Rocket Companies Update (incl. Excel workbook)

Investors are capitulating due to the unexpected surge in mortgage rates. But the business is growing against a brutal macro backdrop. Once the cycle turns sweet, the money printer will be on again.

Announcement: I have decided to use my actual name and face for this publication from now on. I believe it signals the credibility, integrity and professionalism that I strive for every day. Anonymity makes it easier sometimes to speak one’s mind freely. But after thinking about this for a long time, I believe the pros outweigh the cons.

Disclaimer: The information contained in this article is not and should not be construed as investment advice. This is my investing journey and I simply share what I do and why I do that for educational and entertainment purposes.

This article is free to read. The Excel workbook is attached for premium subscribers.

TLDR Summary

As America’s largest mortgage originator, Rocket is effectively a bet on falling mortgage rates, with a bit of disruptive innovation sprinkled on top.

When the worst mortgage rate fears did not materialize, the stock recovered from its $6 low in September 2022 to $21 in August 2024. Since then it has dropped 50% back to $11 as investors have dumped their bets on falling rates. Higher for longer has been revived as investor consensus.

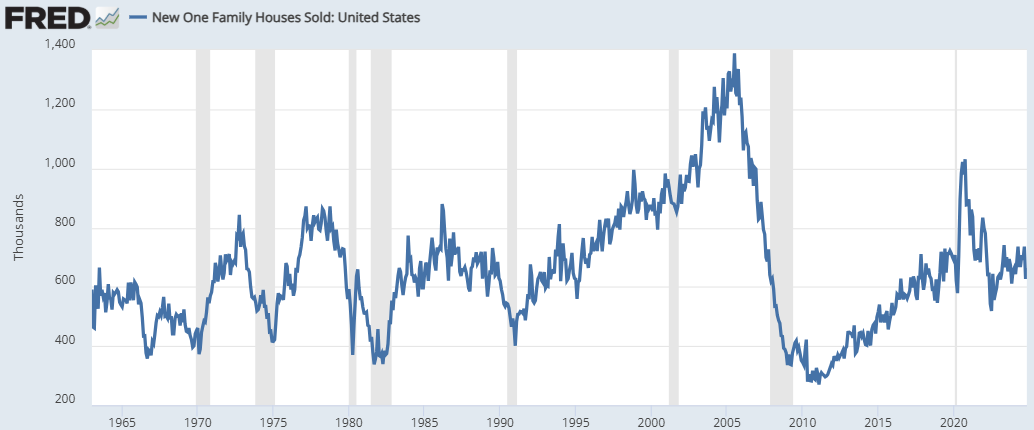

I believe that this dump presents a compelling contrarian opportunity. As I have discussed recently, my macro base case is that rates will fall more in 2025 than most people expect which should revive housing market activity. The housing market remains completely bombed out levels that are utterly unsustainable to persist much longer. New home sales are barely above the average of the last 60 (!) years and existing home sales are close to GFC lows.

Rocket’s operating performance has been remarkably robust against the harsh macro current. In 3Q24, they originated 28% more in mortgages than a year earlier and even 11% more than in 3Q22. Once the housing market cycle turns sweet again, they will print money. Rocket has demonstrated amazing operating leverage historically. The stock is currently trading at $11, which is about a 50% discount to my updated valuation scenario based on estimated mid-cycle earnings power.

Company Background

Rocket is the largest mortgage originator in the US. They achieved this by building out a superior technology suite that enables them to acquire and retain customers cheaper than their peers. As a result, they have been able to outspend their competitors on marketing which has led to substantial and consistent market share gains over time. And in their latest investor day, management has laid out quite ambitious plans for further market share gains.

Check out the articles below for additional background on the company. They do have a quite complicated revenue recognition which is worth studying to understand the company and my valuation exercise below. I explained that in detail in the original investment case in 2022.

Macro Background

New home sales are hovering at about 700k units annualized, barely above the average of the last 60 years during which the US population increased by 80%.

Existing home sales do show more of an uptrend, but they are also at completely bombed out levels, close to the trough after the GFC.

The reason for this is obviously the rapid surge in mortgage rates from 2.7% in 2021 to 6.9% currently. This surge has trapped both potential sellers and buyers. Sellers would lose their favorable mortgage terms if they made a move. And buyers are priced out.

How long can it remain like this? The housing market is paralyzed, but life goes on for people. The three Ds (debt, divorce and death) keep happening and require housing transactions.

Unsurprisingly, Rocket stock is suffering pretty badly in this environment. Its beta to the 30-Year mortgage rate is about 0.3, meaning that a 100bps change in the mortgage rate moves the stock by 30%.

In 2023, the stock started to decouple somewhat from the prevailing mortgage rate. Or framed differently, it reacted violently to speculation on lower long-term interest rates. The unexpected bond market sell-off subsequent to the first rate cut in September 2024 and Trump’s victory (promising more real growth and hence higher rates for longer) have crushed this speculation.

“Over the past few months, the market has thrown our industry almost every curveball imaginable. With inflation easing, the Fed cut rates for the first time in 4 years. But in an interesting twist, while the Fed lowered rates, mortgage rates did not follow suit. Instead, both the 10-Year treasury yield and the 30-Year fixed mortgage rate actually increased.”

Varun Krishna, CEO, 3Q24 earnings call

It is challenging, if not impossible, to anticipate the near-term earnings trajectory of a company that depends so much on the macro environment. The goal of my valuation exercise is therefore to quantify the company’s sustainable mid-cycle cash revenue and cash earnings.

Model update

Rocket’s business model is quite simple. They originate mortgages and then they sell them off for a profit to investors. This is obviously more profitable in a falling rate environment and less profitable in a rising rate environment because it takes time from origination to sale.

In many instances, they retain the right to service the mortgages for which they will then collect a servicing fee. This complicates their income statement because they don’t just book the servicing fees received each period. Instead, they book the present value of originated mortgage servicing rights at the time of origination. This is obviously a non-cash effect and it is subjective because it depends on model assumptions. I recommend you read my original investment case from 2022 to understand this in more detail. For now it should suffice that my approach attempts to measure only the company’s cash revenues and earnings.

In 3Q24, Rocket originated $28.5bn in mortgages. This was 28% above prior year and 11% above 3Q22. The cyclical trough clearly seems behind them and this performance is remarkable considering the bombed out housing transaction charts earlier. In 2019, the company originated almost $40bn each quarter before the whole madness started.

This origination volume generated $1,188m cash revenues for the company and incurred $1,144 in operating costs. The resulting operating margin of 3.7% fits right on my regression line from my earlier articles.

As you can see, Rocket’s business has amazing operating leverage. The operating margin shoots up to north of 50% in peak quarters.

“And when the market contracts, you're left with excess capacity and inflated costs. Today, we have the capacity to support $150 billion in origination volume without adding a single dollar of fixed cost. We proved that this quarter. Not only did we handle more volume, net rate lock volume was up 43%, but we did so with 7% fewer production team members year-over-year. Our AI tools are driving these gains, from automating income verification and collateral review to enabling multiple client chats and insights that boost conversion. Rocket Logic, our proprietary loan origination system, is driving massive efficiency improvements. With recent updates, we're saving over 800,000 team member hours annually, a 14% increase from just 2 months ago, resulting in more than $30 million in annual savings. But it's more than just cost savings. AI is giving us greater speed, accuracy and personalization, boosting conversion rates and fueling growth. Operational efficiency is a top priority for us, and we're constantly evolving to keep ourselves lean, agile and competitive. Another key part of our business model is our origination servicing flywheel.”

Brian Brown, CFO, 3Q24 earnings call

Overall, the latest quarter requires little change to my valuation model. I have tweaked the numbers a bit as illustrated below, mostly reflecting an increase in home prices and slightly higher other income.

My mid-cycle EPS estimate sits now at $1.64. If we granted them a 15x multiple on that estimate, the stock could be worth almost $25. I consider that a decent mid-term price target. Needless to say, that would be more than a doubling from the current level. So, there is a decent margin of safety baked in.

Sincerely,

Rene

Workbook below.