What's the signal in the weakness of the US Dollar?

It could mark the exhaustion of the Fed SuperCycle as foreign demand for US assets may be waning.

Disclaimer: The information contained in this article is not and should not be construed as investment advice. This is my investing journey and I simply share what I do and why I do that for educational and entertainment purposes.

TLDR Summary

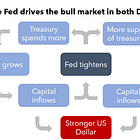

The Fed’s rate hikes have supercharged the bull market that started in 2022 by increasing the Treasury’s deficit, increasing investor risk appetite and attracting capital from abroad. A strong US Dollar was both byproduct and driver of this mechanism which I dubbed the Fed SuperCycle.

As long as the Dollar remains strong, this Fed SuperCycle remains intact. Higher interest rates are then nothing to be feared. Instead they are just a manifestation of economic strength that helps assets with US Dollar cash flows to continue to outperform.

The latest strength of the US economy is astonishing in light of the trade conflict which has caused a rapid recovery of the US stock market since the April growth scare. Increased economic growth expectations have also bumped interest rates up again.

However, higher rates did not coincide with US Dollar strength this time. Instead, the US Dollar has been selling off. This could be a temporary trade distortion from the tariff drama. But it could be the signal for a paradigm shift in that foreign appetite for US assets is reaching exhaustion.

In the short run, this is not necessarily a problem for US assets. In fact, their earnings will react positively to more favorable exchange rates. It could however be problematic in the long run. The valuation premium of the US Dollar has been an implicit form of leverage that made the US economy overconsume and overinvest. A weaker Dollar might unravel this leverage which may make economic growth surprise to the downside.

This doesn’t mean that the structural tailwinds for the US economy aren’t blowing anymore. But it could mean that asset prices have to rerate lower to digest a cyclical excess.

What is the Unwind of the Fed SuperCycle?

As you may remember, I first turned bearish in my December 2024 market strategy, most importantly due to what I considered to be irrational exuberance about the US economy and its stock market.

I was particularly concerned about the role of the US Dollar in this bull market which was both byproduct of and force in a mechanism that frantically pumped capital into US assets.

By March of this year I had structured these observations into a proper framework which I called The Unwind of the Fed SuperCycle.

I argued that rate hikes were not curbing economic demand as they were supposed to do as a tool to control inflation. Instead, they were fueling and in fact overheating the US economy. Rate hikes increased deficit spending and hence the savings injection into the private sector. The Treasury’s issuance and the Fed’s QT supplied large quantities of low risk assets into the market which raised risk appetite because investors felt compelled to rebalance their portfolios. And finally, elevated interest rates and strong economic growth in the US attracted capital from abroad.

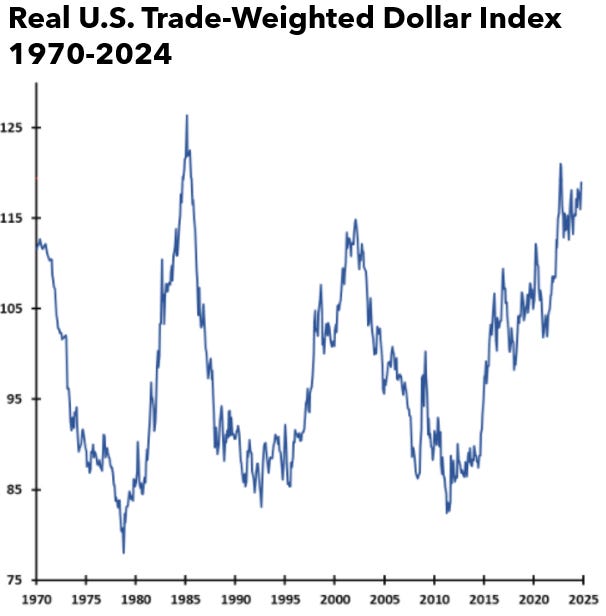

The result of that was an overvaluation of the US Dollar against most other currencies. In real terms, the US Dollar index exceeded the high it had marked in the early 2000s and it was not far off its all-time high shortly before the Plaza Accord.

This overvaluation must be viewed as an implicit form of leverage. It made Americans overconsume just like their explicit borrowing in the 2000s made them overconsume. A surging trade deficit illustrated this overconsumption in both cases.

The valuation premium of the US Dollar is to some extent a manifestation of the strength of the US economy and its amazing ability to convert near endless amounts of capital into profits. This ability has to do with the innovation power in its information technology and energy industries. And it has something to do with demographic tailwinds and the attractiveness of the US for immigrants which provides a constant stream of motivated and qualified newcomers that boosts economic growth.

These structural forces can continue to work for a long time with a sustainable wealth effect for Americans. But the Fed’s contribution as described above is cyclical in nature and must eventually roll over. It causes unpopular inflation that politicians must be wary off to secure reelection. It causes asset mispricing to the upside from investor exuberance that will cause a negative wealth effect once prices mean revert. And it causes financial hardships for indebted households. Many of them are shielded from interest rate swings for the time being, but that won’t be forever.