This Is A Meme's World.

The dangerous game of volatility harvesting in the world's hottest market segment.

TLDR Summary

Investors are typically volatility averse. All else equal, the more volatile an asset, the less they are willing to pay for it. The higher the VIX, the lower the S&P 500.

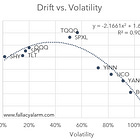

In contrast, meme stocks feed on volatility. The more volatile they are, the quicker they can make their owners rich. Volatility attracts capital. The more volatility priced into Tesla stock options, the higher its market cap.

Shrewd management teams are taking advantage of that by issuing warrants and similar derivatives structures. This suppresses volatility by countercyclically managing share supply. Ultimately, this destroys the ability of the meme stock to serve its purpose. Option leverage will disappear. And with it large amounts of market capitalization.

More similar content from Fallacy Alarm

Risk aversion vs. risk affection

In the article below, I introduced the terms “stairs-up-elevator-down assets” and “elevator-up-stairs-down assets”.

Stairs-up-elevator-down assets

Most investors are choosing their portfolio allocation based on their assessment how much risk they are able and willing to bear. An insurance company with a ton of claims coming up will be mostly in cash and money market. A young professional with a high saving rate and a long investment horizon will be mostly in stocks.