Root 1Q25: Reigniting the growth engine (incl. Excel Workbook)

The company reported an impressive 37% YoY revenue growth and confirmed its record low loss ratio. Most exciting to watch will be whether the Carvana warrants will exercise in September.

Disclaimer: The information contained in this article is not and should not be construed as investment advice. This is my investing journey and I simply share what I do and why I do that for educational and entertainment purposes.

TLDR Summary

As anticipated, Root posted solid earnings with 37% YoY revenue growth and a confirmation of their record low net loss ratio of 64%. The stock market’s reaction is muted which is my opinion due to two reasons.

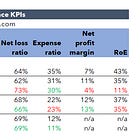

Firstly, expenses were possibly a bit ahead of expectations which made the combined ratio climb by four percentage points to 101%. Such concerns are understandable. The bull case for Root requires them to demonstrate economies of scale to get their expense ratio down to where their more established peers are. However, a bump in the expense ratio is not unexpected in a quarter with that much sequential top line growth. The company frontloads customer acquisition costs which means that profitability will move up in the coming quarters when growth normalizes. At this point, I am not overly concerned.

Secondly, investors are possibly worried about the loss ratio going forward. Management indicated that its current loss ratio is below their target and tariffs will put upward pressure on insurance losses in the coming quarters. In addition, the insurance industry cycle is close to its peak or possibly beyond which increases downside risks.

The most exciting thing to watch about Root in the coming months will be whether or not Carvana’s warrants will end up in the money on September 1, 2025. If they do, a lot of money will pour into Root’s balance sheet which could create a lot of value once deployed into profitable underwriting. My updated valuation scenario suggests that this could boost the stock to $250+.

Earnings summary

As a reminder, in my earnings preview, I had noted that the most important information in Root’s earnings release will be to what extent they can confirm the profitability demonstrated in the last quarters because it will inform us about the company’s near-term growth potential. I expected strong results based on the positive results posted by their competitors.

Root posted strong topline growth in 1Q25. Revenues increased by an impressive 37.1% YoY, driven by an acceleration in both direct and embedded (i.e. partnerships). Pretty amazing what this company can do when they decide to put the pedal to the metal.