Rocket Companies 2Q24 Earnings Review (incl. Excel workbook)

Mortgage rates are still high, but revenues are growing again. Pent-up demand will likely be very strong. Incoming rate cuts will be a formidable catalyst.

Disclaimer: The information contained in this article is not and should not be construed as investment advice. This is my investing journey and I simply share what I do and why I do that for educational and entertainment purposes.

This article is entirely free to read. An excerpt of my Excel workbook is attached for premium subscribers.

On August 1, 2024, Rocket Companies reported their 2Q24 earnings. The last time I covered this stock was after their 2Q23 earnings. I argued that their recent decoupling from mortgage rates pointed to an attractive entry point for a contrarian buy. My conservative mid-cycle EPS model suggested a fair value of $22, which was 125% upside from their share price of $10 at that time.

Today, the stock is trading at $17. It has run a lot. Can it run more?

TLDR Summary

In spite of mortgage rate still being quite high, Rocket has delivered a fourth consecutive quarter of positive year-over-year growth in terms of cash revenues. The cyclical trough in the mortgage industry is clearly behind us.

This may be one of the best rate cut plays out there considering how massive pent-up likely is in the housing market after years of being starved by the Fed. Falling rates will also be a continuous earnings tailwind for them given how their mortgage inventory rolls through their balance sheet. The more rates fall between origination and selling off the mortgage, the higher the premium will be that Rocket can charge to the mortgage buyer.

The mortgage industry is still very fragmented. But Rocket is the clear market leader, technologically and culturally enabled to keep taking market share and work towards a market consolidation.

I have updated my valuation model from last year. I estimate their current mid-cycle EPS potential at $1.58 which could support a share price of $24. This suggests about 40% upside which is not much compared to the 125% upside last year. However, it should be noted that this is designed as a mid-cycle valuation based on current market metrics. Rocket will keep compounding alongside residential real estate as a function of economic growth and monetary debasement. I consider this a decent buy even at fair value. As long as it shows upside in my simplified mid-cycle earnings model, it looks even better.

Incoming rate cuts will be a formidable catalyst for this stock. It’s in my opinion highly unlikely that the top is in for this stock given how early we are in the real estate comeback.

Investment Thesis Summary

Rocket originates and services mortgages, primarily in the US. They have built out a superior technology suite that enables them to acquire and retain customers cheaper than their peers. As a result, they have been able to outspend their competitors on marketing which has led to substantial market share gains over time.

The true beauty of their business model is what I call inflationary disruption. Their top line is a function of originated mortgage volume which is a function of home prices which are a function of monetary debasement.

Typically, technological disruption is based on deflationary drivers. A new product or service needs to be cheaper than the existing solution to win in the market place. Amazon revolutionized shopping by making it cheaper. Google revolutionized information collection by making it cheaper. This means that innovators are usually in a race against deflation. In terms of value-add, Google needs to permanently outrun the deflation in their revenue by click.

There are some exceptions to this rule, which I call the Inflationary Disruptors. Companies like Apple or AirBnB that disrupt an industry, taking market share and expanding the total market while at the same time benefiting from inflationary pressures on their products. Rocket is similar. They are a technological leader in a market niche that benefits from inflation as real estate appreciation drives up the mortgage volume of which RKT gets a percentage cut. For more details, please check out my original deep dive from last year:

Earnings Summary

In 2Q24, Rocket generated $1,301m in revenues, of which $1,068m were cash revenues. As a reminder, a considerable share of their revenues are non cash because they book the present value of originated mortgage servicing rights upfront as revenues. It’s important to understand this accounting issue. I recommend to read the original investment case from February 2022 for more background.

This is the fourth consecutive quarter of year-over-year cash revenue growth which clearly demonstrates that the company has turned a cyclical corner. Their business had been contracting since 2Q21 on a cash revenue basis.

Their operating expenses for the quarter were $1,109m, which means they operated close to - but below - breakeven. This is however not much of a concern. Rocket is a cash machine with very high operating leverage once the cycle turns. Operating cash margins can surge to way past 50% in peak quarters.

Valuation Update

As mentioned previously, the goal of my valuation exercise is to quantify the company’s sustainable mid-cycle cash revenue and cash earnings. I do this because of the highly cyclical nature of the business and the company’s horribly confusing accounting mechanics.

Gain on sale of loans

There are three avenues for Rocket to originate mortgages: New home sales, existing home sales and refinancing.

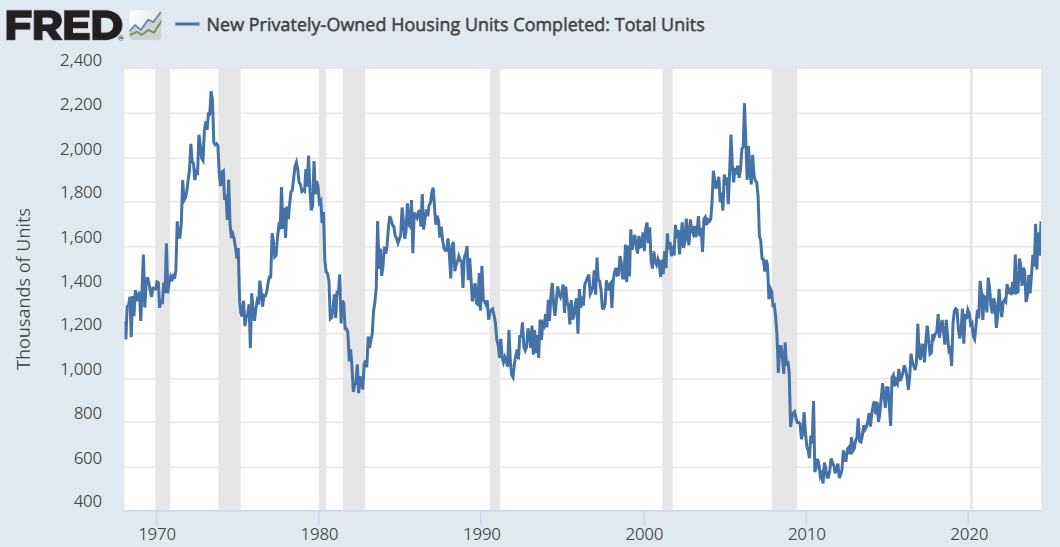

New home sales have been steadily improving since the GFC trough and even the real estate turmoil of the last few years has not caused more than some noise in this trend. We are still way below cyclical peaks of previous cycles of the past five decades. And that is with a much bigger US population. I had originally worked with an extremely conservative assumption of 1m units annually. For this update, I am upping this to 1.5m, which I still consider quite conservative.

As I have mentioned in recent articles, existing home sales are at insanely low levels when compared against history. I had worked with a conservative assumption of 5m units annually before. I am now upping this to 5.5m units which still doesn’t feel ambitious.

Most mortgages in the US are fixed for their entire term, meaning that a mortgage never comes up for refinancing if the borrower doesn’t choose to. They do however choose to refinance for variety of reasons, most importantly when rates drop a lot. Such drops cannot be foreseen. However, we can observe historical refinancing volumes. As you can see in the chart below, refinancing volume is highly volatile and can range from less than $100bn annually to almost $1tn.

For modelling purposes, I have chosen to assume $500bn annually going forward. Again, this will be very lumpy and this assumption assigns value to rate drop optionality in Rocket’s business.

Putting all of this together suggests that there will be $2.9tn of mortgage originations sustainably in the US going forward. If Rocket keeps capturing 10% of this and makes 2.5% in revenue for every Dollar in originations, they should be able to clear $7.3bn in gains on sale of loans annually going forward. The table below summarizes my assumptions and calculation results. The grey column shows my prior assumptions for reference.

It should be noted that these assumptions are rather conservative in nature. Home prices will keep growing and Rocket’s market share will likely be growing. This is a mid-cycle assumption as of today. It will likely drift up with time.

Servicing fee income, net interest income and other income

I have kept these assumptions largely consistent with the previous model iteration.

Overall, this suggests a sustainable mid-cycle cash revenue potential of currently $9.8bn.

Margins

As mentioned previously, margins are highly cyclical. My regression analysis suggests that $9.8bn in revenues would likely come with an operating margin of 40%.

Taxes

Rocket has a very funky corporate structure with Dan Gilbert owning a different share class than minority shareholders and they are doing some weird tax gymnastics. As a result of that, the company currently has an extremely low tax rate. To be honest, for an outside analyst it’s virtually impossible to fully comprehend what is going on. My assumption is that one way or another, Rocket will have to pay a federal and state income tax rate of 20% eventually which is in line with other public companies.

Valuation Result

Bringing it all together, I estimate the company’s sustainable mid-cycle net profit potential to be $3.1bn which equates to an EPS of $1.58.

I believe they could be assigned a premium P/E multiple to reflect their growth profile. They will likely continue to gain market share. But I doubt that markets will reflect that in the near to mid term due to its pronounced cyclicality and the suboptimal organizational structure. 15x should be doable though which would value the stock at $23.66, which equates to 39% upside.

It’s not the no brainer multibagger that it was a year ago. But again, this is meant as a mid-cycle valuation based on current market metrics. Since Rocket will keep compounding alongside residential real estate as a function of economic growth and monetary debasement, I consider this a decent buy even at fair value. As long as it shows upside in my simplified mid-cycle earnings model, it looks even better.

Sincerely,

Your Fallacy Alarm

Model below.