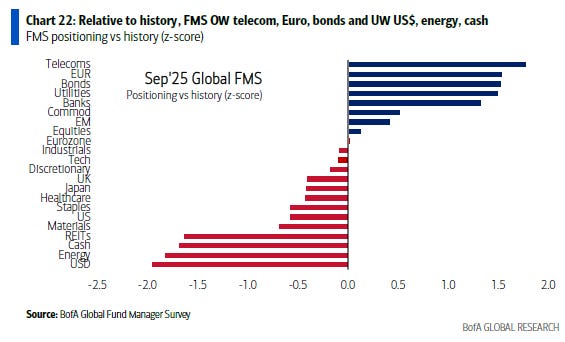

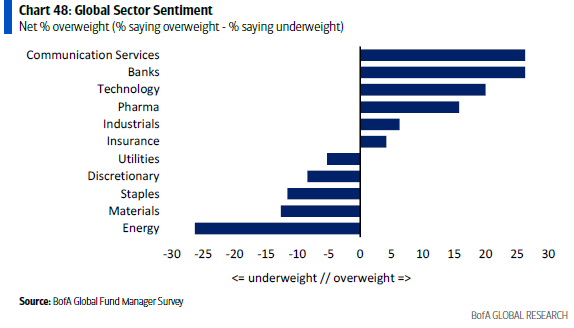

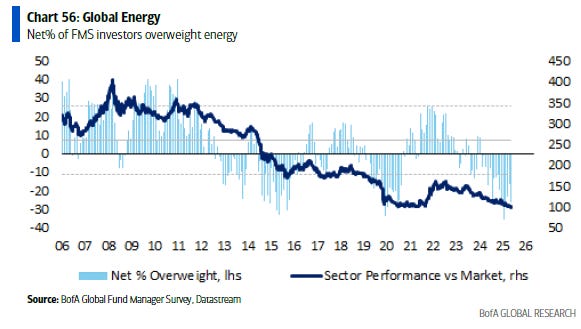

Per the September 2025 global fund manager survey, energy (which is primarily oil & gas, but also includes coal) is the most hated sector. This has been a common sight during the last few years. Only REITs are equally dismissed and often rank last as well (mostly due to the office crisis).

Energy is currently as underweighted as it was in 2020 (lockdown demand shock) and 2015 (fracking supply shock). Both of that preceded major relative outperformance periods of the energy sector.

I discussed the energy sector broadly in more detail in the article below if you are interested:

In the remainder of this article, I will look into the latest operating trends of Peabody and I will develop a simple valuation scenario analysis to understand the stock’s sensitivity to various price, volume and margin assumptions.