The Tesla Transformation 2030 (incl. Excel Model)

From hardware to services. From a unit sales-based business model to a fleet-based business model.

Check out my interviews with Randy Kirk on options and futures trader positioning and on recent bond market volatility.

“If you have visions, you should go see a doctor.”

Helmut Schmidt, German Chancellor 1974-1982

A resigning CFO, a billionaire cage fight, surging car financing rates, price cuts, product delays, sequentially falling EPS. Being a Tesla investor is always challenging. And these days are not an exception. Focusing on the big picture will help maintain (and potentially regain) clarity on the investment thesis.

Helmut Schmidt was a smart man. But in this case, I won’t follow his advice. Instead, I am going to share my 2030 vision for Tesla with you today. This article is the culmination of various articles I have written on Tesla. I have linked to these articles throughout where applicable for further reading. Those go into much greater detail. The nature of this article requires me to remain at the surface on some important aspects. I hope I have found a reasonable balance between avoiding repetition (for regular readers) and providing enough substance (for new readers).

This article comes with the full valuation model for premium subscribers. For free subscribers, I have included the most relevant model excerpts as screenshots throughout.

From Volume x ASP to Fleet x ARPU

Today, Tesla is a hardware business. Every quarter, we worry about how much metal are they shipping in the shape of vehicles and energy products and how much revenue and margin they generate doing so. I call this is a Volume x ASP model. As this is the current identity of Tesla, it is understandable that many people use it as the basis for building out long term projections. They attempt to value the stock by deriving assumptions for key KPIs such as EV adoption, market share, ASP and gross margin.

There is a problem with this approach though. Tesla’s shape will shift as this decade unfolds. And its financial market perception with it. Nobody will value the company in 2030 like illustrated above. Therefore, it is in my opinion pointless to do so today. Hardware revenues and earnings will always play a role, of course. But in the future this model will more and more morph into what I call a Fleet x ARPU (Average Revenue per User) model. This means it will be less relevant how much product they ship every year, but instead how much of their product is out there generating income.

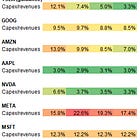

This is by the way not revolutionary at all. Most big tech companies operate like that. Look at the 5 largest companies in the S&P:

Apple AAPL 0.00%↑ : Started as a hardware business, but today services account for 20% of total revenues. These include advertising, warranties, cloud services, digital content and payment services.

Microsoft MSFT 0.00%↑ : Originally they sold software like Windows or Office piece by piece. Today, services account for more than 60% of total revenues. These include for example Office 365 or their cloud offering Azure.

Amazon AMZN 0.00%↑ : They started as a plain online retailer. Today, services account for more than 40% of total revenues. These include third party seller fees, AWS, advertising and digital subscriptions such as Amazon Prime.

Nvidia NVDA 0.00%↑ : They started by making and selling GPUs. Today, their Compute & Networking segment generates more than 50% of the revenues. This segment bundles their data center and cloud service offering.

Google GOOG 0.00%↑ : They have always been a services business. First, their business was to monetize users via ads. Then they added cloud computing.

And even legacy automakers operate fleet-based business models. They generate a large chunk of their revenues and earnings through their financing and after-market business.

Auto OEMs and Big Tech, the two relevant peer groups for Tesla, operate fleet/user-based business models. It’s obvious that this is Tesla’s destiny as well, isn’t it? A simple model of selling as much metal as possible at as high margins as possible is unlikely to ever support the multitrillion dollar valuation that we are all waiting for.

Tesla 2030

This process will go far beyond this decade. But by the end of it, there will be visible progress into this direction. Take a look at the simplified overview of Tesla’s current and future product portfolio below:

Today, revenue, profits and market value basically consist exclusively of the two light-blue categories: Automotive and Energy Storage hardware. In the coming years, the green categories will enter the stage in quarterly earnings releases. Tesla will generate revenues by selling software, insurance and financing services. The goal of this article is to quantify the opportunity presented by Tesla’s metamorphosis. I will derive an estimate for the 2030 EPS and stock price. There are additional nascent businesses (marked in light grey). I have abstained from quantifying them here because they are either not yet tangible enough or it is unlikely their earnings potential will be meaningful to the Tesla story.

I believe that this is a suitable moment for this exercise because current earnings have lost their relevance as a primary indicator for the company. Current earnings have always been problematic as a value indicator because of the company’s growth targets. But with their recent strategic decisions, they have traded present earnings for future earnings like never before. In my opinion, this opened the gates for a valuation-driven bear trap.

Markets are looking past current challenges. And to built conviction on this investment, we need to do so as well.

So, here is how I envision the company to look like by 2030.

1. Automotive

Tesla aspires to reach a production volume of 20 million vehicles annually by 2030. This would be a ~10x vs. 2023, equivalent to a ~40% compound annual growth rate. It’s a highly ambitious target and barely anyone actually takes it at face value. While I believe it is fair to give them credit for their track record, I also believe it is prudent to apply some haircut. In my model, they achieve an annual delivery and production volume of 12 million units by 2030. Admittedly, this has not yet happened before for any car maker. But competitive landscape is very different for electric vehicles.

Assuming a 10% annual scrap rate, this would put the global Tesla fleet at 43.5 million units in 2030.

The Tesla flywheel is simple: Increase production volume, unlock economies of scale, cut prices, unlock incremental demand and repeat. As a result, their average sales prices and production costs have decreased steadily over the past years.

However, this process is not smooth. It is in fact highly cyclical. Sometimes they find new demand faster. Then they can keep prices elevated for longer and enjoy expanding margins. We saw that in 2021 for example. During other times, they have to cut prices faster in anticipation of future cost savings to unlock enough demand to maintain their growth rates. Then margins contract. From that perspective, a growth story like Tesla becomes a cyclical company like any other. Only the slope is steeper.

For model purposes, I have assumed the ASP to drop to $39k over time and gross profits to settle at $10k. This includes cheaper mass vehicles like the third generation platform. But it also includes lower volume and higher price vehicles such as the Cybertruck, the Semi or the roadster.

Assuming that the average battery capacity per vehicle will be 63 kWh, this would put the Automotive hardware business to 756 GWh of annual energy deployment.

2. Software

I believe that Tesla is the only company out there with a generalized approach that has a true shot at solving full autonomy. By ‘true shot’ I mean scalable and therefore commercially viable. Feel free to disagree with that, but you should know upfront that you are dealing with a Tesla maxi here and it’s a pointless endeavor to debate me on that assertation.

Having said that, I believe it is prudent not to value full autonomy and the naturally following robotaxi business model for two reasons:

If Tesla really solves autonomy fully and deploys robotaxis, its valuation will likely increase 10x or even 50x from here because they will capture a lion share of the entire mobility industry. In my opinion, this renders any ex ante valuation exercise pointless.

Achieving full autonomy would be an unprecedented feat and we don’t fully comprehend all its prerequisites and implications. I prefer to avoid such a black swan (in a positive sense) in my investment decisions. I simply don’t want to rely on it.

I believe that Tesla’s FSD suite is already a compelling product today and its utility will rise rapidly with future iterations. There will be a certain portion of the vehicle fleet that will find it compelling and affordable enough to subscribe. While it is mostly a toy for enthusiasts at the moment, I think Tesla FSD will be a fabulous subscription model, even if there won’t be robotaxis for a long time. Competitors are already catching up to that reality. And financial markets will do the same eventually.

Both its price and its take rate will increase as the technology matures and the company will expand into more jurisdictions. As awareness grows, people will appreciate its safety and comfort features. It will be great for cargo use cases and the Semi for example. And with a subscription you can opt in and out as you see fit and you don’t need to make a bet on the future potential for FSD and the use case for your specific vehicle that the license is linked to. Tesla will also be able to bundle additional software services into FSD, for example navigation, entertainment or performance features.

I know that people can (and many do in fact) buy the FSD license. But for valuation purposes, I have assumed 100% subscriptions. Eventually it will lead to the same valuation result regardless of how you calibrate between subscriptions and purchases. You can read additional details on my FSD assessment in the article below.

Assuming that 25% of the Tesla fleet will be subscribed to FSD for $4k annually, they would generate $43.5bn in revenues in 2030. At 80% gross margin, this equates to $34.8bn in gross profit.

3. Insurance

Underwriting car insurance is like writing a put option on a car. If it falls in value due factors covered in the policy, the carrier will pay the difference. From this perspective an insurance business can be summarized like this: Take some capital as collateral to sell put options on assets for which the collected premium ideally exceeds the expected payout. Then invest the proceeds received upfront wisely in assets that will either appreciate or generate income. The better you are at doing this, the higher your return on that capital (RoE) will be and the more premium your share price will command on top of that capital (P/B). That premium is the value creation of an insurance carrier.

Therefore, there are principally three ways how an insurance carrier can create value:

Acquire policies cheaper than their peers: Insurance policies are are highly commoditized with price being the primary decision factor for customers. So, the cheaper you onboard new customers, the higher your margins will be.

Make customers more profitable: Reduce costs associated with fraudulent and valid insurance claims.

Generate superior returns by having attractive investment opportunities available.

I believe that Tesla is in an excellent position to enter the insurance industry and scale profitably. In contrast to most carriers, Tesla owns the customer relationship with the car buyer. Companies like Allstate ALL 0.00%↑ or Progressive PGR 0.00%↑ have to pay ~10% of their revenues for policy acquisition costs.

For Tesla, this cost will be negligible. They can either enjoy this margin advantage or use this it to undercut their competition on pricing to grow market share. Once the customer is onboarded, Tesla will be able to manage the policy more cost efficiently because they have superior information on the driver and the vehicle’s repair expenses. And lastly, Tesla has enormously profitable investment opportunities at their hands. The RoIs on their giga and mega factories are unrivalled at such a scale.

You can find additional detail on my assessment on Tesla Insurance in the article below.

Assuming that ~30% of the Tesla fleet will be insured by Tesla in 2030, I can see this business generating $27bn in revenues and $7bn in gross profit.

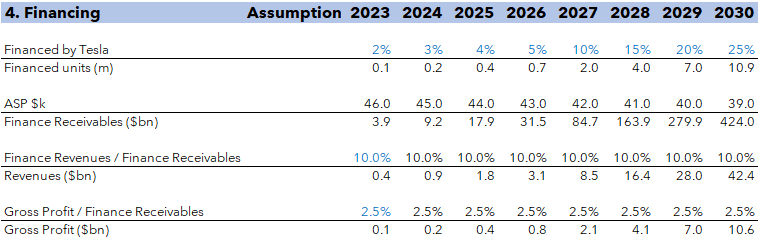

4. Financing

Selling car loans is a very lucrative business that is a major profit center for many car manufacturers. Some of them are effectively consumer loan banks that only use their vehicle production to acquire loan customers.

There are two prerequisites to run a car financing business profitably:

Access to cheap credit: This requires an investment grade credit rating that Tesla as finally obtained last year.

Economies of scale: Loan administration becomes much cheaper with a larger volume. That’s why we continue to see consolidation in the banking industry, producing bigger and bigger financial institutions.

Volkswagen sells about 10m vehicles every year and they have about the same number of car loans on their balance sheet. It is hard for a niche player to compete with that.

While Tesla’s market share in terms of annual unit sales has actually become meaningful recently (~2%), it’s market share of the total global vehicle fleet is still miniscule (~0.2%). As Tesla ramps up to become a true mass market automotive manufacturer, the case for building out their own finance operations becomes more and more obvious.

Assuming that about 25% of the Tesla fleet will be Tesla-financed by 2030, the loan volume could surge to $424bn. This could generate $42bn in revenues and $11bn in gross profit for them.

5. Megapack

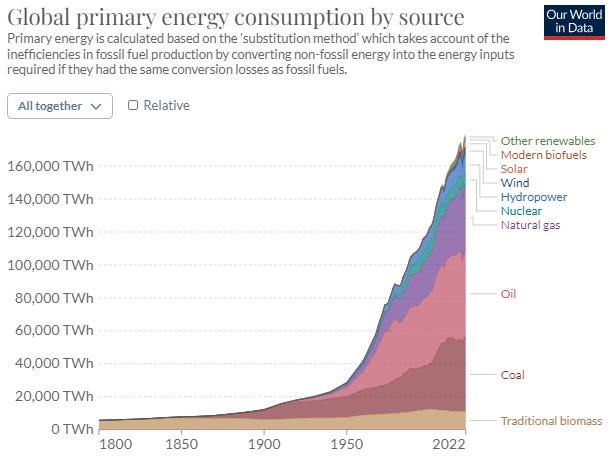

The decarbonization of our economy is the most important megatrend of our time. The world consumes 180,000 TWh energy per year. Only 20% of that is generated with renewable energy (Nuclear is not renewable). This 20% share will grow rapidly over the next years and decades.

Solar and wind are the most scalable renewable energy solutions. We’re adding about 400 GW capacity of those globally every year.

The problem of these energy sources is that they are intermittent. That is why I call them dumb energy. A watt of solar and wind is not the same as a watt of coal and gas. It’s not the same product because it is not reliable.

We can’t shut down our factories in the night or when the wind doesn’t blow. We need to be able to store energy and use it on demand. Just like we do with fossil fuels.

Hydropower is great for that, but it’s often not scalable. Gas peaker plants are very economical and very complementary to wind and solar, but we don’t want them anymore from a political perspective. That’s why batteries will be extremely important to convert dumb solar and wind energy into smart energy. The addressable market is enormous (practically unlimited) and political will is strong.

With Lathrop fully ramped, Tesla will be able to churn out 40 GWh in energy storage every year. Their ambition is to scale this to 1 TWh by 2030, which would equate to a ~60% annual growth rate. It can’t be overstated how insanely ambitious this target is. Securing the materials and building out the supply chain and the factories will be very challenging.

For model purposes, I have assumed that they will achieve half of that goal, namely 500 GWh by 2030. This would make them $250bn in revenues. They target 20% margin, so that would be $50bn in gross profit.

I have focused on the megapack exclusively here because I believe that solar and powerwalls will remain to be secondary products. Solar has yet to prove its commercial viability. And powerwalls will take a backseat vs. megapack. I believe there are material economies of scale for battery energy storage products which makes it difficult for powerwalls to compete with megapacks from a pure economic perspective. I believe they will remain a niche product for consumers that have a specific desire for self-sufficiency.

Valuation

Putting this all together, looking out to 2030, we’re talking about an absolute beast of a company with $830bn in revenues and $222bn in gross profit.

Throwing in a few more assumptions on overhead costs and taxes, net income would be $150bn. For reference, Apple’s LTM revenues are $384bn and net income is $95bn.

By the way, this is supposed to be a directional high-level assessment to gauge the company’s long term potential. This model is not suited to derive an estimate for 2023 or 2024 EPS as I have made use of some abstractions that deviate from current reality (FSD subscription model for example).

As the importance of the fleet-based services business grows, its revenue and gross profit share will increase as well. By the end of this decade, it could generate north of 10% of Tesla’s revenues and more than 20% of gross profits. CNBC will start talking about this metamorphosis by 2027ish. But you have heard it here first. ;)

I have taken this earnings model a step further to build a valuation model by throwing in a few more assumptions on capex spending and P/E multiple. I work off the assumption that any maintenance capex is reflected in the company’s depreciation figures which are baked into net income. But they will have to invest a ton of money in the coming years to build the infrastructure for their massive production ramp.

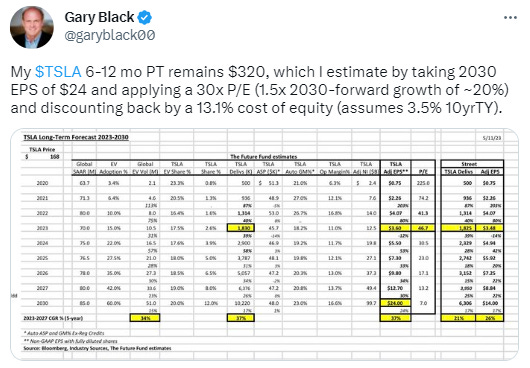

With respect to a reasonable P/E ratio, I had originally derived 50-60x in the article below.

I do believe this company will be a hyperscaler way into the 2030. It’s in its DNA. But I also want to be prudent. There will eventually have to be a flattening of the growth curve. So, I chose 30x.

My 2030 price target is $1,200, a 5x from today. More importantly a 25% CAGR that would handily beat the S&P.

I’d be fine with that. How about you?

Bonus: Unquantified Upside

In addition to the above, the company has a lot of long shot commercialization opportunities up their sleeves. I have not quantified them here because they are either not tangible enough or it is uncertain whether they can meaningfully drive earnings.

Bots/Other AI

Sure, give Meta and Google credit for the foundational work on AI. But Tesla is running the most ambitious and commercially relevant real world AI project. While most other companies train chatbots, they train real bots. Even if that won’t bring us robotaxis in the near future, I am convinced there will be opportunities to commercialize some of this expertise. I have written more about that here:

Charging

Tesla is running the most ambitious fast charging roll out and they have recently secured deals with other OEMs making them the standard setter. I have looked into this, but could not identify an angle where it would make more than a couple of billion in revenues eventually. If you are interested, Larry Goldberg did a great post on the potential here. In any case, even if it won’t drive earnings significantly, all these chargers will be fantastic brand building for Tesla.

Energy Services

Once renewable energy production starts dominating, there is a lot of economic value to be created by balancing the grid as it needs to be fed energy during peak consumption times and there needs to be a release valve during peak production time. It is yet to be decided who can capture this economic value. But Tesla has a good shot at playing a decent role as a leading provider of energy storage solutions, specifically with their Autobidder software.

Sincerely,

Your Fallacy Alarm

Model below.