I strangled the TLT.

Before yields can fall substantially, the long bonds crowd needs to capitulate. With overpriced options, I believe there's an opportunity to extract money from them while waiting for the actual pitch.

A quick announcement before we dive in: My first actual vacation in two years is approaching fast. I have a few other projects to finish up next week and then I will head to Europe to visit family and attend an important wedding. I will be back in the office on July 16. If anything comes up, I might publish another piece before that. But to manage expectations, the next Fallacy Alarm edition likely won’t be in your inbox before the 3rd week of July.

The last few months have been intense and you might have noticed that the volume (and hopefully the quality) of my work has increased substantially as I have dedicated significantly more time to this solopreneurship venture. I hope you have been enjoying it as much as I do! And perhaps you can fill the summer break by catching up with some of my recent work you have not had the chance to read yet. :)

Pundits have discussed for many years what finally happened in 2022: The 2010s bond bubble burst. No matter what happens from here, I believe it is fair to state that as a fact.

There is a lot of uncertainty regarding the path forward. Quite a few people believe we have returned to a new normal with higher rates and higher persistent inflation. The other camp believes the structural forces pressing down inflation (and hence rates) are still strong and the 2010s were not an outlier, but part of a larger trend that will resume.

As you know, I am a proponent of the latter. In my opinion, a return of low rates appears to be a certainty given demographic forces and insane public debt levels. But our camp has grown a lot. People are betting on disinflation, falling rates and rising bonds in droves. You can see it in futures and options positioning, in fund flows and in investor surveys. It has become a crowded trade. And in investing, crowds typically don’t win.

The last chapter of this story is already written. But it is not yet the time for us to read it. Cyclical forces will likely overshadow structural forces making the long bonds trade a losing bet until investors capitulate in sufficiently large numbers.

This will take a while to unfold, potentially years. Looking at the elevated volatility priced into bond options, I believe there is an opportunity to extract money from the long bonds crowd while we wait for the actual pitch. In this article, I will explain why I believe that to be the case and how I have structured my trade.

TLT ETF

I believe the opportunity to exploit elevated bond volatility is in longer dated tenors because those will be more stubborn and less impacted by the super slow motion monetary policy pivot that we are witnessing right now.

TLT 0.00%↑ is a large ETF for long-term US treasuries. Its popularity has recently increased dramatically. Over the past two years, its market cap has increased from $14bn to $39bn. The market cap of an ETF is effectively its AuM as they create new shares with inflows.

This is even more remarkable considering its disappointing performance. The price of the ETF has dropped by 30%, which means it has received ~$30bn in net inflows during that time. Without these inflows, it would have a $10bn market cap today. After adjusting for price performance, investors have effectively quadrupled the size of this ETF.

$30bn inflows! And that’s just one of many possible vehicles to bet on long-term US treasuries. This is by the way money with appetite for long duration, which means that some of it will eventually move into stocks.

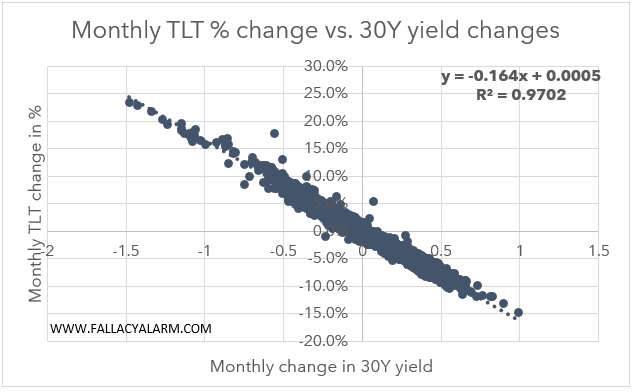

The regression analysis below illustrates the tight relationship with 30Y treasury yields:

The slope of the regression line can be interpreted as follows: If the yield rises/drops by 100bps, TLT will drop/rise by 16%, which is approximately consistent with a 16 year average duration of the securities held by the fund.

MOVE Index

The Merrill Lynch Option Volatility Estimate (in short MOVE) Index measures the one-month volatility implied in treasuries of pretty much all tenors.