Pumping Up the Heat: Carrier's Growth Transformation

Management is courageously buying into the residential energy transition, one of the biggest megatrends of our time. It will transform the company and its perception in financial markets.

Before we dive in: I have overhauled my About page. You can expect to receive the same type, depth and cadence of reports from me going forward, but I believe I have clarified it better now for prospective readers (and for myself) what Fallacy Alarm is and what content can be expected.

I have also had some great conversations with institutional subscribers recently based on which I have decided to introduce an Institutional subscription level. I am now offering custom coverage and one-on-one calls. You have questions relating to my work or the topics I cover? I have (or will find) the answers. Use me as your outsourced research analyst. Scope and pricing can be negotiated. Reach out for details by responding to this email.

“This is probably, given the energy transition happening in Europe, I would say this is the most predictable sustained growth market in the world.”

David L. Gitlin, Carrier CEO, 1Q23 earnings call

On April 25, 2023, CARR 0.00%↑ announced the acquisition of Viessmann Climate Solutions for €12bn ($13bn). Carrier’s market cap is currently $35bn. It is a game-changing acquisition that will be transformative for the company. In this report, I will explain the nature of and rationale for this acquisition. And I will contextualize the investment opportunity that lies therein. I have attached my deal model for additional details.

Table of Contents

1. Investment Thesis Summary

2. Company Background

Carrier

Viessmann

3. The Heat Pump Opportunity

Germany

Europe

USA

Global

4. Valuation

Rerating

Sentiment

Price Target

1. Investment Thesis Summary

The decarbonization of our economy is one (if not the) megatrend of our time. Climate control in buildings causes 25% of global emissions, ~2x more than transportation. Heat pumps will be to climate control what electric vehicles already are today for transportation: the primary method of achieving emission targets. For many applications, it is a superior technology due to its efficiency, versatility, comfort and durability. And where it is not, it will be forced into the marketplace by political will.

Globally, the heat pump market will grow by >20% for years to come. Europe and Germany in particular are at the forefront of this trend with growth rates north of 30%. The 2020s energy transition is shaping up to become a gold rush that will rival 2010s mobile and cloud computing.

Carrier has just announced that they will acquire Viessmann, the #1 player in the #1 market for heat pumps. It’s a true hidden champion of the kind that public equity investors rarely get their hands on. In Lynch lingo, it will transform the company from a Stalwart to a Fast Grower.

This change in the company’s growth profile has the potential to meaningfully alter how it is perceived in the market. I can imagine it will rerate the stock and lift its 17x P/E multiple into the range of energy transition pure plays like Enphase or SolarEdge, which are trading at 25x. So, this valuation uplift alone provides a 50% upside in the stock.

I have modelled how the combined entity will presumably look like from a financial perspective and what growth profile we can expect. With a 4-5 year time horizon, I see this as a $100 stock, which would be a 2.5x vs. today. It’s a highly asymmetric opportunity because the legacy business is solid and very unambitiously valued.

If you have some time, I highly encourage you to listen to their 1Q23 earnings call in which they go into great detail about the Viessmann deal. The presentation outlines the opportunity very well, but the subsequent Q&A session with the analysts was even better. If that doesn’t excite you, I don’t know what will. :)

2. Company Background

Carrier

Carrier provides HVAC, commercial refrigeration and fire & safety (mostly detection devices and extinguishers) solutions. They currently generate $22bn in revenues and $3.5bn in EBITDA (16% margin). They are operating globally with an emphasis on the Americas (~60%). Subsequent to the acquisition, Carrier will sell substantial portions of their refrigeration and fire & safety business because they do not deem these core following this transformation.

Carrier was spun off from RTX 0.00%↑ in 2020. The stock has appreciated by 220% since then. Spin-Offs often outperform market indices since these are often underappreciated assets that start shining once they are freed from their parent. It seems like this is the case for Carrier. When they went public, they issued a mid-term guidance of up mid-single digits sales growth and EPS growth. They have by and large been able to demonstrate that since then as evidenced by the 2018-2022 revenue growth profile below. EPS trajectory is naturally more lumpy.

Viessmann

Viessmann provides energy and climate solutions for commercial and residential buildings.

This primarily includes heat pumps, gas furnaces and energy generation and storage. Most revenues are generated in Europe, with Germany being the largest market.

They are expected to generate €4bn in revenues in 2023 at €700m EBITDA (17.5% margin). An important differentiator for Viessmann is their 75k strong installer workforce, which provides the company with a superior distribution channel.

This distribution channel has two dimensions: First, their proprietary installer force builds trust and intimacy with their customers. And secondly, their integrated solutions make it seamless for customers to add additional products/services after the first installation. I believe they are a natural winner in the connected/smart home trend.

“Professor Dr. Martin Viessmann really had encouraged to see the value in going to this direct-to-installer model. And if you think about Europe, in many cases, both sell to distributors, who sell to wholesalers, who sell to installers, who sell to the homeowner, both in Germany and many of its other countries, Viessmann Climate Solutions did establish this direct-to-installer model, which has so many advantages in Germany and in Europe, not only the obvious that they -- from a margin perspective, but even more importantly is that they end up with a lot of customer intimacy. And what's also happening is that the demand for these heat pumps is so acute throughout Europe that their installers are struggling to just keep up with the underlying demand.”

“You can think of it almost as the Apple of their space because all of their products are seamlessly integrated into an ecosystem approach. So if a homeowner can't afford to buy solar PV battery and a heat pump all at the same time, they predesigned them, so they're all interoperable and interconnected at the time of installation. So what really makes them unique is their ability. So if you only install the heat pump in the battery and a year later, you install Solar PV, it's been seamlessly integrated.”

David Gitlin, 1Q23 earnings call

3. The Heat Pump Opportunity

Per the US Environmental Protection Agency, electricity and heat production accounts for 25% of global emissions. This is almost twice the emissions of the transportation sector.

We’re in the first innings of a huge policy push to electrify climate control in buildings. Heat pumps will likely take the centerstage in this process. They will be to climate control what electric vehicles already are today for transportation: the primary method of achieving emission targets.

Heat pumps basically work like a two way refrigerator. By compressing and decompressing a refrigerant (a gas or liquid), it transports heat from one location to another. They are praised for their efficiency and low running costs, but they are sometimes considered insufficient in colder climates because their efficiency drops with colder weather. Not much heat to transport when there isn’t any to begin with. It is therefore paramount to have good insulation, which can increase the total system cost (but decrease the running costs).

For many applications, it is a superior technology due to its efficiency, versatility, comfort and durability. And where it is not, it will be forced into the marketplace by political will.

It is plausible to me that heat pumps are a natural winner of the energy transition from a technological perspective. But even if I am wrong, it does not matter much. They have the political support needed to secure their victory. It is a common theme in the public domain to equate decarbonization with electrification. While policymakers scrutinize the origins of fuel gas, they consider electricity as clean energy no matter how it was produced. For them, it just comes out of the socket like money comes out of the ATM. It is not a level playing field for alternative solutions.

After the acquisition and the planned divestitures of non-core legacy businesses are completed, the combined entity will generate 75% of its revenues with HVAC, a good and rising amount of which will be heat pump revenues. In this section, I will provide an overview of the most important end markets, incl:

Germany 30-40% growth annually

Europe 20-30%

USA 10-15%

Global 15-20%

Germany

On April 19, 2023, Germany updated its Gebaeudeenergiegesetz (GEG), which requires that every newly installed heating system must in principle be fueled with at least 65% renewable energy. There are certain exceptions, for example for old aged homeowners or for gas furnaces that are fueled by renewable natural gases, such as biomethane. In the transition phase, people can also choose to install a gas furnace if they agree to replace it after three years. This is supposed to give them time to prepare the home for a more sustainable solution.

Considering all options at hand, it appears obvious that most consumers with the need for a new heating system (both in new buildings and existing ones) will opt for a heat pump or at least a hybrid solution including a heat pump. For example, Germany consumes ~90bn cubic meters (bcm) of natural gas per year. Today, the total biomethane production in the *entire* EU is only 3bcm and the European Commission wants to ramp this to 35bcm by 2030. It is therefore obvious that this will not be a viable alternative for most households for the foreseeable future.

The efficiency problem of heat pumps in cold weather is likely less of an issue in Germany because winters tend to be fairly mild and homes are typically insulated very well to begin with. As an enticing side effect, heat pumps also provide cooling, the comfort of which Germans/Europeans have not yet appreciated at scale. Less than 5% of German and French households have air conditioning, while 90% of Americans do. They will enjoy this as an upgrade in their quality of life. And pay for that accordingly. The installation cost of a heating system with a heat pump is multiple times higher than a traditional furnace.

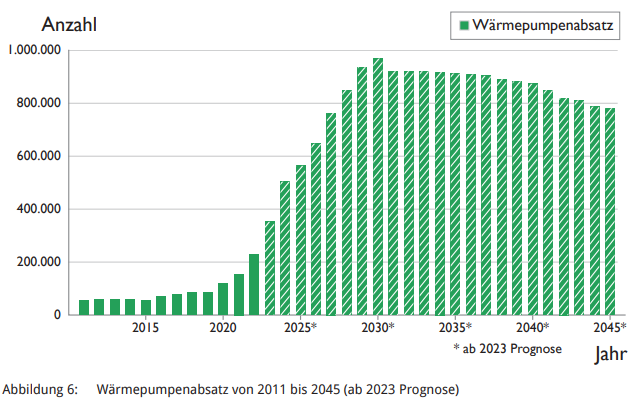

In 2022, the German heat pump market grew by 53% to more than 230k units. BWP, the Germany industry association expects that to grow to 500k (!) units in 2024. It’s a gold rush.

For reference, the total market for heating systems is ~1m units annually, 70% of which is currently gas. (Waermepumpe = heat pump)

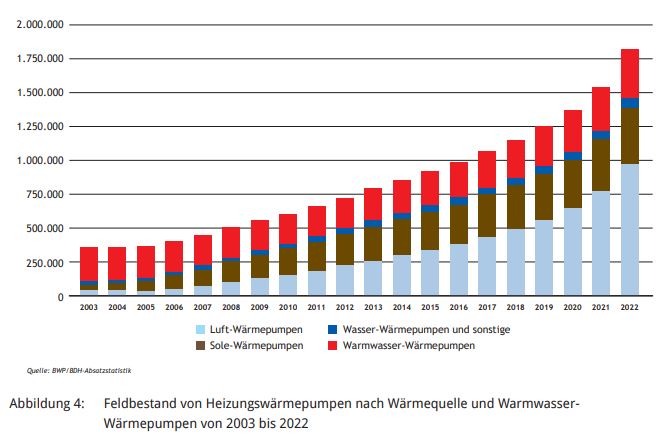

The installed base of heat pumps for heating purposes (was opposed to water boiling which is also included in the chart below) is 1.45m units. There are currently 19m buildings in Germany, which equates to a market penetration of just 8%.

The BWP expects the annual volume to rise to almost 1m units annually by 2030, which would be 4x vs. 2022, and then level off to 800k thereafter.

A heat pump system can easily cost north of €10k. So, we’re talking about a market in Germany alone that is worth €3bn annually today and will likely be worth €10bn in a few years. And about 25% of that is tax payer funded. Money that will ultimately end up in the pockets of manufacturers and installers. Based on the information provided by Carrier, I would estimate that Viessmann owns €700m or 20-25% of that market.